cagkansayin/iStock via Getty Images

Executive Summary

Mercury General (NYSE:MCY) is a listed insurance company which was obliged to cut its dividend in 2022 to maintain its financial solvency, losing its status of dividend aristocrat.

Indeed, the situation was untenable due to an anemic operational performance. Despite a favorable business position in California, Mercury could not deliver sustainable and recurring operating performance.

Following the dividend cut announcement, investors took fright and abandoned the company. The share price has since fallen by more than 20%, surviving on a series of earnings releases that analysts more or less appreciated.

Recently, Mercury announced its results for the first quarter of 2023. This is an opportunity to review the historical performance of the insurance group.

A Hopelessly Unprofitable Insurer

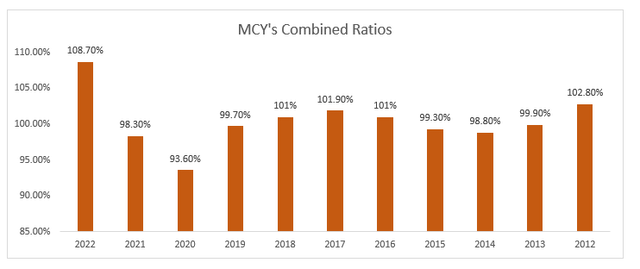

Mercury General has never really been able to improve its profitability over the past decade.

Mercury General Annual Reports (information gathered by the author)

2020 was a breath of fresh air for the group due to COVID-19. The government restrictions reduced claims experience and thus improved the profitability of Mercury’s portfolio.

However, this improvement in portfolio profitability was a sham. With the decrease in restrictions, the loss ratio went up sharply, also impacted by an increase in inflation. Thus, in 2022, Mercury reported a combined ratio of 108.7%. And 2023 might not be a profitable year from an underwriting point of view.

Insufficient Rate Increases Planned For 2023

Because of the losses incurred in 2022, Mercury has applied for rate increases from the California regulator (the Department of Insurance, or DOI). In January 2023, the California DOI approved an average rate increase of 6.9% for the personal auto portfolio, representing 56% of Mercury’s total portfolio.

However, this rate increase has started to be implemented in March 2023. In addition, the company has planned to file for another 6.9% rate increase with the California DOI in March 2023.

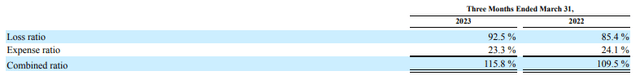

Hence, the first quarter of the year was not impacted by the price increases validated by the California insurance regulator. In Q1 2023, The combined ratio amounted to 115.8%, vs. a 109.5% combined ratio one year ago in the same period.

Q1 2023 Mercury General Report

The deterioration in the underwriting losses resulted from an increase in the loss ratio from 85.4% to 92.5%.

The insurance portfolio was affected by higher catastrophe costs due to winter storms and rainstorms in California, Texas, and Oklahoma, impacting the loss ratio by $98 million. Furthermore, the increase in claims inflation resulted in a higher loss severity in the motor insurance business.

Adjusted from the prior years’ claims development and the catastrophe impact, the loss ratio deteriorated from 77.7% to 84.3%.

Unfortunately, the inflationary pressures will continue to impact loss severity negatively over the coming quarters, and the already-validated price increases will not offset the claim inflation entirely.

Let’s assume that the 6.9% rate increase would have affected 56% of the total premiums from the 1st of January. Hence, the earned premiums would have increased by $41 million to circa $1.045 billion of earned premiums.

Consequently, the combined ratio adjusted from the rate increase would have been 111.3% or a 4.5%-point improvement. Despite the upcoming favorable price changes, this rough computation highlights one point: Mercury Group is doomed to fail, struggling with profitability issues.

An Unnecessary Dividend

While it is very understandable that the company wants to maintain its dividend-friendly status, maintaining the dividend is, in my opinion, unnecessary and even suicidal. Generally, a dividend is a redistribution of profits to the shareholders. For the shareholder, it is proof of the company’s excellent health.

It is a cost for the company since this money cannot be reinvested to grow or improve its profitability.

With this dividend, Mercury is making a strong statement that it can improve its profitability and reward its shareholders. In the current situation, and given the poor operational performance of the past years, this is a fable that only fools can believe. To save as much cash as possible, Mercury should take the most painful decision for shareholders: stop paying dividends if the profitability is not restored.

Mercury, A Worthless Company?

Is Mercury a worthless company? The harshest critics might say Mercury is a big joke, not worth a penny. I would moderate this position. Mercury does have a favorable business position in California, although the insurer struggles with operating performance issues.

The current company’s market capitalization is around $1.63 billion for a loss-making business, which generates an annual premium turnover of circa $4.0 billion. On top of the premium income, the insurer might generate around $200 million yearly pre-tax investment income, partially offsetting the underwriting losses.

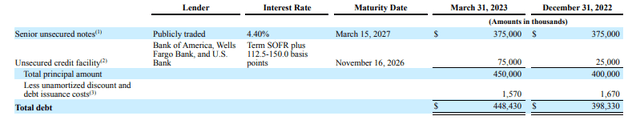

Furthermore, the shareholders’ equity is $1.45 billion, and the debt amounts to $448 million as of March 2023.

Q1 2023 Mercury General Report

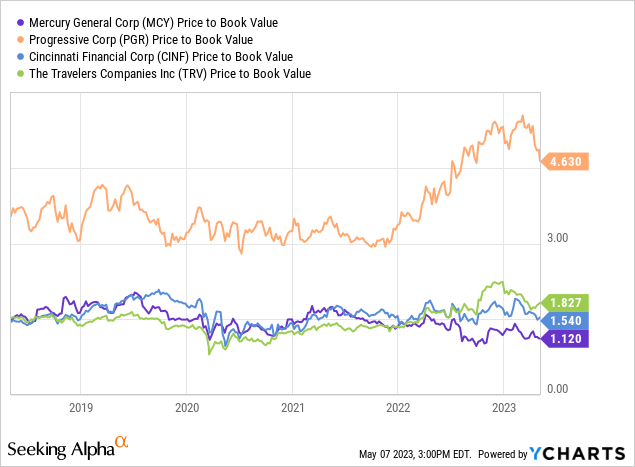

In other ways, the current valuation is around 1.12 times the book value, while the company is indebted for $448 million and generates losses. For a loss-making company, investors are strangely optimistic regarding the valuation metrics.

Confident shareholders of Mercury might counter-argue that the company is undervalued compared to peers, like Progressive (PGR), Chubb (CB), or Travelers (TRV), which are valued from 1.5 times to 4.6 times their book value.

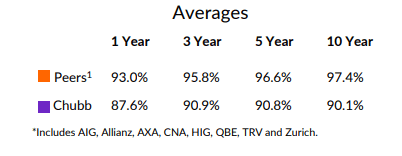

Nonetheless, those competitors are either profitable in the motor insurance market or are present in other more profitable insurance markets, resulting in a combined ratio below 100% over the cycle. For example, Chubb succeeded in delivering an average combined ratio of around 90% over the last ten years.

Q1 2023 Chubb Presentation

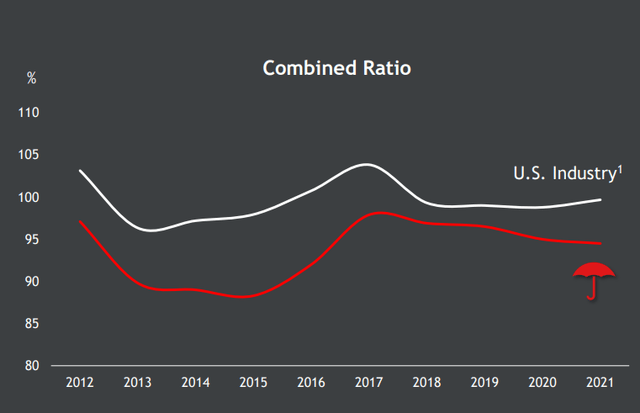

While Travelers are less disciplined than Chubb, the company’s underwriting performance remained above the market, with a combined ratio oscillating around 97% over the cycle.

2022 Travelers Presentation

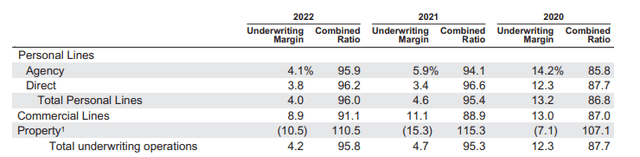

Despite recurring losses from the homeowners’ insurance business, Progressive has recorded a combined ratio of respectively 95.8%, 95.3%, and 87.7% in 2022, 2021, and 2020.

2022 Progressive Annual Report

Although Progressive has recorded reduced underwriting margins during the first quarter of 2023, the insurance company is better equipped than Mercury to face inflationary pressures over the long term. The motor insurer benefits from both geographical and product diversifications, while Mercury is doomed to suffer from any potential headwinds in California (e.g., increase in catastrophe costs and regulatory constraints).

Final Thoughts

Figures prove the insurer’s underwriting performance will remain weak over 2023, despite the genuine efforts from Mercury’s teams to restore profitability.

Hence, the company’s salvation may come from something other than the underwriting and pricing initiatives. A competitor might buy out Mercury to increase its footprint in California.

This scenario might be the best for the current shareholders, who have suffered for the last few years. As an investor, I am not willing to invest in Mercury because of the meager operating performance. Moreover, the scenario of a buy-out might never happen. As written in a previous article, Mercury General, as an investment, can be summed up in one sentence “Always No, Forever No”. However, I wish Mercury Group could find a way to be back on track and reward their loyal stakeholders.

Credit: Source link