Coompia77/iStock via Getty Images

Introduction

Capital Southwest (NASDAQ:CSWC) recently reported its Q3 earnings and again showed why it’s one of the top BDCs in the sector and one of my favorite portfolio holdings. Since the start of interest rate hikes, many BDCs in the sector are now trading at lofty valuations above their NAV prices. CSWC has continued to perform exceptionally well over the past 18 months, and I think it will continue to do so for the foreseeable future. In this article I get into why Capital Southwest is a must-have for those looking for income but due to their share price appreciation, they should wait for a pullback in price before starting or adding to a position.

Previous Thesis

I last covered Capital Southwest back in November, where I asserted they were a top-tier BDC for any environment and gave them a Hold rating. Meaning, investors should consider holding this BDC for any environment, not just because of high interest rates. I also compared CSWC to their peers, showing their superior returns and strong balance sheet. Since then, the share price has appreciated nearly 20% at the time of writing and hit a new 52-week high of $26.17. Because of this, I think investors should wait for a pullback in price before starting or adding to their position.

Will There Be A Pullback?

I think most of us know BDCs have risen in price because of the current high interest rate environment. Because of their predominantly floating rate portfolios, many have enjoyed extra income in the process from portfolio companies, in turn rewarding shareholders with dividend increases, specials, and supplementals.

Since the start of rate hikes, I have not added to any of my BDC positions because I think many are now trading at nosebleed valuations. But some have to wonder will they ever drop to the prices they were trading at before the rapid rise in interest rates?

I don’t have a crystal ball, so I can’t answer that question, but I do think they will retract when rates are cut. I’ve heard everything from 7 rate cuts this year to 4 or even 3. And the first one is expected to as early as next month. Again, I don’t know how many or when, but I suspect we’ll get a rate cut around or near the second half of 2024. And if so, BDCs will likely fall.

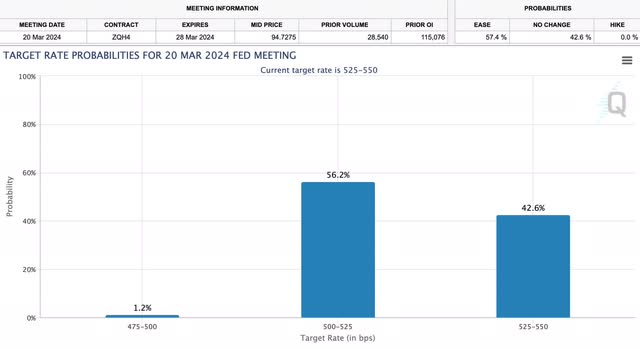

At the time of writing, there’s a 56.2% we will see our first-rate cut in March, but of course this is subject to change and is all data dependent.

CME FedWatch Tool

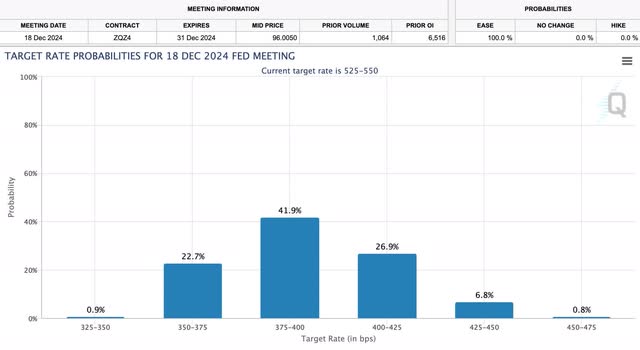

By the end of this year, rates are expected to be in a range of 375-400 bps. Again, this is all speculation, but I do think rates will be lower, and BDC prices to retract as a result.

CME FedWatch Tool

Latest Earnings & Continued Growth

Capital Southwest reported Q3 earnings on January 29th and the company did not disappoint. They delivered another beat by $0.04 bringing in net investment income of $0.70 vs the $0.66 estimate. Total investment income of $48.6 million also beat estimates by nearly $4 million.

Nll grew nearly 4.5% while Tll grew double digits at nearly 14%. Furthermore, CSWC originated $116 million in new commitments, adding four new portfolio companies to bring their total portfolio value to $1.4 billion. They also added onto 12 existing portfolio companies for a total of $45.6 million. Since the beginning of the fiscal year, CSWC has continued to grow their portfolio, despite the challenging environment, at a healthy pace.

Increased Liquidity & Buybacks

CSWC also further strengthened their balance sheet, increasing liquidity slightly from $23 million in Q2 to $23.6 million. Furthermore, they also announced an increase to their available credit facility by an additional $25 million, bringing total commitments to $460 million.

This further positions CSWC to make accretive acquisitions in volatile capital markets, but also allows them to repurchase shares in the foreseeable future. If and when interest rates are cut, I expect management to repurchase shares opportunistically, especially if the share price drops near or below NAV. Another reason is because CSWC has no debt maturities to worry about until 2026.

Speaking of NAV, the company also grew their NAV quarter-over-quarter by $0.31 from $16.46 to $16.77. One reason for the strong growth in NAV was by the company continuing to out-earn its dividend by a significant amount. In the chart below, you can see CSWC not only managed to grow NAV quarter-over-quarter, but year-over-year as well. This is in comparison to their largest peer Ares Capital (ARCC) who experienced a slight decline in NAV quarter-over-quarter from $18.58 to $18.56.

Author creation

Expect More Dividend Increases In The Future

Seeing as how Capital Southwest has been comfortably out-earning its dividend, I expect more increases in the foreseeable future. However, with rates expected to decline, these might slow. But I wouldn’t be surprised if the BDC pays an end-of-year special dividend, similar to how they did in 2021. Even with the supplemental of $0.06 and an increase to the regular dividend last year, the total payout of $0.63 is well-covered by net investment income.

Since the start of rate hikes, CSWC not only increased the supplemental but raised the regular dividend nearly 19% from $0.48 to the current $0.57. To put this into perspective, the only other high-quality BDC that outdid CSWC in raising their dividend is another favorite of mine, Blackstone Secured Lending (BXSL) where they raised the dividend more than 45% from $0.53 to $0.77.

Overvalued Currently

Because of their more shareholder friendly management team as a result of being internally-managed, they have conducted more increases to the dividend. One reason I think the stock’s valuation increased more than others in the sector since rate hikes began.

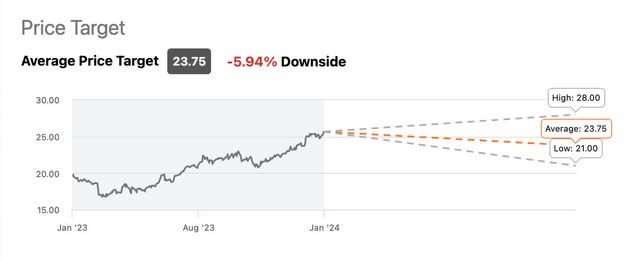

Furthermore, the stock offers no upside to its current price target of roughly $24 and currently trades at a P/NAV ratio of 1.44x. This increased from 1.31x since my last article 3 months ago, causing the stock to be downgraded at B. Riley due to their rich valuation. In comparison, their ratio is significantly higher than their largest peer ARCC’s P/NAV ratio of 1.06x and Blackstone Secured Lending’s (BXSL) 1.07X.

Seeking Alpha

However, Wall Street still rates the stock a buy. Although the share price could appreciate more from here, I think there’s more downside risk starting a position at the current price. If you typically dollar-cost average into positions like I do, then initiating a small position here while averaging in on pullbacks wouldn’t be a bad idea as well.

I personally have been a shareholder for quite some time and like CSWC under $20 a share, in the $17-$19 range. This is also closer to where the BDC traded prior to rate hikes with an average P/NAV ratio of roughly 1.0x, which I think is fair value. And if we experience several rate cuts this year, investors may see a comparable share price in the foreseeable future.

Risk Factors

Although the BDC has been further strengthening its portfolio in first-lien loans, they still face the risk of rises in non-accrual loans, especially in a recession. During the quarter, CSWC received repayment on five debt investments totaling $78.6 million and the sale of one equity investment.

Non-accruals stood at a fair value of $29.4 million and accounted for 2.2% of their total portfolio, an increase from $26.9 million in Q2. If rates are held longer or the economy transitions into a recession, CSWC could face financial pressure as these rise in the coming quarters or months. And although this could put the dividend at risk, I expect CSWC’s management team to navigate just fine. Their increased liquidity also puts them in a favorable position to temporarily fund struggling portfolio companies if need be.

Bottom Line

As a dividend investor, CSWC is a must-have for those looking for income. If you’re new to the sector, I would highly suggest considering CSWC on a pullback. Although BDCs have enjoyed a strong year due to their business structures, they are also great long-term investments as well. Even though Capital Southwest has faced challenges, they’ve continued to grow their portfolio and reward its shareholders while comfortably out-earning the dividend.

However, if the economy does enter into a recession or unexpected downturn, CSWC could face some financial pressure as portfolio companies experience headwinds in the process. And even though I expect management to navigate this, this is still a risk one must consider when investing in BDCs.

If you’re willing to be patient, I think CSWC will offer a more attractive price entry if and when we experience rate cuts this year. If you’re a current shareholder, I suggest waiting to add to your position, or maybe even selling shares to take profit. Until the share price retracts to a more attractive level, I continue to rate Capital Southwest a hold.

Credit: Source link