Oselote/iStock via Getty Images

In September of 2023, we penned an article titled: “Super Micro: You Should Buy The AI Hype”, which talked about how we thought Super Micro Computer (NASDAQ:SMCI) was both well priced and well positioned to continue growing revenues and profits off of the back of a close partnership with Nvidia and growth in the secular generative AI trend.

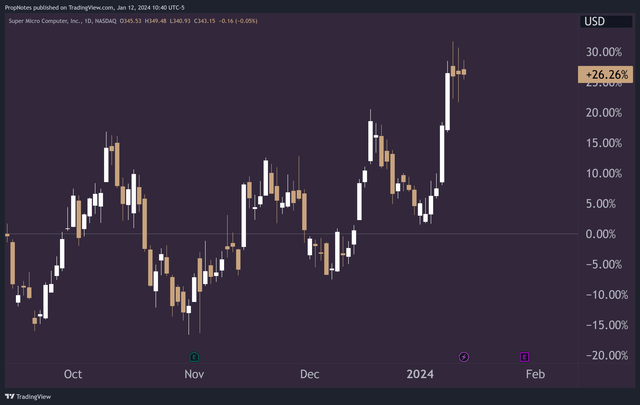

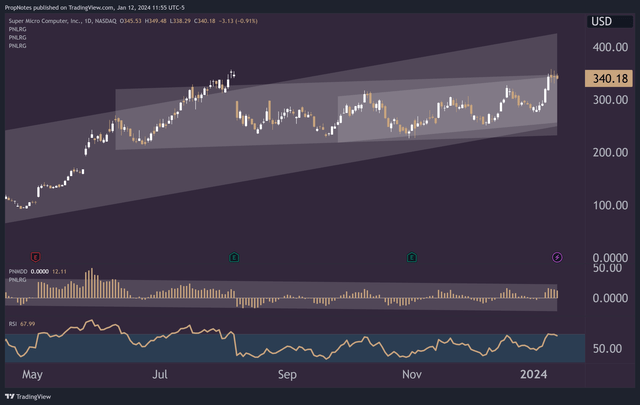

Fast forward to the present, and our prediction has borne fruit – SMCI is up more than 26% in that time, following another blockbuster earnings result and continued momentum in the generative AI space:

TradingView

However, since our initial bullishness, the company’s top line growth has slowed somewhat, margin pressures are mounting, and the business has become more expensive – growing its TTM GAAP P/E from 23x to more than 31x presently.

Today, we thought it would be a good time to take another look at the stock, its growth prospects, and its valuation in order to determine whether or not the company has become too expensive to continue investing in at the current juncture.

Sound good?

Let’s jump in!

The Original Thesis

Our original bullish view was based on a few key pieces of data that it makes sense to review now before diving into the latest developments with the stock. Here’s what initially backed our idea about SMCI being a solid investment opportunity:

-

Financial Performance and Growth:

- Super Micro Computer’s financials were in hyper growth, with top-line sales more than doubling in the last ~3 years, reaching around $7 billion. This was accompanied by an even more impressive increase in net income of more than 470% during the same period.

- The growth was largely due to SMCI’s significant partnership with Nvidia, which allowed for a highly competitive product line for AI use cases, along with enterprise and datacenter deal flow.

-

Positive Future Outlook:

- Management was (and remains to this day) bullish about the future, emphasizing the positive impact of generative AI across the product line.

- The company is well-positioned to meet the demand for high-performance compute and AI server systems, with a focus on the increasing need for enhanced storage performance to support massive data sets in AI applications.

-

The Valuation:

- Despite its impressive performance and optimistic outlook, SMCI seemed reasonably valued, with Seeking Alpha’s Quant Rating System giving it a “C-“.

- The Price/Sales ratio had seen a recent jump, but the Price/Earnings ratio remained within its historical regression range at only 23x, suggesting room for potential multiple expansion.

Financial Results

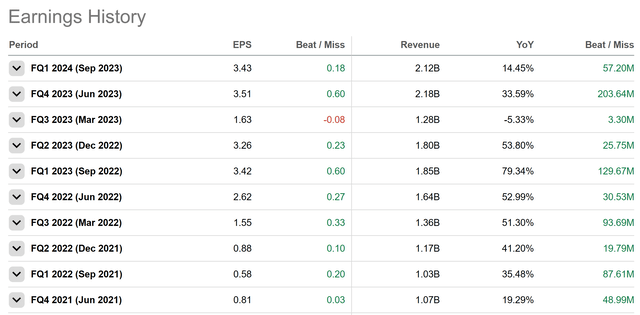

Since our article, SMCI reported Q1 earnings in November 2023 that came in way ahead of expectations.

On the top line, sales beat by $57 million, and on the bottom line, EPS was 18 cents ahead of estimates, coming in at a healthy $3.43 per share:

Seeking Alpha

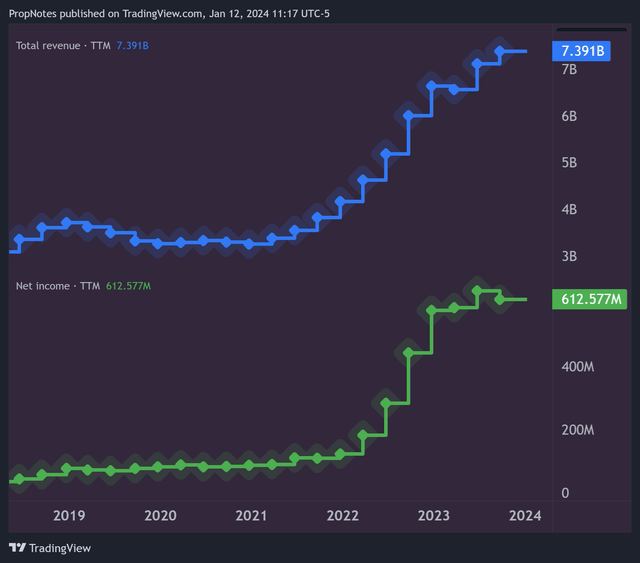

This follows a strong string of mostly beats and raises over the last few years, which can be seen more clearly in this zoomed-out TTM chart of continually growing revenue and net income since 2018:

TradingView

However, despite the positive surface level results, there are some deeper issues worth mentioning.

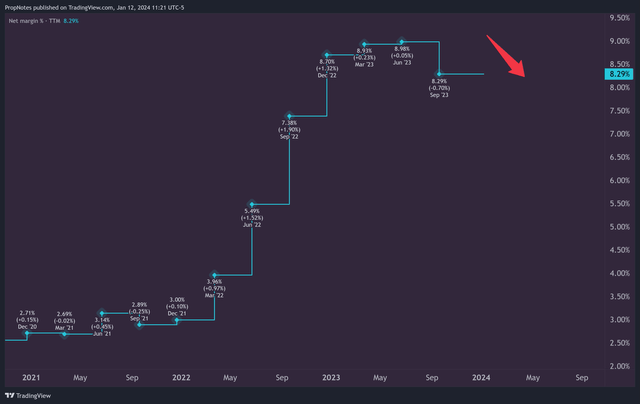

First is the fact that margins are actually shrinking for the first time since the recent boom began:

TradingView

In this chart of net income margins, it appears that margin growth – a key factor in driving EPS outperformance – has flatlined and even come in somewhat negative in the most recent TTM quarter.

If you zoom into the quarterly chart, you can see that net margins stopped expanding in September of 2022, and have been slowly drifting down up until the present day. This data shows margins under pressure in the following quarters: Q2 2023, Q3 2023, and now Q1 2024.

This is widely a result of cost pressures surrounding the inputs to many of SMCI’s final products, but the key here is that this trend isn’t abating. Here’s how CEO Charles Liang answered a question about increasing cost pressures from a Susquehanna analyst on the Q1 earnings call:

Mehdi Hosseini

Got it. Thank you. And Charles, a big part of your cause is memory and other components. And everything we have heard from memory manufacturers that they are not going to sell at prices that were prevalent just a couple of months ago. So memory prices are going up. And how do you alleviate that inflationary trend to be able to expand margins?

Charles Liang

Thank you. I mean, basically we are able to pass-through our cost to customers. So for that portion, basically we are kind of okay. We won’t be impacted by that. At least it won’t be impacted too much.

In short, gross margins aren’t expected to improve, if they’re even able to remain stable at all, as costs are passed through to customers.

If SMCI has officially saturated the market opportunity in terms of margin, then that removes a piece of the company’s bull thesis from the picture entirely.

Growth

At the same time as margins are coming under pressure, growth is also slowing down.

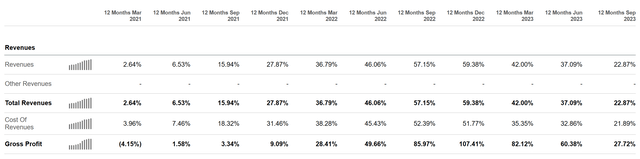

As we mentioned, in Q1, SMCI beat top line estimates by more than $57 million, which is great. What isn’t so great is what SMCI is producing in terms of top line YoY sales growth:

Seeking Alpha

Smoothing out some choppiness by looking at TTM results as opposed to quarterly results, you can see that revenue growth for SMCI peaked in December 2022, at 59.4%. Since then, growth has decelerated, coming in at only 22% YoY in the most recent TTM period.

Zooming in further, in Q1 alone, the company only produced 14% YoY top line expansion.

While these rates are still quite quick for a computer hardware company, they are significantly slower than what SMCI was generating over previous periods, which shows that the company is struggling to keep up the same pace of growth as time goes on.

To some degree, this is to be expected, as the company will reach a natural limit on how much revenue they can generate from the recent generative AI infrastructure build out.

Earnings are expected in a few weeks, and on both the margin front and the growth front, we think things will continue as they have been – growing overall, but in a slower, less profitable way. This appears to be the case due to the momentum in profitability we’ve highlighted, along with some of management’s comments about the future.

That said, management is expecting $10-$11 billion in sales in FY 2024 ending June of this year. With $2.1 billion in revenue in the books so far, that implies $2.6 billion in revenue for the three remaining quarters, on average.

It’s tough to know how much of that will drop to the bottom line in the coming quarters, especially because some of the highlighted plans to improve profitability, like moving manufacturing to Malaysia, will likely take longer to show up in the numbers.

All in all, while there are some optimistic things to point to and there’s no question that the company is growing, it also appears that pressures are starting to mount, challenging the company’s market saturation. It appears that much of the low hanging fruit has been picked already.

The Valuation

At the same time that top line growth is slowing down, and net margins are coming under pressure, the valuation is getting more expensive. This is troubling to us as former bulls on the name.

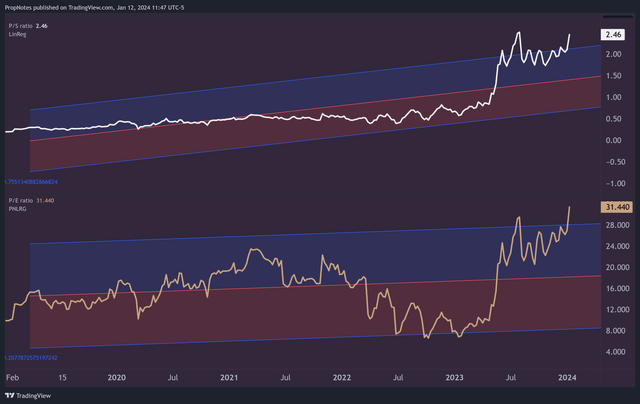

In sum, Since our last article, the growth and margin picture has continued to worsen, but the valuation has only gotten more expensive.

Previously, when we wrote about SMCI in September, the company was trading at 1.9x sales and 23x GAAP P/E.

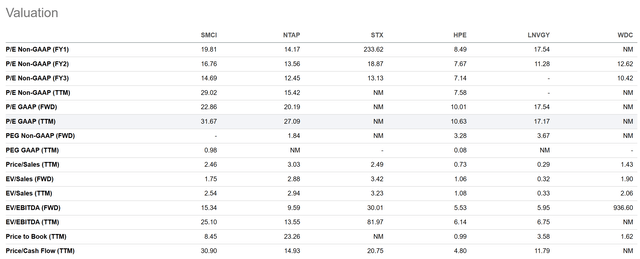

Now, SMCI is trading at 2.4x sales, and 31x P/E:

TradingView

That’s a top and bottom-line multiple expansion of 26% and 34%, respectively, in just under 4 months.

Additionally, now, the multiples are both trading well outside of their historical deviation ranges, which indicates a heightened potential risk of multiple collapse over the interim.

Some may see this expansion as increasing optimism in the company’s future prospects, and this is partially true given management’s predictions surrounding top line re-acceleration. However, given the financial pressures we’ve outlined above, this doesn’t appear to be the sole case.

What could be the culprit, then?

It appears to be momentum.

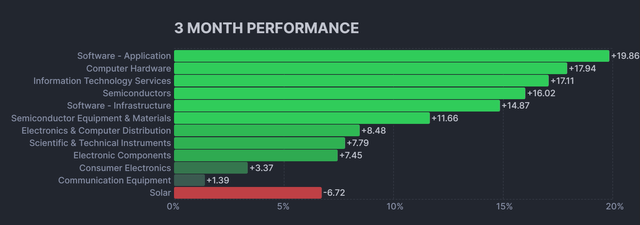

Over the last three months, tech has done well, with computer hardware names being some of the top winners over that time:

Finviz

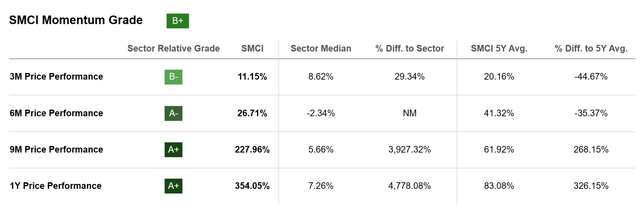

Momentum has also been generally strong for SMCI, as the company has generated a strong Seeking Alpha Quant grade in this category of a “B+”:

Seeking Alpha

However, when zooming out, SMCI appears to be overbought on short- and medium-term timeframes:

TradingView

The RSI is near the ‘overbought’ mark, and the stock price is just scraping the top of the short- and medium-term price ranges that were created throughout 2023.

And, while the stock could breakout in a more convincing way to all-time highs and likely generate some continued short-term velocity off of that, in general, in both technical and valuation terms, things seem to be extending well over their fundamental skis.

One could argue that the company was undervalued before and deserves a higher multiple now, but historically that hasn’t been the case, and SMCI’s peer group also appears more humbly valued:

Seeking Alpha

In fact, we’d argue that the company’s fair value is somewhere in the range of $280 – $330, if you bake in a relative premium to peer valuations, the lack of debt on the balance sheet, and the key Nvidia (NVDA) partnership.

However, at the end of the day, SMCI is a computer hardware company, and despite the growth profile and quality earnings, as things saturate and the stock price becomes more fully valued, taking some risk off of the table here seems like the best course of action.

We’re keen to see where the stock is trading a year from now.

Summary

Ultimately, we expect that SMCI will go on to be a successful, profitable company for years to come. However, with increasing gross margin pressure and a slowing top line growth engine, SMCI’s days of explosive EPS growth appear to be in the past, which is concerning for new buyers of the stock. It’s possible that top line growth could re-accelerate alongside management’s projections, but having those increases drop to the bottom line seems like a more suspect expectation.

When combined with a pricier-than-ever multiple and a technically overbought momentum condition, trimming risk here appears to be the prudent move for the time being. We’ll wait to become more bullish again at a lower price, should the opportunity present itself.

As a consequence, we’re downgrading SMCI to a “Hold” at this time.

Stay safe out there.

Cheers!

Credit: Source link