MarsBars

I laid out my bull thesis for Enterprise Products Partners (NYSE:EPD) in my last article on the company titled Enterprise Products Partners Vs. MPLX: Only One Of These Is A Buy. In essence, I believed that EPD was a Buy because:

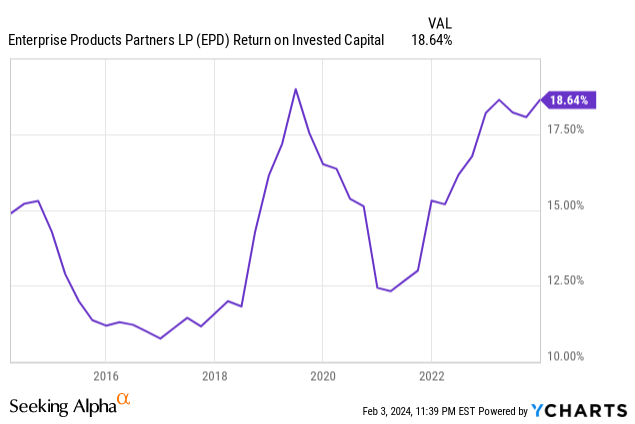

1. It has a well-diversified and fully integrated business model that has proven to generate very stable and consistently growing cash flows through good times and bad. Moreover, its returns on invested capital have also been consistently in the double-digits over the past decade, even during some of the worst energy price crashes that the world has ever seen:

2. Its balance sheet is tops in the sector, earning it a sector-best A- credit rating from S&P.

3. Its distribution has grown every year for a quarter century, making it one of the very few midstream businesses – along with Enbridge (ENB) – to accomplish such a feat. Moreover, it is well positioned to continue growing its distribution for years to come.

4. Despite its numerous strengths, its valuation remains quite compelling compared to its own history as well as that of peers.

5. Last, but not least, insiders are well-aligned with unitholders as they own about one-third of the partnership’s common equity and management have proven to be excellent capital allocators and prudent balance sheet managers over time.

Q4 made me even more bullish on EPD and in fact, it is now displacing Energy Transfer (ET) as my top MLP (AMLP) pick of the moment, for the following reasons:

#1. Valuation Growing Increasingly Compelling

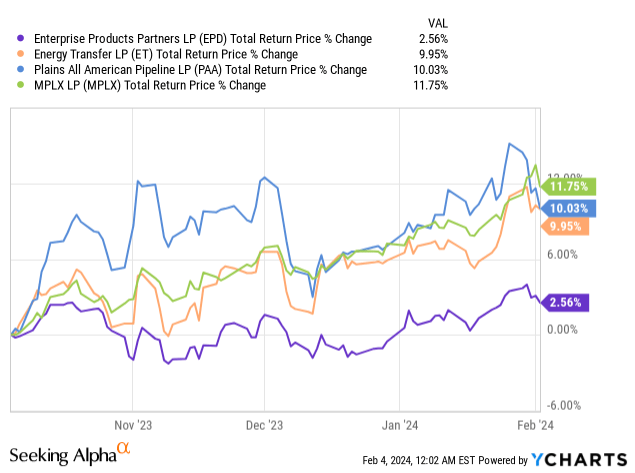

The first reason why EPD is now my favorite midstream opportunity is simply a matter of valuation. Over the past four months alone, its most prominent fellow investment grade K-1 issuing MLPs (Energy Transfer (ET), MPLX (MPLX), and Plains All American Pipeline (PAA)) have all seen their unit prices race ahead while EPD’s has remained quite stagnant:

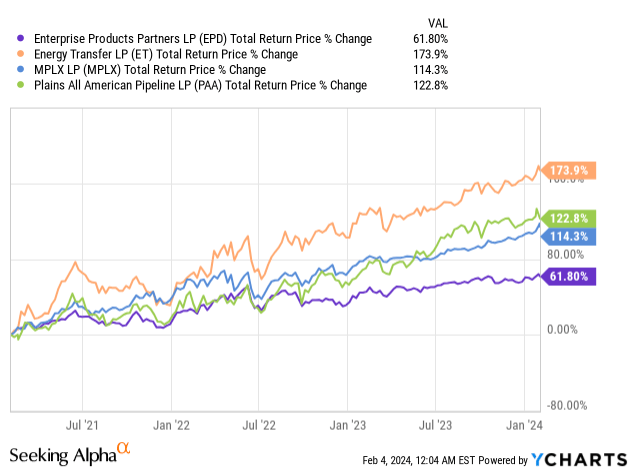

This performance gap extends back even further. If we go back three years, we see that EPD has significantly lagged these other MLPs over that period of time:

Is this due to EPD not performing well over that period of time? Not at all. It’s already conservative leverage ratio has dropped even further, its credit rating has been upgraded to being the best in the industry, its distribution has continued to grow at a solid clip, and it has continued to buy back units. In fact, as management stated on their latest earnings call:

Since 2019, Enterprise is the only midstream energy company to reduce absolute outstanding units outstanding without significant asset sales.

What this means is that the valuation between EPD and its peers has narrowed significantly – or even vanished completely in the case of MPLX – despite it being widely recognized as the higher quality business (as evidenced by its exceptional returns on invested capital and sector-best credit rating). As a result, when it comes to risk-adjusted returns relative to the rest of its sector, EPD has arguably never looked more attractive than it does now.

#2. Growth Is Accelerating

Another reason I am increasingly bullish on EPD is that its growth is accelerating. Between macro factors that are making North American hydrocarbons more valuable to the global economy than ever (which management referred to several times on its Q4 earnings call) and its robust growth pipeline, EPD’s growth outlook is increasingly bullish.

As R. Paul Drake recently pointed out, EPD has plenty of opportunities to invest aggressively for further growth and is even flexing its impressive balance sheet to do so. As part of this, the company recently issued $2 billion of senior notes comprised of $1 billion of three-year notes at a coupon of 4.6% and $1 billion of 10-year notes at a 4.85% coupon, the majority of which will go towards funding its capital expenditure program. Given the consistency with which they have generated double-digit returns on invested capital and the very low level of their leverage ratio, this seems like a very prudent use of capital.

Keep in mind as well that their leverage ratio is unlikely to rise much – if at all – from this recent debt raise and their ongoing aggressive capital spending. This is because they continue to bring on substantial amounts of new EBITDA each year as their growth projects come online and their businesses continue to deliver strong performance. As management pointed out on the Q4 earnings call:

I think 2024 is shaping up to be a better year than 2023. It’s not just the assets we’ve brought on. We’re seeing, for example, and Brent’s got some information, our processing margins on what is not fee-based is looking better.

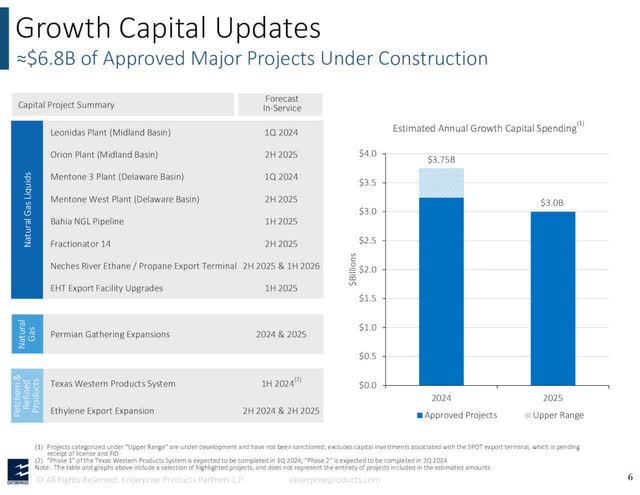

EPD spent $2.75 billion on organic growth CapEx in 2023, expects to spend $3.5 billion at the midpoint this year, and expects to spend around $3 billion on growth capital expenditures in 2025. As you can see in the graphic below, this means that they are going to have a lot of projects coming online over the next two years:

EPD Growth Pipeline (Investor Presentation)

#3. Capital Returns Are Poised To Accelerate

While heavy growth CapEx generally means that capital returns are likely to suffer in the near-term, we do not think this is the case, and we also believe that EPD is likely only two years away from announcing some significant acceleration of their capital return program. Here is why:

1. Their leverage ratio is already very low at 3.0x and is unlikely to increase much at all in the coming years given that they will be bringing online so many projects even as they continue to spend aggressively on CapEx. This means that EPD will still be free to grow its distribution at a mid-single digits clip as it has been in recent years alongside opportunistic repurchases.

2. Their capital return flexibility is also bolstered by the fact that they delivered a 1.7x DCF coverage ratio of their distribution despite 2023 being plagued by startup issues at their PDH2 facility which have since been resolved.

3. Management emphasized on the earnings call that distribution growth is highly likely going to continue at a mid-single digits CAGR for the foreseeable future, stating:

We’re going to continue to come in and do that as far as distribution growth. I think you’ve seen over the last two or three years, we’re back to mid-single digit distribution growth, which is good to be there…I think with the CapEx we’re deploying and the return on capital that we’re expecting to get, I think coming in, and we’ve been increasing distribution 25 years in a row. And I feel pretty good about 2026. And we’ve been doing it around mid-single digits.

4. Management accelerated its buybacks during Q4 to take advantage of the dip in the unit price, showing that they are not afraid to step on the gas pedal a bit with buybacks – despite their aggressive growth capex budget right now – when it is opportunistic to do so.

5. Best of all, with their focus on growth CapEx while also maintaining a ~3.0x leverage ratio, EPD is effectively building up a massive amount of potential energy for capital returns that will eventually be released. This is because their free cash flow will likely soar in a few years due to the one-two punch of a marked decline in growth CapEx spending and their growth projects coming online. On top of that, the significant increase in EBITDA from those growth projects coming online alongside the reduced need to raise debt to finance them will lead to a meaningful reduction in the leverage ratio. This in turn will free up additional financial capacity on EPD’s balance sheet for capital returns to unitholders.

Management hinted at this reality on its latest earnings call, stating that after they get through some of their lumpy capital spending over the next few years, they expect CapEx to likely drop into the $2 billion range, potentially as soon as 2026. Then later on in the call, management said:

obviously if we come into an era where we’re not spending as much CapEx, then we’ll have more flexibility to come in and do buybacks.

What this means is that over the next few years, investors can look forward to a continued mid-single digit distribution CAGR alongside the juicy current 7.7% distribution yield while EPD builds up its underlying business further. Then, once it turns on the free cash flow spigot, it will be flush with potentially billions of dollars in excess capital that it can return to unitholders via an aggressive buyback program. Then, as the unit count decreases meaningfully, EPD could turn around and accelerate distribution growth as well in order to keep EPD’s already elevated 1.7x DCF coverage ratio at around that same level. In fact, they could even lower it from that level since their capital expenditure budget would then be lower as well.

Investor Takeaway

EPD has been a great long-term investment over its quarter-century history. Moreover, it is in exceptional shape to significantly outperform peers on a risk-adjusted basis moving forward, thanks to its relatively attractive valuation, its robust growth outlook, and its potential for significant capital return acceleration in the coming years. As a result, EPD is now my top MLP pick.

Credit: Source link