Ton Photograph

The Angel Oak Income ETF (NYSEARCA:CARY) is a small, little-known income ETF focusing on short-term investment-grade bonds. CARY’s diversified holdings, solid 6.2% dividend yield (highest in its peer group), and strong performance track record make the fund a buy.

CARY – Overview and Investment Thesis

Diversified Holdings

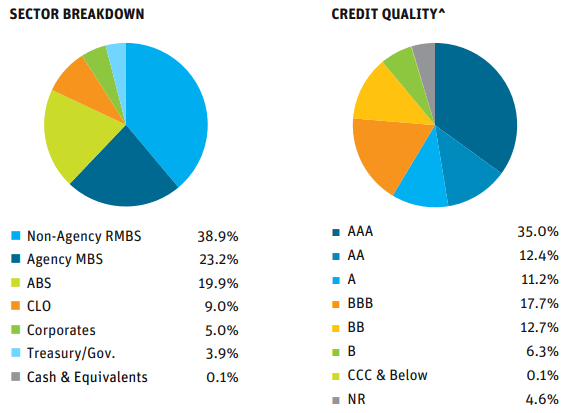

CARY is an actively managed ETF focusing on short-term investment-grade bonds. It holds a diversified portfolio of assets, with investments in 253 securities from several bond sub-asset classes, including mortgage-backed securities, or MBS, corporate bonds, treasuries, and CLO debt tranches. It does hold some non-investment grade bonds, with these accounting for around 20% of its portfolio. Weights are as follows:

CARY

Overall, CARY seems like an incredibly well-diversified fund, with exposure to most relevant bond sub-asset classes. CARY is diversified enough to be a core portfolio holding, in my opinion at least.

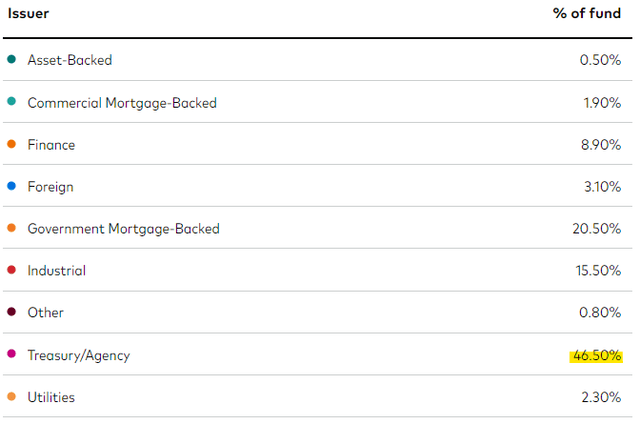

CARY focuses on MBS much more so than average, with lower treasury weights. Compare the fund’s sector weights with those of the Vanguard Total Bond Market Index Fund ETF Shares (BND), the largest investment-grade bond ETF in the market.

BND

As an actively managed fund, the above are likely active investment decisions, meant to (potentially) boost income and returns, or reduce risk. MBSs have outperformed treasuries since the fund’s inception, so the decision seems to have worked, so far at least.

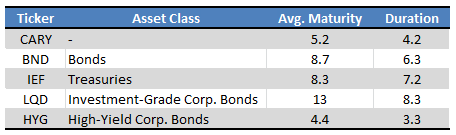

CARY also leans short-term, with average maturity of 5.2 years and a duration of 4.2, both below-average figures.

Fund Filings – Table by Author

From what I’ve seen, this is either due to focusing on non-agency MBSs with lower maturities, underweighting treasuries, especially long-term treasuries, or another active investment decision taken by management. Short-term securities have outperformed since the fund’s inception, so focusing on these seems to have worked, so far at least.

Overall, CARY’s portfolio seems well-diversified, of reasonably good quality, and leaning towards asset classes with strong recent performance.

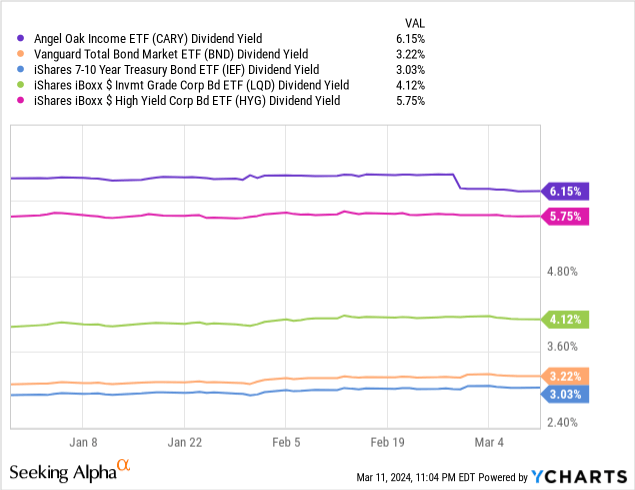

Solid 6.2% Dividend Yield

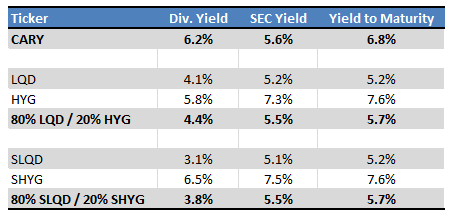

CARY sports a 6.2% dividend yield, quite good on an absolute basis, and higher than that of most bonds and bond sub-asset classes. It yields twice as much as BND, a broad-based bond index ETF. It also yields 0.60% more than the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the largest high-yield bond ETF in the market, and with much less credit risk. CARY’s yield is also the highest in its peer group, to the best of my knowledge at least (lots of ETFs out there, perhaps I’ve missed one).

CARY sports a higher SEC yield and yield to maturity, two more forward-looking yield metrics, than investment-grade bonds, but not high-yield corporate bonds. The same is true for short-term investment-grade bonds too, although not short-term high-yield bonds. Remember that CARY leans short-term. Dividends are higher than portfolios consisting of 80% investment-grade, 20% high-yield bonds, in line with current portfolio weights.

Fund Filings – Table by Author

My point is that CARY’s dividends are indeed higher than average for an investment-grade bond fund, and this is not simply due to the fund taking higher credit risk, the fact that short-term rates are currently elevated, or the dividend yield metric selected.

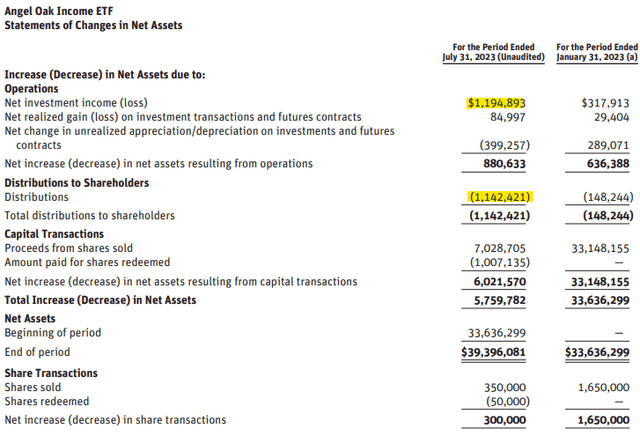

CARY’s dividends are also fully covered by underlying generation of income, as evidenced by its latest annual report.

CARY

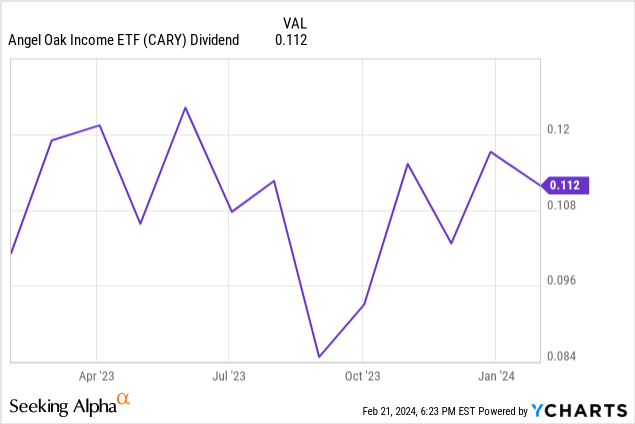

Most bond ETFs have seen strong dividend growth since early 2022, due to Fed hikes. The situation for CARY is a bit complicated, as the fund is quite young, with inception in late 2022. Dividends have technically grown since, but the trend seems unclear, and realized growth could have simply been due to volatility, asset shifts, or timing.

Data by YCharts

Overall, CARY’s 6.2% yield is quite good, and solidly above-average.

Good Performance Track Record

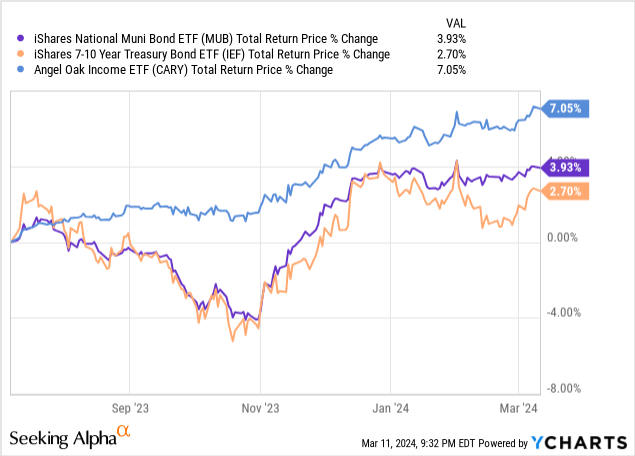

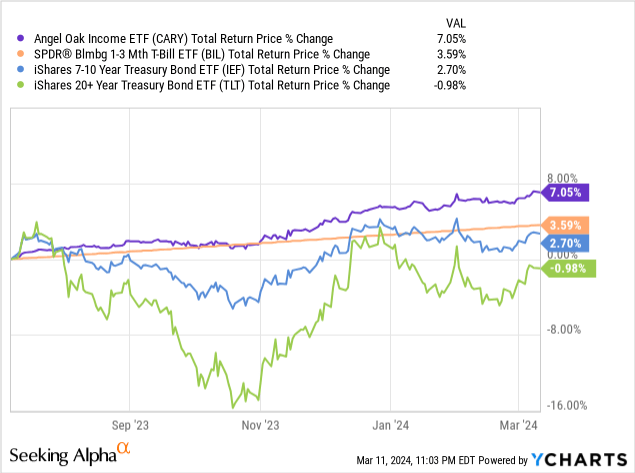

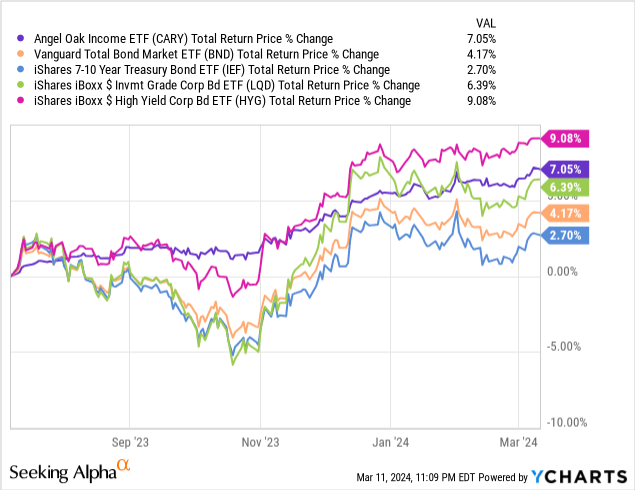

CARY’s performance track record is quite good, with the fund outperforming most bonds and bond sub-asset classes since its inception, with the exception of high-yield bonds. As the fund is quite young, with its inception in late 2022, its track record is quite short.

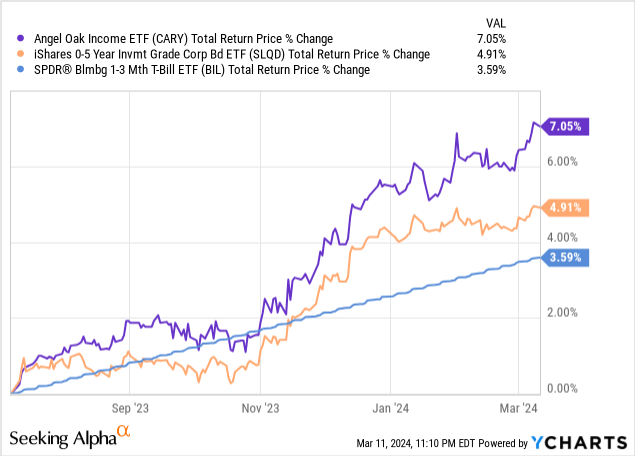

CARY has also outperformed short-term investment-grade bonds and t-bills since its inception. Although these are less representative sub-asset classes, as the fund leans short-term, I thought the comparison was important.

In my opinion, CARY’s outperformance has been due to a combination of focusing on short-term bonds, and those with above-average yields. Insofar as the latter continues, the fund should continue to outperform moving forward.

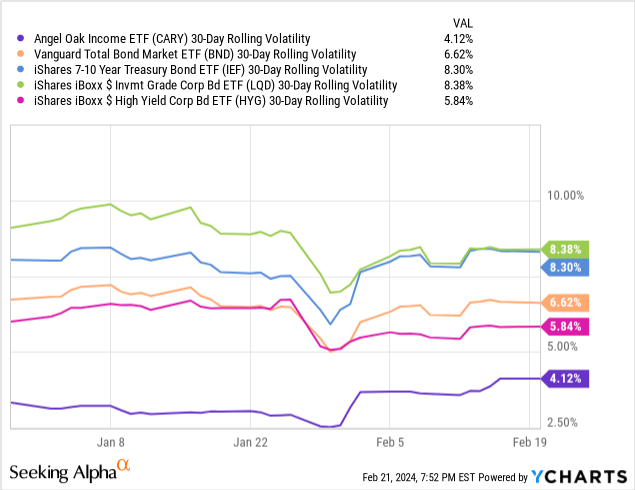

Besides the returns themselves, CARY also seems less risky and volatile than average, at least relative to broader bond indexes and funds. Most of this is due to focusing on short-term bonds, as evidenced by the table above. Right now, there is no evidence that the fund’s strategy or holdings are riskier than average.

Data by YCharts

CARY – Other Considerations

Expenses

CARY is an expensive fund, with a 0.79% expense ratio. Bond ETFs generally have expenses in the 0.05%-0.30% range. Actively managed ETFs are generally a bit more expensive, but still cheaper than CARY. Expenses directly decrease dividends and returns, a direct, straightforward negative for investors.

Expenses are also a much more certain characteristic than most, and so matters more. Dividends are uncertain: perhaps the Fed slashes rates tomorrow. Prices are uncertain too: perhaps trouble in the housing market will cause MBS prices to plummet. Although expenses are not set in stone, they are definitely stickier, and necessarily decrease dividends and returns.

I generally prefer cheaper funds to CARY, although I’ve yet to find a particularly strong, cheap, investment-grade ETF. CARY will have to do, for now at least.

Young Fund, Uncertain Benefits

Although CARY does offer investors some important benefits, I think there is some uncertainty surrounding these as the fund is quite young. CARY has performed quite well since its inception, but it has yet to experience a recession or a period of stable/rising rates. Current conditions have been somewhat favorable to the fund, which might make it seem stronger than it actually is. On a more positive note, the fund’s yield is quite good, and that is a more forward metric, of particular importance to bond funds.

Conclusion

CARY’s diversified holdings, solid 6.2% dividend yield, highest in its peer group, and strong performance track record make the fund a buy.

Credit: Source link