Orbon Alija

Thesis

In my last article on EPAM Systems (NYSE:EPAM), I showed how the former growth stalwart is slowing down. At that time, I had a ‘neutral/hold’ outlook on the stock and in retrospect, this was a lost opportunity to benefit from the downside as the stock has fallen 26.92% since then compared to the S&P500’s rise of 2.06%.

The company recently reported weak Q1 FY23 results and an even worse outlook. The stock is already down 11.94% but I believe it is still too risky to hold on as the company seems very much out of its depth in the current IT Services environment with material headwinds on both growth and margins. Therefore, I am revising my rating down to a ‘sell’.

A bad quarter and an even worse outlook

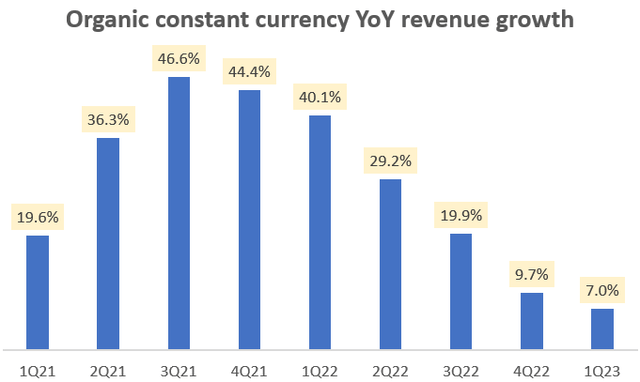

Over the last 2 quarters, the single-digit annual growth rates have been quite uncharacteristic of EPAM’s former consistent 20%+ YoY glory:

Organic constant currency YoY revenue growth (Company Filings, Author’s Analysis)

Note that Q1 FY23’s 7.0% growth rate excludes a non-recurring growth fall impact from the exit of Russia-related business

On a QoQ basis, revenues fell 1.6%. This was weak but a bit better than expected; the mid-point of the guided range last quarter implied a 2% QoQ decline.

Despite in-line revenues, the stock fell 10.33% on May 5, 2023. This is attributable to a very sharp cut in the 2023 growth guidance from 9% YoY to a mere 3% YoY on an organic, constant currency basis. Moreover, management guided for continued slowness in Q2 FY23, indicating yet another QoQ decline in revenues. Headcount additions in the industry are a leading indicator of future demand. On this indicator too, there are clear signs of a sharp growth slowdown as the company sees a net reduction of 1750 workers and guides for another headcount reduction in Q2 FY23 along with restricted hiring for the rest of the year.

EPAM is out of its depth and losing share

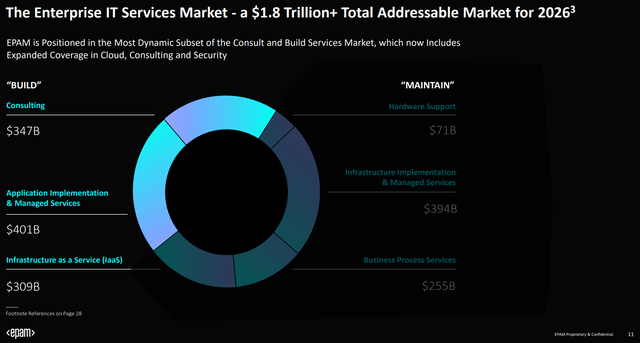

EPAM is geared toward the $748 billion ‘build’ part of the overall $1.8 trillion technology services market:

EPAM Positioning (EPAM Q1 FY23 Investor Presentation)

‘Build’ type spends are more discretionary than ‘maintain’ type spends. The problem now is that the current environment strongly favors ‘maintain’ type spends:

Instead, during the last 3 months, it became very clear that the economic environment is more focused than it has been for decades, on cost optimization, which for now benefiting more traditional outsourcing firms with strong cost take out offerings.

– CEO Arkadiy Dobkin in the Q1 FY23 earnings call, author’s emphasis

This is a very concerning statement as it implies there is continued risk of loss in market share; a trend that started to materially affect the business from Q4 FY22:

…we’re realizing right now that some work, future work, which we traditionally, we’ll be getting from existing client base, were offered probably to some alternative vendors

– CEO Arkadiy Dobkin in the Q4 FY22 earnings call, author’s emphasis

The extent of the shift in demand sentiment has caught the management team by surprise:

…we underestimated the breadth of the macroeconomic slowdown and the depth of the impact specifically in the transformational sector of the IT services market.

– Author’s emphasis

I believe all these are signs that EPAM and its management are out of their depth in these challenging times.

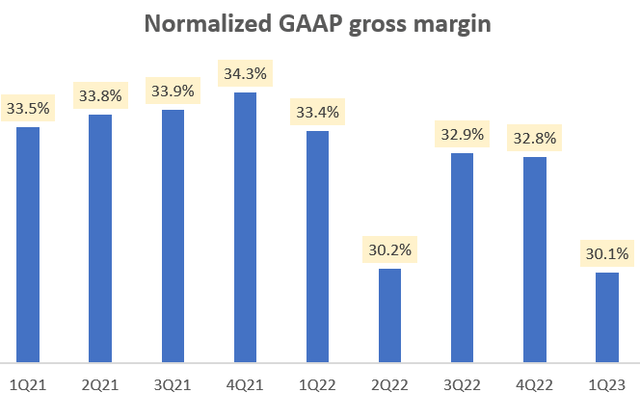

Management is implicitly guiding for further margin contraction

Normalized (excluding the impact of assistive non-recurring Russia – Ukraine spends), GAAP gross margins fell 170bps from 32.8% to 30.1%:

Normalized GAAP gross margin (Company Filings, Author’s Analysis)

Note that this is ~90bps worse than what was expected by management in Q4 FY22. In this case, management attributed this sharp decline to account margin compression (pricing pressures). Yet, they expect 33% gross margins in the second half of FY23, unlocked by pricing increases. Given how out of depth EPAM looks in the current demand environment, I am skeptical about any margin expansion playing out.

Management is effectively guiding for a 14-15% adjusted non-GAAP margin band. The Q1 FY23 print of this figure was 14.5%. However, I argue that the real level is actually 15.3% since there is an 80bps impact of a one-time $9.5 million severance cost skewing the figures. This paints a worse picture of the underlying economics; instead of the original -50bps to +50bps margin expansion guidance, the company management is effectively looking at a further 30bps to 130bps margin contraction from the normalized (corrected for one-offs) margins today.

Takeaway

EPAM is really struggling in the current IT Services demand environment. I can’t remember the last time I saw a sharp 600bps cut from 9% YoY growth to 3% YoY growth in this industry.

The key challenge for the company seems to be structural; its core forte in the ‘build’ side of IT Services has enabled it to consistently clock in rolling 20%+ revenue CAGRs consistently for a decade. However this has now changed as enterprises are squarely preferring vendors who have strong competencies on the ‘maintain’ work. I anticipate these troubles to continue leading to pricing pressures and market share losses.

The normalized adjusted operating margin print for the business in Q1 FY23 is 80bps higher than reported due to a one-time impact of severance costs. Considering this base-line, it is apparent that management’s margin guidance implies further margin contraction from the base level operations instead of a flat margin band. I believe this is something that has the potential to negatively surprise the street next quarter.

Overall, as I anticipate further negative results and surprises in Q2 FY23, I downgrade the stock from a ‘hold’ to a ‘sell’ for existing shareholders. I believe it is best to wait for the sequential growth declines and margins to stabilize before thinking about a re-entry into EPAM stock.

Credit: Source link