Wang Yukun/Moment via Getty Images

The last time I covered National CineMedia, Inc. (NASDAQ:NCMI), the company had just cut its dividend and was struggling under an enormous debt load. I warned that the company would likely have to restructure its debts, and that is exactly what happened.

On June 27th, 2023, National CineMedia confirmed it had filed for Chapter 11 bankruptcy with the United States Bankruptcy Court for the Southern District of Texas.

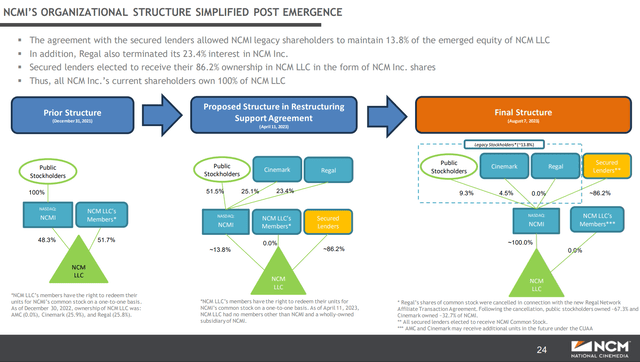

Under the confirmed plan of re-organization, National CineMedia converted its secured debt holders into 83.4 million new shares (or ~86.2% of the company), while its old shareholders saw their equity ownership diluted down through a 1-for-10 reverse stock split (Figure 1). Regal Cinema’s holdings of 40.7 million old shares were also terminated as part of the negotiations.

Figure 1 – NCMI restructuring (NCMI investor presentation)

In terms of bankruptcies, National CineMedia’s Chapter 11 filing was a relatively quick one, as the company was able to emerge from bankruptcy protection in August with a clean balance sheet and a fresh start.

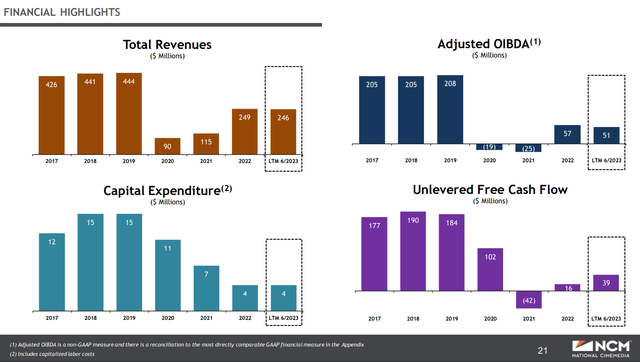

In my prior articles, I commented that historically, NCMI had a fairly stable business of selling movie theater ads that generated over $440 million in advertising revenues as recently as 2019 (Figure 2).

Figure 2 – NCMI financial highlights (NCMI investor presentation)

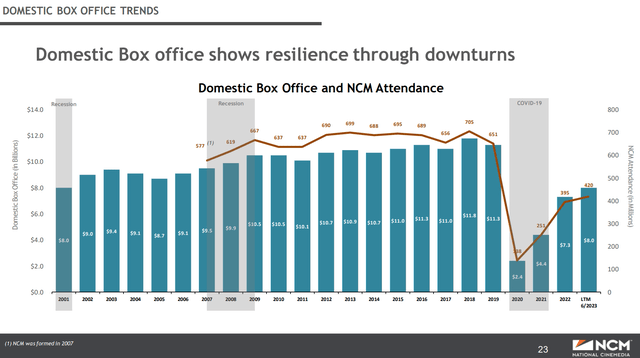

However, the COVID-19 pandemic severely impacted NCMI’s revenues and the company had to rely on borrowings to fund its revenue shortfalls. Unfortunately, theater attendance entered a ‘new normal’ even after COVID-19 restrictions were lifted, and so NCMI’s debt load became unmanageable, forcing the bankruptcy filing (Figure 3).

Figure 3 – New normal in theater attendance (NCMI investor presentation)

Starting with a clean balance sheet, is NCMI now an attractive investment opportunity?

Brief Company Overview

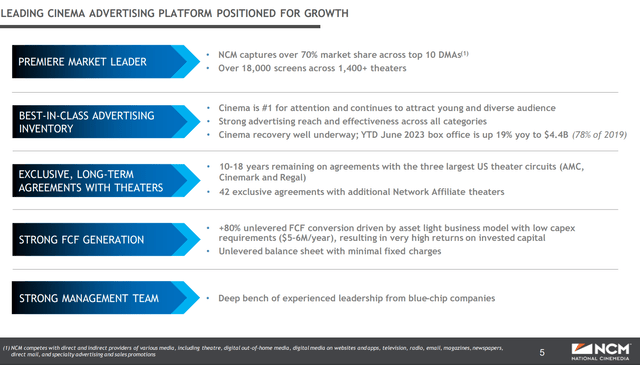

For those not familiar with National CineMedia, NCMI is the largest U.S. theater ad network, showing advertising on over 18,000 screens and 1,400 theatres. Its advertising network includes leading national chains such as AMC, Cinemark, and Regal (Figure 3).

Figure 4 – NCMI overview (NCMI investor presentation)

The company primarily sells ads on-screen before the main attractions, as well as lobby advertising and digital advertising (Figure 5).

Figure 5 – NCMI business model (NCMI investor presentation)

Messy Financial Statements Due To Restructuring

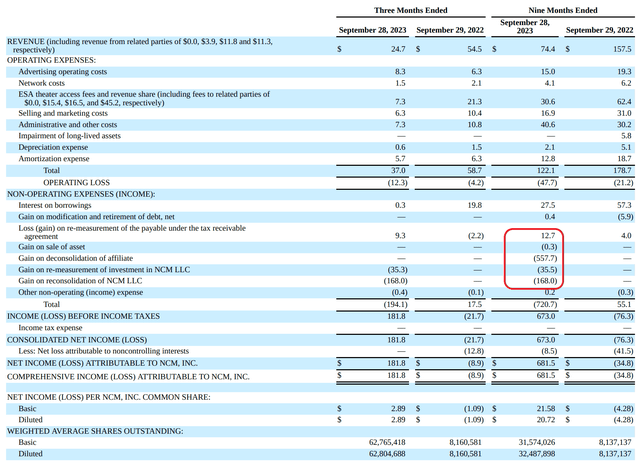

Financially, NCMI’s latest earnings report was marred by a series of one-time adjustments due to the debt restructuring (Figure 6). For example, in the 9 months to September 28, 2023, NCMI recorded $750 million in non-operating gains, which led to a net income of $682 million for the 9-month period.

Figure 6 – NCMI financial statement (NCMI Q3/23 10Q report)

However, stripping out the one-time gains and losses, how is the underlying business actually doing?

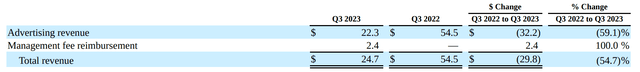

Operationally, NCMI saw a 55% decrease in revenues from $54.5 million to $24.7 million in Q3 2023 (Figure 7). However, this figure is a little misleading, as the operating company was deconsolidated as a result of the bankruptcy filing, so corporate revenues were only recorded when the company emerged from bankruptcy and reconsolidated from August 7th to September 28th, 2023.

Figure 7 – NCMI Q3/23 revenues (NCMI Q3/23 10Q report)

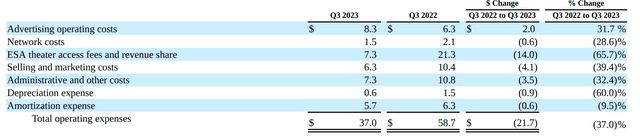

Operating expenses likewise saw quite a bit of give and take, as advertising expenses paid to Regal Cinemas were converted from Exhibitor Service Agreement (“ESA”) fees to Advertising operating costs after NCMI replaced its ESA agreement with Regal with a new Network Affiliate Transaction Agreement as part of the bankruptcy filing (Figure 8).

Figure 8 – NCMI Q3/23 operating expenses (NCMI Q3/23 10Q report)

Not Out Of The Woods Yet

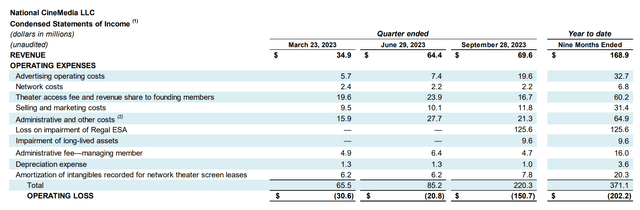

On a pro forma basis, assuming the operating company had been consolidated for the entire period, NCMI’s revenues would have been $69.6 million for Q3/23, or a 28% YoY gain (Figure 9). However, the operating company still suffered an operating loss during the period.

Figure 9 – Pro-forma financials (NCMI Q3/23 earnings supplement)

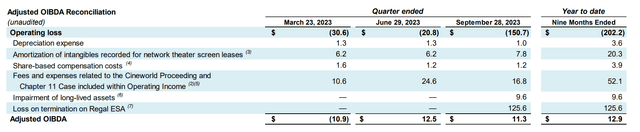

A large part of the operating losses can be attributed to one-time impairment losses, as well as fees and expenses related to the Chapter 11 bankruptcy filing and prior legal fees related to the Cineworld bankruptcy (Figure 10).

Figure 10 – Pro-forma OIBDA (NCMI Q3/23 earnings supplement)

Backing out these legal fees and one-time expenses, the operating business actually generated positive adj. OIBDA of $11.3 million in Q3/23 and $12.9 million YTD 2023.

Valuation Is Misleading At First Glance

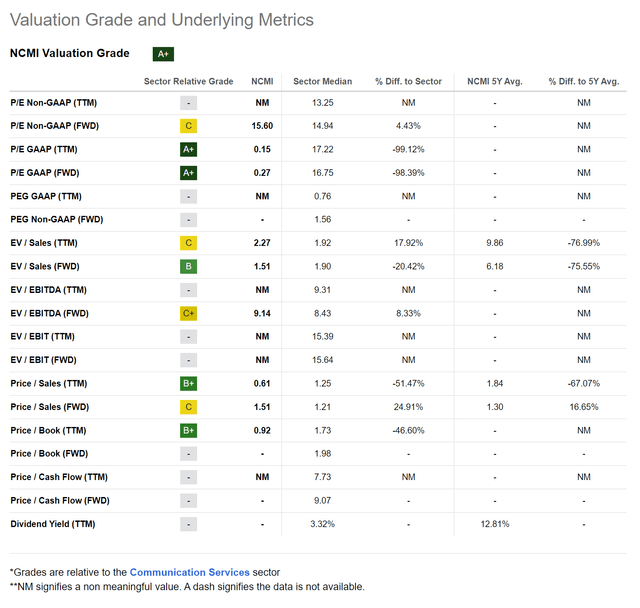

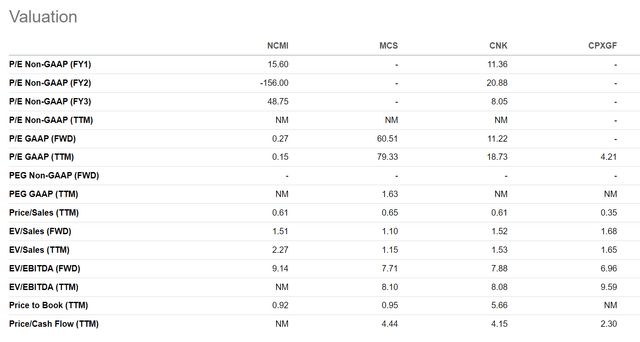

At first glance, NCMI looks like a steal according to data on Seeking Alpha. The company is trading at only a 0.3x GAAP Fwd P/E, about as cheap as can be (Figure 11).

Figure 11 – NCMI valuation (Seeking Alpha)

However, I believe this valuation is misleading, as 2023 forward earnings captured by Seeking Alpha include the restructuring gains I mentioned earlier.

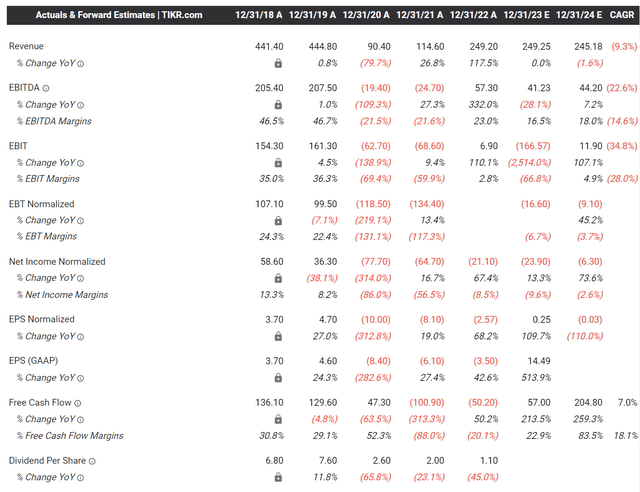

On a non-GAAP basis, Wall Street analysts expect NCMI to earn $0.25 in 2023 and -$0.03 in 2024, for a Fwd P/E of 15.6x based on 2023 estimates (Figure 12).

Figure 12 – NCMI forward estimates (tikr.com)

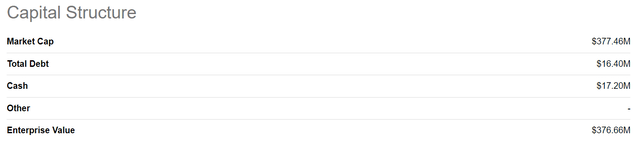

With an enterprise value of $377 million, NCMI is also trading at 9.1x 2023E EV/EBITDA and 8.5x 2024E EV/EBITDA (Figure 13).

Figure 13 – NCMI enterprise value (Seeking Alpha)

Comparing NCMI’s valuation to theater chain peers, it is currently trading at a premium multiple of 9.1x Fwd EV/EBITDA vs. 7.7x for The Marcus Corporation (MCS), 7.9x for Cinemark Holdings, Inc. (CNK) and 7.0x for Cineplex Inc. (OTCPK:CPXGF) (Figure 14).

Figure 14 – NCMI valuation vs. theater peers (Seeking Alpha)

NCMI arguably deserves a premium valuation as its business is less capital-intensive, since it does not have to maintain the physical theaters. It also has virtually no debt (after the Chapter 11 restructuring), while its peers are all debt-laden.

Overall, I believe NCMI is properly valued relative to the company’s prospects in the ‘new normal’.

Will NCMI Be Able To Pay A Dividend?

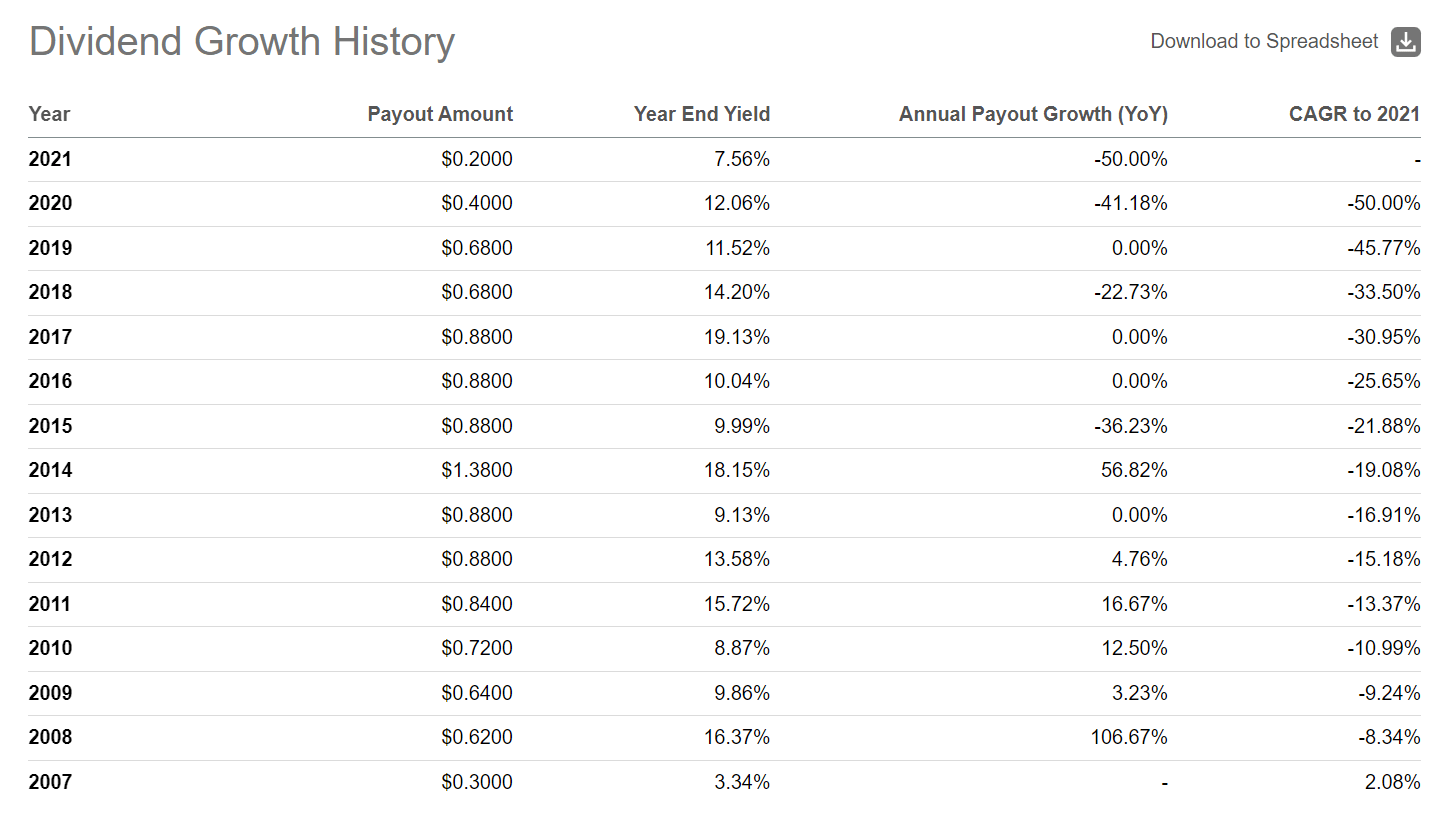

One of the key attractions of NCMI historically was the company’s attractive dividend yield, which averaged ~10% prior to running into financial trouble (Figure 15).

Figure 15 – NCMI historical dividend yields (Seeking Alpha)

Given NCMI’s cleaned-up balance sheet, will the company be able to restart a dividend as well?

I do not believe a dividend is in the cards for NCMI in the immediate future, as the company may still have legal fees to pay with ongoing litigation. However, with $40 million+ in annualized EBITDA, NCMI certainly has the capacity to support a modest dividend in a few quarters’ time.

At 96.8 million shares outstanding post the debt restructuring, I believe the company can comfortably support a $0.12-0.15 / share annualized dividend or a 3-4% yield in a year’s time once its financial operations are stabilized.

Conclusion

As I expected, National CineMedia declared Chapter 11 bankruptcy in 2023 due to its crushing debt load. Secured debt holders were converted into equity, and existing shareholders were diluted.

Looking forward, NCMI looks to be on firmer footing with a cleaned-up balance sheet. Backing out legal fees and one-time charges, NCMI is EBITDA positive with no debt.

I believe NCMI’s shares are currently properly valued, trading at 9.1x Fwd EV/EBITDA, a slight premium to theater peers. This premium valuation is justified as NCMI’s business model is less capital-intensive and the company has no debt.

I rate NCMI a hold for now.

Credit: Source link