MarsBars

Building a dividend income snowball is a great way to set yourself up for retirement because it gives you greater clarity into how close you are to being able to live off of passive income. Moreover, since dividend income is much more reliable and less volatile than stock market returns, this approach to funding retirement can reduce the sequence of returns risk. As a result, retirees who live off of dividends can enjoy greater peace of mind during market crashes since their dividend income stream often remains undisturbed, or at the very least, is reduced by much less than the market value of stocks during such periods. As a result, they are less likely to make a rash decision and sell near the bottom.

A recent report indicates that those nearing retirement (in their fifties today) think they will need a ~$1.5 million nest egg in order to retire. In this article, we are going to look at a sample portfolio of seven funds that could comfortably fund a retirement with a nest egg of $1.5 million through dividend passive income.

The Retirement Dividend Portfolio

The foundation for this portfolio will be the Schwab U.S. Dividend Equity ETF™ (SCHD). The reason for this is that SCHD is arguably the best dividend growth exchange-traded fund, or ETF, there is, as it combines a very low 0.06% expense ratio with substantial diversification across 104 high-quality holdings that are well-diversified across several sectors. Even more impressively, it offers a pretty attractive 3.4% dividend yield and has a very impressive 13.05% five-year dividend growth CAGR. As a result, it provides retirees with solid current income and should be growing at a pace that significantly exceeds inflation over the long term.

That being said, as we pointed out in a recent article, SCHD’s main flaws are that its yield is just a bit on the low side for an income-focused investor, only 11.43% of its portfolio is invested in proven inflation hedges such as energy, materials, and real estate, and it also has very little exposure to yield-oriented defensive sectors such as utilities and fixed income. Finally, it lacks meaningful exposure to mega-cap technology stocks, which have become dominant forces in the stock market.

As a result, we will round out this portfolio with six other funds that help to resolve these shortcomings:

| Tickers | Amount | % | Yield |

| SCHD | $ 600,000.00 | 40% | 3.35% |

| PFFR | $ 150,000.00 | 10% | 7.62% |

| AMLP | $ 150,000.00 | 10% | 7.53% |

| BIZD | $ 150,000.00 | 10% | 10.63% |

| JEPQ | $ 150,000.00 | 10% | 9.07% |

| XLU | $ 150,000.00 | 10% | 3.36% |

| GLD | $ 150,000.00 | 10% | 0.00% |

| Total | $ 1,500,000.00 | 100% | 5.16% |

This portfolio throws off about $6500 per month in passive income, which should be plenty for a retiree to live off of, especially when combined with social security, barring a need to live in one of America’s most expensive markets.

Let’s now take a look at each of these holdings in depth:

- InfraCap REIT Preferred ETF (PFFR): With a very reasonable expense ratio of 0.45%, an attractive monthly dividend, and a well-diversified portfolio (103 holdings and the top holding only constituting 2.7% of the portfolio) of REIT preferred equities (REITs rarely go bankrupt due to the ability for them to encumber their underlying assets as needed to raise liquidity and the stable and generally defensive nature of their business model), PFFR helps to solve several of the problems that plague SCHD (low exposure to real estate, low exposure to fixed income securities, and a yield that is a bit too low). Moreover, its income yield should be quite stable and reliable for investors to be able to rely on through thick and thin.

- Alerian MLP ETF (AMLP): Backed by investment-grade midstream businesses with very well-covered distributions and solid distribution growth, AMLP not only provides an attractive 7.53% yield, but one that is likely to grow moving forward. Moreover, it solves several of the shortcomings of SCHD (low exposure to energy and a yield that is a bit too low).

- VanEck BDC Income ETF (BIZD): BIZD is heavily overweight blue chip BDCs and offers investors a very attractive dividend yield. While its payout is a bit choppy from quarter to quarter, its dividend has proven to be quite sustainable over time, and it is also very high. Moreover, BIZD tends to benefit from rising interest rates, so it helps to diversify the portfolio nicely while also enhancing SCHD’s yield and giving exposure to floating rate, senior-secured, middle market loans.

- JPMorgan Nasdaq Equity Premium Income ETF (JEPQ): The reason to include JEPQ in the portfolio stems from the simple fact that SCHD lacks exposure to mega-cap technology stocks, whereas JEPQ is heavily overweight them. Meanwhile, JEPQ also employs a notional covered-call strategy that enables it to pay out a hefty monthly dividend. As a result, it solves two of the shortcomings of SCHD: giving the portfolio exposure to mega-cap tech and also juicing its yield. You can read more about the fund here.

- Utilities Select Sector SPDR® Fund ETF (XLU): XLU offers us a very low-cost fund that provides diversified exposure to utilities, a very defensive sector that SCHD lacks much exposure to while still generating a decent dividend yield. Moreover, we are very bullish on this sector right now, so including it in the portfolio enhances its overall risk-reward.

- SPDR® Gold Shares ETF (GLD): While it may be surprising to see a fund that does not pay a yield included in a passive income portfolio for retirees, as we have already demonstrated, our portfolio already pays sufficient passive income. Meanwhile, GLD – with its low correlation with the broader stock market – helps to diversify the portfolio nicely and hedge a retiree’s portfolio against a potentially disastrous scenario where China invades Taiwan and plunges the global economy into depression, there is a debt crisis, and/or the U.S. economy faces hyperinflation. To read more on why we think that gold is such an important component of a portfolio right now, read here.

Investor Takeaway

This portfolio is just a thought experiment: you should not take the listing of any of these funds as a buy recommendation or endorsement. That being said, we do think this portfolio is well set up to provide retirees with stable and sufficient income for the long term, and – in the event that a really terrible macro scenario plays out – the GLD position should help hedge the portfolio.

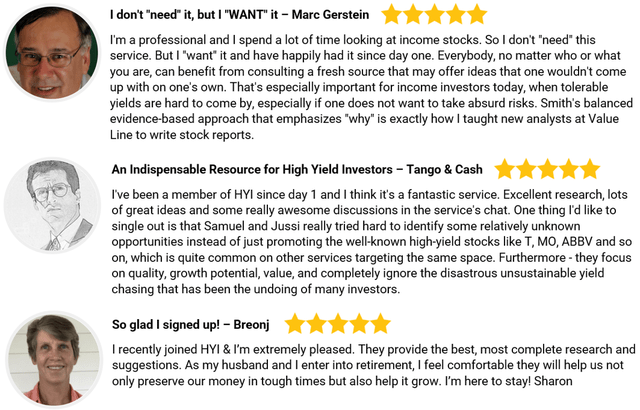

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing high yield-seeking investment service on Seeking Alpha with over 1,700 members on board and a perfect 5/5 rating from 166 reviews.

Our members are profiting from our high-yielding strategies, and you won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Credit: Source link