Michael M. Santiago

Wells Fargo (NYSE:WFC) has benefited from higher rates in the recent past, but this is expected to change leading to lower earnings ahead. While its valuation can be considered fair, I don’t see any catalyst for a higher share price in the short to medium term.

As I’ve covered in previous articles, I have been mainly bearish on Wells Fargo over the past few years, as the bank continues to operate under the Fed’s asset cap and its fundamental issues continue to penalize its profitability.

However, the rising interest rate environment over the past couple of years was a strong tailwind for higher revenue and earnings growth, but not surprisingly its shares have underperformed the market and the financial sector in the past two years, as shown in the next graph.

Share price (Bloomberg)

Given that the interest rate cycle is expected to change in the coming months, as the market is expecting the Federal Reserve to cut rates ahead, I think it’s now a good time to revisit Wells Fargo’s recent financial performance and investment case to see it remains a trap, or not, within the banking sector.

Financial Performance & Outlook

Wells Fargo is a bank that is heavily exposed to retail and commercial banking, being the least exposed to capital market activities among U.S. large banks. Theoretically, this profile should have been positive over the past couple of years, as the combination of higher rates and weaker performance of investment banking clearly benefits Wells Fargo’s business profile.

Indeed, this has been a positive support for higher net interest income (NII) during 2022 and 2023, which increased from about $35.8 billion in 2021 to $52.4 billion last year, an increase of 46%. This is explained by higher average asset yields due to higher interest rates in this period, which increased at a faster pace than its average liability costs.

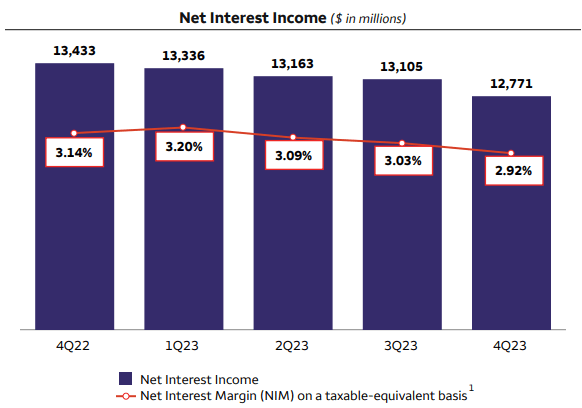

However, banking is a spread business and rising rates don’t necessarily lead to higher margins, a situation that happened during 2023 for Wells Fargo. As shown in the next graph, the bank’s net interest income peaked at the end of 2022, well before the Fed stopped its hiking campaign last summer. This is explained by higher deposit costs, with customers searching for higher yielding alternatives, such as money market funds, which led banks to increase interest rates on time deposits to stay competitive.

NII (Wells Fargo)

This dynamic puts pressure on the bank’s net interest margin (NIM), which has declined consistently over the past three quarters to 2.92% in Q4 2023, even though for the whole year its NIM was much higher than in 2022 (3.13% vs. 2.68%).

Given that rates are expected to go down in the near future, it’s quite likely that Wells Fargo’s NII will continue in a downward trend in the coming quarters, which is a headwind for revenue and earnings growth ahead.

Indeed, according to analysts’ estimates, Wells Fargo’s NII is expected to decline gradually during 2024, to $48.7 billion in the year, a decline of 7% YoY. This is more or less in-line with the bank’s guidance, but it will depend on how many times the Fed eventually cuts interest rates during this year, thus I think the main risk is for further downside on NII, rather than current consensus being too much negative.

Therefore, I expect downward revisions to NII in the coming months, as inflation is at much more moderate levels than it was in the recent past, thus there isn’t much need for the Fed to maintain its rate at current high levels.

Regarding other revenues, they were practically flat in 2023 at about $30 billion, leading to total revenues of $82.6 billion in 2023 (+11% YoY). Taking into account that NII is expected to go down in 2024, Wells Fargo is likely to report lower overall revenues, as noninterest income is not expected to offset NII weakness. Indeed, current consensus expects Wells Fargo to report revenues of $80.4 billion in 2024, a decline of 2.6% YoY.

As the bank is expected to report a lower top-line in 2024, it becomes even more important in the coming quarters to improve efficiency, namely through cost reductions, then it was over the past couple of years. Indeed, the bank’s strategy over the past few years to boost its profitability has been focused on cost cutting, but this has not played out as expected.

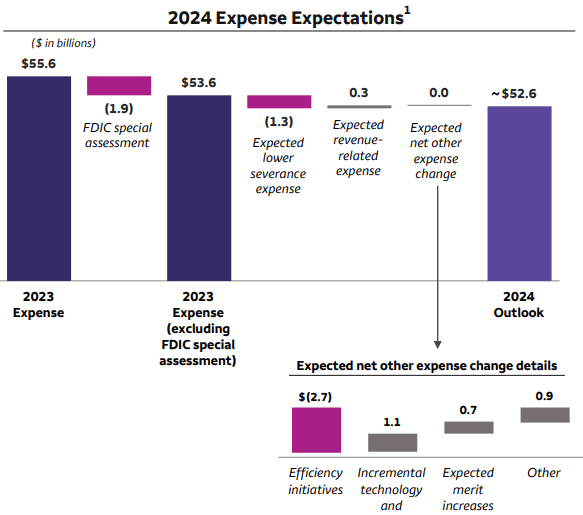

Due to the inflationary environment and some specific issues, Wells Fargo’s cost base has not changed much in recent years, with the bank reporting total costs of $55.6 billion in 2023, which was only 4.5% below its 2019 level. This includes the extraordinary FDIC contribution of $1.9 billion booked in Q4 2023, thus adjusted for this its costs would have been about $53.7 billion, practically flat compared to 2021.

This means that while Wells Fargo says that it was able to generate some $10 billion gross expense savings from 2021-23, there were other factors leading to overall cost increases, thus the net effect was more or less close to zero.

For 2024, its guidance is to continue its path of cost reductions, expecting to report a cost base of around $52.6 billion, a decline of 2% YoY compared to its adjusted costs in 2023. However, due to lower revenues also expected in 2024, its efficiency ratio is expected to be close to 66%, a small decline compared to 2023 (ratio of 67%).

Operating expenses (Wells Fargo)

This means that improved efficiency is not likely to be a major support for higher earnings in the coming quarters, especially when taking into account the bank’s track record regarding cost cutting, which has not been impressive over the past few years.

Therefore, its efficiency ratio is likely to remain at a relatively stable level of around 65% in the coming quarters, which is not among the best in the industry, and cost cutting should not be deep enough to significantly boost the bank’s earnings in the near future.

This has been a key factor why I have been bearish on Wells Fargo in the past, as a large part of its costs are sticky and not easy to cut, thus poor efficiency is a structural issue for the bank.

Regarding credit quality, Wells Fargo reported much higher provisions for loan losses during 2023 than compared to the previous two years, as higher rates had a negative impact on consumers and also on the corporate segment. Its total provisions for credit losses amounted to $5.4 billion in 2023, an increase of 252% YoY, representing a significant headwind for earnings growth.

This increase is justified by a deteriorating credit quality trend in some segment, such as credit cards or commercial real estate (CRE), of which Wells Fargo is the most exposed compared to other large U.S. banks. In Q4 2023, net loan charge-offs related to CRE amounted to $377 million, representing a cost of risk ratio of 99 basis points in this segment. The bank is experiencing losses mainly in the office segment, a trend that is not likely to reverse soon.

However, current consensus expect relatively stable loan loss provisions in 2024 compared to the previous year, which I think may be too optimistic. While in this current interest rate cycle there has been a higher lag than in previous cycles regarding deteriorating credit quality, the trend is clearly upwards and a weaker economy or higher unemployment ahead could lead to rising loan loss provisions, which would to another headwind for earnings growth.

Taking this combination of lower revenues, relatively stable efficiency, and potentially higher loan loss provisions in the coming quarters, Wells Fargo’s operating momentum is likely to be negative in 2024 and put pressure on its share price.

Indeed, its net income is expected to be slightly below $17 billion in 2024, a decline of 11% YoY, and its return on equity (ROE) ratio, a key measure of profitability in the banking sector, is expected to be around 10% (vs. 11% in 2023). Given this backdrop, Wells Fargo’s current valuation of 1.1x book value seems acceptable, being close to its historical average of 1x over the past five years.

Conclusion

I have been mainly bearish on Wells Fargo over the past few years, due to some structural issues that aren’t easy to fix and continue to pressure its operating performance. While over the past couple of years the bank benefited from higher interest rates, this is about to change in the near future, making the bank’s earnings outlook quite muted.

While I don’t expect its share price to collapse in the near term, I also fail to see much upside from current levels, and from an income perspective its dividend yield is also rather low, thus I think Wells Fargo continues to be unattractive to long-term investors for the time being.

Credit: Source link