andresr/E+ via Getty Images

If you ever encounter an analyst or investor who claims to be right or almost always right, run for the hills. Even the best of us makes mistakes. If you don’t believe me, ask Warren Buffett. Even he will fess up to plenty of errors.

An example of one mistake I made a little over a year ago in January of 2023 involved a company called Superior Group of Companies, Inc. (NASDAQ:SGC). For those not familiar with the enterprise, it focuses largely on the production and sale of uniforms, corporate identity apparel, career apparel, and accessories. It mostly caters to the medical space, the industrial markets, leisure and hospitality companies, public safety organizations, and more.

Back then, I acknowledged that sales of the business had been increasing at a nice pace. However, I was turned off by profits and cash flows that had been showing signs of volatility. I did acknowledge that upside could be attractive because of how cheap shares were. But the cash flow problems led me to believe that the company was risky enough to give a more cautious rating to. This led me to rating the business a “hold” as opposed to a “buy.” Since then, shares have spiked 63.4%. That’s over double the 31.7% seen by the S&P 500 (SP500) over the same window of time.

Even though revenue has started to decline, the firm’s bottom line has shown signs of improvement. What’s more, management is forecasting a revenue increase for 2024. That increase, combined with the expectations of higher profits year-over-year, all on top of the fact that management exceeded forecasts when it came to both revenue and profits when it reported financial results for the final quarter of 2023, was all instrumental in pushing shares up a whopping 13.5% on March 14th.

Given this massive amount of upside, you might think that I would be cautious about the business still. But after further consideration and after seeing how well management has controlled bottom line results, I believe that an upgrade to a soft “buy” makes a lot of sense.

The picture fits

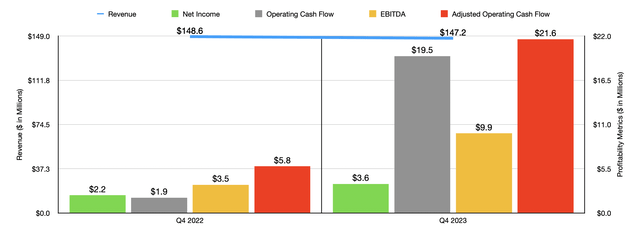

As I mentioned already, shares performed particularly well on March 14th. They ended up closing up 13.5% after management announced financial results covering the final quarter of the 2023 fiscal year. To see what caused all of this excitement, we need only look at the data provided by management. Revenue, for instance, came in at $147.2 million. Even though that represented a decline of nearly 1% compared to the $148.6 million reported one year earlier, the sales figure actually exceeded analysts’ forecasts by $4.6 million.

Author – SEC EDGAR Data

Unfortunately, management didn’t really give any context as to why revenue fell for that specific quarter. But they did say that, for the year as a whole, sales fell entirely because of the Branded Products portion of the enterprise. That revenue decline was 11.7% and it was driven by a reduction in demand that mostly took place in the first half of last year caused by market conditions that reduced the advertising spending of its customers, as well as the timing of new branded uniform rollout programs for some of its customers. Some of the sales weakness was also attributable to a reduction in personal protective equipment that had seen robust demand during the COVID-19 pandemic.

Even though revenue took a hit, net profits for the company actually improved year-over-year. The company booked a profit per share of $0.22. That’s up from the $0.14 per share reported one year earlier, and it came in at $0.08 per share above what analysts were anticipating. Even though selling and administrative costs increased quite a bit year-over-year, the company saw margin improvement when it came to its cost of goods sold. These declined from 69.8% of sales to 62.2%. A reduction in inventory write-downs, combined with lower costs that were mostly associated with favorable pricing, which customers were buying, and lower supply chain costs, helped out on this front.

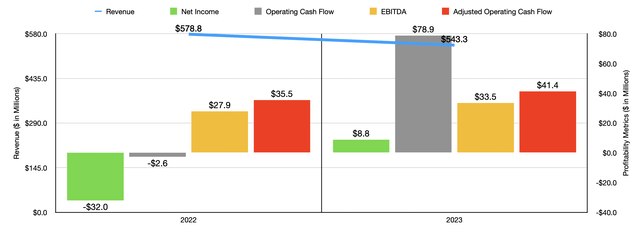

Author – SEC EDGAR Data

The earnings per share for the company translated into total profits for the final quarter of the year of $3.6 million. That’s comfortably above the $2.2 million reported one year earlier. Other profitability metrics increased as well. Operating cash flow, for instance, skyrocketed from $1.9 million to $19.5 million. Even if we adjust for changes in working capital, we get a rise from $5.8 million to $21.6 million. And lastly, EBITDA for the company expanded from $3.5 million to $9.9 million.

It’s worth noting that the strong bottom line results for the business were very helpful in pushing up results for 2023 in its entirety. As you can see in the chart above, profits and cash flows improved materially last year compared to the year prior, even as revenue fell from $578.8 million to $543.3 million.

As much as I dislike revenue declines when it comes to businesses, I do prioritize robust bottom line results. It’s also imperative to note that management is forecasting further improvement this year. With a recovery in the markets in which it operates, management is forecasting revenue of between $558 million and $568 million. They also believe that earnings per share will be between $0.61 and $0.68. At the midpoint, that should translate to net profits of around $10.5 million. If other profitability metrics increase at the same rate year over year, we will be looking at adjusted operating cash flow of around $49.4 million and EBITDA of approximately $40 million.

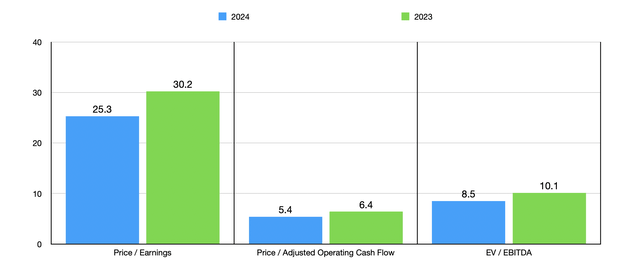

Author – SEC EDGAR Data

Using these results, we can see how shares are priced in the chart above. Relative to earnings, the stock looks very expensive. But when it comes to the cash flow figures, the picture is different. I also, in the table below, compared the enterprise to five similar firms. Relative to earnings, three of the five companies were cheaper than it. This number drops to two of the five using the EV to EBITDA approach and, when it comes to the price to operating cash flow approach, Superior Group of Companies ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Superior Group of Companies | 30.2 | 6.4 | 10.1 |

| Lakeland Industries (LAKE) | 18.2 | 15.8 | 8.2 |

| FIGS (FIGS) | 45.1 | 9.0 | 17.3 |

| Aramark (ARMK) | 13.3 | 11.5 | 7.9 |

| Cintas Corp (CTAS) | 45.7 | 38.1 | 28.1 |

| UniFirst Corporation (UNF) | 28.1 | 13.5 | 11.6 |

Beyond 2024, management has some high hopes. When it comes to just the health care apparel market, for instance, they believe that there is a total addressable market that’s worth around $4.1 billion. And that’s in the U.S. alone. They estimate they have a roughly 6% market share. So there is plenty of room for growth in the long run. And with customer retention averaging about 90 per cent, it’s clear that they provide a quality product. Of course, the market opportunity is even larger than this when you focus on other categories. For what it sells under the Branded Products segment, the market is estimated to be worth about $25.8 billion in the U.S. The company has only a 2% market share here. But for the five years ending in 2023, it has achieved a 9.5% annualized growth rate compared to the much slower 2.3% increase in the healthcare space. And with the company being the 8th largest of over 25,000 branded products distributors in the US, there’s plenty of opportunity to acquire its way to a larger size.

Another sizable opportunity for the company comes from a part of the business that accounts for 16.7% of its overall revenue. This is the Contact Centers unit that was responsible for $91.5 million in revenue in 2023, which was up 8.6% from the $84.2 million reported one year earlier. This particular segment provides outsourced, near shore business process outsourcing, contact, and call center support services to customers here in North America. For the U.S. market alone, management sees this as a $101 billion opportunity that it controls only about 0.1% of. But over the past five years, this has been a rapidly growing part of the enterprise, with annualized revenue growth of 26%.

Takeaway

As things stand, the picture for Superior Group of Companies is looking up. After a year of weakness on the top line and strength on the bottom line, it stands to see growth in both respects this year. The company has multiple verticals of growth opportunities that it can tap into moving forward. And while shares are expensive relative to earnings, they are attractively priced relative to cash flows and look close to being fairly valued on that basis relative to similar entities. Due to these factors and in spite of how much the stock has risen since I last wrote about it, I’ve decided to upgrade Superior Group of Companies, Inc. shares to a soft “buy.”

Credit: Source link