Guido Mieth

Investment Thesis

Atlanticus Holdings Corporation (NASDAQ:ATLC) has seen some explosive growth in its business over the past few years. Yet, I think the stock is still undervalued as the company can continue to grow at steady rates and push earnings even higher. The company has attractive markets that are still unsaturated and can sustain solid profitable growth going forward. Thus, I think Atlanticus Holdings is a buy because of its attractive valuation, high growth and ROE, and potential efficiency gains from leveraging AI technology.

Financial Services For The Underserved

The company is designed to serve people who are underserved, meaning they can’t get credit from the typical bank or credit union. These consumers are considered sub-prime, meaning they are riskier because they have limited credit history and are typically living paycheck to paycheck. According to the annual report,

According to data published by Experian, 40% of Americans had FICO® scores of less than 700. We believe this equates to a population of over 100 million everyday Americans in need of access to credit. These consumers often have financial needs that are not effectively met by larger financial institutions. By facilitating appropriately priced consumer credit and financial service alternatives with value-added features and benefits curated for the unique needs of these consumers, we endeavor to empower better financial outcomes for everyday Americans.

These consumers are typically overlooked by traditional banks and credit card companies because they are considered too risky. While too risky for most, Atlanticus Holdings has stepped up to the plate to fill this gap in the market and have made the sub-prime market their core focus.

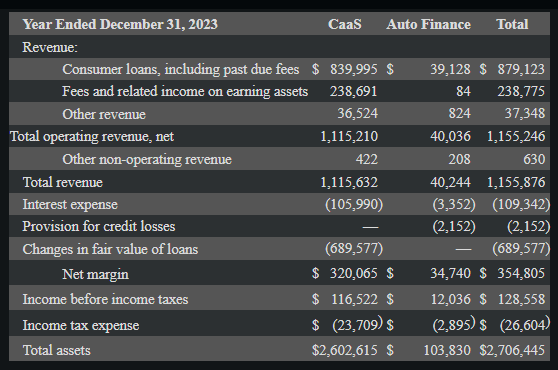

The company makes money in two segments: Credit As A Service, and Auto Finance. According to the annual report, CaaS refers to

Currently, within our Credit as a Service (“CaaS”) segment, we apply our technology solutions, in combination with the experiences gained, and infrastructure built from servicing over $39 billion in consumer loans over more than 25 years of operating history, to support lenders in offering more inclusive financial services. These products include private label credit and general purpose credit cards originated by lenders through multiple channels, including retail and healthcare, direct mail solicitation, digital marketing and partnerships with third parties.

In essence, they help lenders offer customized credit cards and banking products to help the financial well being of subprime borrowers. They offer general purpose credit cards such as Fortiva, Aspire, and Imagine. These cards have flexible payment schedules to fit the budgets of their consumers. Cash comes in by “(1) private label credit and general purpose credit card receivables, (2) servicing compensation and (3) credit card receivables portfolios” (Annual Report, Page 1). For 2023, CaaS made up the majority of sales at around 96.5% of total revenues, coming in at $1.15 billion.

Company Website Annual Report

Their auto finance business is very small at the moment and makes money by buying and servicing auto loans from dealers and making money on the interest. The annual report says,

We generate revenues on purchased loans through interest earned on the face value of the installment agreements combined with the accretion of discounts on loans purchased.

For 2023, auto finance revenues came in at $40 million, which accounts for the remaining 3.5% of total sales.

I believe the business is uniquely situated to deliver strong value to an underserved market that is expected to grow. The company has a strong track record of managing risk, underwriting solid loans, and collecting consistently on their credit card receivables. Given their long operating history, I believe management has learned much about the proper way to service their niche market and can leverage AI technology to further reduce risk and grow their business. All their proprietary data can be fed to large language models and AI algorithms to better screen borrowers and make the facilitation process faster. Their future growth will likely stem from the growing number of people who are living paycheck to paycheck, strong digital innovation to increase convenience, and addition of new retail partners to diversify their lender base.

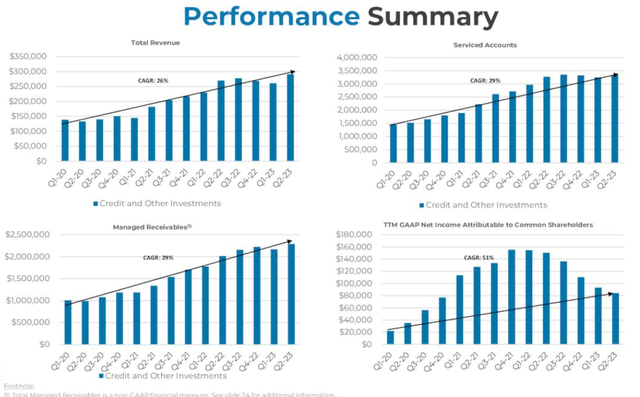

Growth Remains Robust

Management indicates that the market potential is over $1 trillion in their investor presentation. I believe this to be true because I see a growing number of Americans living paycheck to paycheck with FICO credit scores that are considered subprime. The track record at Atlanticus is quite strong with seemingly never ending growth in revenues, accounts, and receivables for the past few years. The company was recognized as one of Fortune’s 100 Fastest-Growing companies for the third consecutive year, highlighting their strong growth performance.

Investor Presentation

I believe the reasons for this growth is the higher cost of living, which puts financial pressure on Americans, as many of them may have weak credit scores and need to purchase more and more expensive items. Furthermore, the primary method of payment for many Americans has been increasingly more dependent on credit cards. According to DocuClipper,

Credit cards remain a popular payment method, with the number of credit card payments in the U.S. increasing by nearly 26 billion.

Credit cards accounted for 77% of non-cash payments, with 157 billion credit card payments made in the U.S.

Higher inflation and interest rates has made many things unaffordable, from housing to cars to even the rent. Thus, many businesses utilize solutions like Fortiva Retail credit to make their products accessible to the mass US population with flexible financing options. According to the Fortiva website, their merchant partners experience 30% increase in average ticket size, 35% increase in incremental approvals, and 30% increase in repeat transactions. I believe many merchants in America are happy to use Fortiva based on its strong track record in bringing in new business and growth. This value is quite substantial and will likely continue as Atlanticus leverages its proprietary data to make their underwriting technology more accurate and efficient.

The market is still relatively untapped, as sales are around $1.1 billion which is a small percentage of the $1 trillion that management anticipates is the entire market. I expect the company to gain new customer accounts, grow receivables, and add new retailers who are interested in their point of sale solutions from Fortiva. The growth happens to be very profitable, as the company sports high ROE in the 20 percent range TTM, showing that the growth is a value add for shareholders.

A High Return, Asset-Light Business

I believe the high ROEs that Atlanticus earns signals some sort of competitive edge that is sustainable. After all, if it were easy to copy the advantage, eventually new entrants would arbitrage this edge away and returns on capital would fall down to average levels. Their ROE is relatively stable and seems to hold up due to the asset-light nature of the business, eliminating the typical depreciation and COGS expenses that chip away at net income while reducing the net asset base the business needs. All the cash flow that comes in does not need to be reinvested in capex, inventories, or significant equipment. Thus, I believe the growth engine is very strong and cheap to maintain, as reinvestment needs are relatively low to maintain this growth rate.

Moreover, I see some advantages that should allow Atlanticus to maintain their profit margins for the foreseeable future. For one, they have an enormous amount of proprietary historical data they can tap into to make their underwriting process more accurate and efficient. Their technological analytics is likely very strong, which contributes to their effective screening process to identify creditworthy borrowers among the subprime group.

Merchant retail partners, banks, and healthcare institutions who rely on Fortiva Retail Credit and Curae are unlikely to abandon the goose that is laying eggs for them. As long as the solution is effective, a lot of their banks’ lending activity is tied up with Atlanticus, making it hard to switch providers easily as the service is still ongoing. With Curae, people generally aren’t price sensitive when it comes to their health. If they have to pay for surgery, medicine, or healthcare, they will likely do anything to protect their lives and Curae is helping them get the money they need affordably. Healthcare providers like Curae because it allows patients to pay up in full for high-quality care and eliminates the hassle of AR management and bad debts. Overall, it seems like Atlanticus is creating win-win deals for both the borrower and the lender by creating value for all their stakeholders.

Curae Website

Valuation – $50 Fair Value

Starting with TTM revenues of $1.15 billion, I believe revenues can grow 5% year over year consistently over the next 3 years. As mentioned, the company is a consistent fast grower with huge markets to tap into. It shows no signs of slowing down despite macroeconomic challenges in the United States. I believe 5% is reasonable because the demand for flexible financing solutions is very strong as the company continues to work with more banks.

By 2027, I expect the company to have sales of $1.3 billion assuming they grow steadily. Apply a conservative net margin of 6%, which is below the TTM net margin of 8% gets me earnings of $78 million. Divide by shares outstanding of 15 million gets me EPS of $5.20 by 2027.

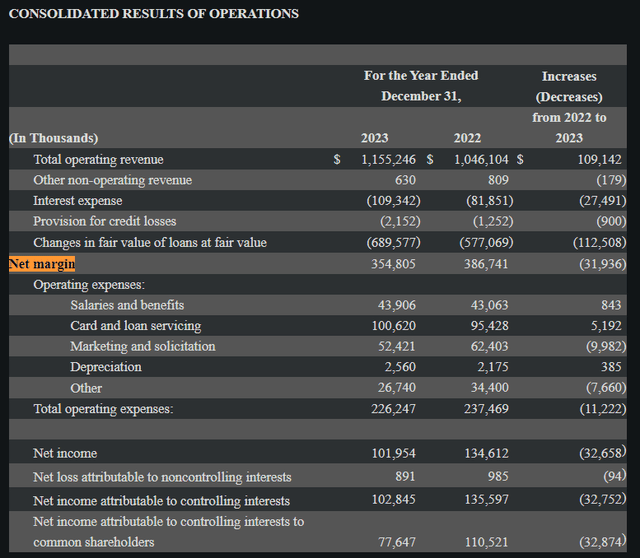

Investors should note the net margin I’m talking about is net income divided by total sales. The company uses a net margin that is higher up on the income statement, which does not account for operating expenses. The net margin the company uses is calculated at around 30%. I’m talking about the total net income margin after deducting operating expenses, which for TTM is around 8%.

Annual Report

Apply a sector median multiple of 10x to $5.20 gets me $50, rounded down. I think EPS can steadily grow from $5 onwards, but I will assume by 2027 the stock will be at least $50 assuming it trades at a 10x PE multiple. The stock also trades at around 1x cash flow, which is another signal of undervaluation.

Another nice point is that insiders own 74% of the company, which shows alignment to unlocking value with shareholders. I think eventually buybacks will accelerate as the stock is materially undervalued and management has incentive to deliver value.

Risks

As an investor of large credit card receivables they originate, Atlanticus suffers from significant credit risk especially considering their borrowers are considered subprime. Consider the fact they eat their own cooking, it could be risky for the company if the economy does poorly and interest and inflation rise, making defaults more common in their receivables portfolio.

The industry of originating credit cards and banking products is heavily regulated and subject to change, which could negatively impact Atlanticus’ ability to grow their business. Regulators can require higher compliance standards and disrupt their origination activities. Lenders can be restricted in how much money they can lend out by regulators, as regulators may deem subprime lending too risky as it can lead to significant defaults and cause weakness in the banks’ financial strength.

Competition in the sector can intensify as new entrants are attracted by the high ROEs they can potentially earn. Despite the proprietary data and technology, reputation, and sticky relationships Atlanticus has with their banks, this could change if a new entrant uses technology better to potentially outperform Atlanticus.

Economic downturns and financial instability could weaken the receivables portfolio and increase credit risk. This company is relatively susceptible to economic shocks, and the weakness of the consumer may directly translate to higher write-offs, more risk, and less creditworthy borrowers in the market.

Buy Atlanticus Holdings

I believe the story here is a growth at a very cheap price. At 6x forward earnings, it is very cheap considering the growth rates are in the double digits. Management has significant insider ownership and motivation to deliver value by partnering with more banks, using AI technology to improve underwriting, and growing the business in a large, unsaturated total addressable market. Thus, the stock is a buy assuming earnings can grow without much reinvestment needs, freeing up cash for potential buybacks to further accelerate EPS growth.

Credit: Source link