NicoElNino

2023 Review

Once again November did not disappoint, delivering exceptional gains much like investors have become accustomed to in years past. During 8 out of the last 11 Novembers, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) yielded attractive returns in excess of 3%. The past two years were even more impressive with gains of 7.12% and 6.6%. On average, since its inception in 2013, NOBL has averaged a 4.42% return in November. Far better than the next best month, July, that has yielded gains of 2.52% on average. December is thus far looking positive as well, NOBL is up 3.91% through December 22nd. Inclusive of partial December, NOBL is up 6.75% this year.

Not all of the dividend aristocrats are sharing the same fate as NOBL. Let’s take a look at which individual aristocrats are driving the return in 2023; 30 dividend aristocrats beat NOBL year-to-date through month-end November. The following aristocrats are ahead of the ETF on the year following November:

- West Pharmaceutical (WST) +49.41%

- Pentair (PNR) +45.73%

- W.W. Grainger (GWW) +42.79%

- Cardinal Health (CAH) +41.77%

- A. O. Smith (AOS) +34.06%

- Ecolab (ECL) +32.97%

- Brown & Brown (BRO) +32.13%

- Nucor Corp. (NUE) +30.23%

- Linde plc (LIN) +28.22%

- Stanley Black & Decker (SWK) +25.53%

- S&P Global (SPGI) +25.35%

- Roper Technologies (ROP) +25.33%

- Cintas (CTAS) +23.78%

- Church & Dwight (CHD) +21.32%

- Sherwin-Williams (SHW) +18.64%

- International Business Machines (IBM) +18.15%

- Aflac (AFL) +17.67%

- PPG Industries (PPG) +15.09%

- Expeditors International of Washington (EXPD) +13.26%

- Illinois Tool Works (ITW) +11.79%

- Walmart (WMT) +11.08%

- McDonald’s (MCD) +9.35%

- Caterpillar (CAT) +6.82%

- Dover (DOV) +5.74%

- Clorox (CLX) +5.54%

- Chubb (CB) +5.34%

- Medtronic (MDT) +4.59%

- Atmos Energy (ATO) +4.24%

- Essex Property Trust (ESS) +3.99%

- Procter & Gamble (PG) +3.88%

The S&P 500, as measured by SPDR® S&P 500 ETF Trust (SPY), was up an amazing 9.13% in November, outperforming NOBL during the month. Month-to-date through December 22nd SPY is up 3.78%, slightly behind NOBL. NOBL beat SPY in 2022 with a loss of 6.5% compared to a loss of 21.65%. SPY started 2023 on stronger footing and is beating NOBL by 18.47% year-to-date. The dividend aristocrats are not known to consistently beat the S&P 500 index, in fact, the dividend aristocrat index underperformed the S&P 500 index for 6 out of the last 8 full calendar years.

However, if you look further back in history, the dividend aristocrat index is outperforming the S&P 500 index by about 2.18% per year between 1990 and 2022. A significant portion of this long-term outperformance is attributable to the dot com bubble and the financial crisis as well as the immediate years following each market crash. This pattern was broken with the 2020 market crash, perhaps the much shorter duration of the crash and recovery are the reason. The dot com bubble and the financial crisis both extended for multiple years while the 2020 market crash was fully recovered in a matter of months. 2022 also proved to be a strong year for the aristocrats as they earned 15.15% of alpha on the S&P, making up for 3 years of underperformance.

Even though the dividend aristocrats have trailed the S&P for the better part of the last 8 years, long-term investors can rest assured that based on history, over a much longer time period, the dividend aristocrats can hold their own. There are currently 67 companies in the dividend aristocrat index but strong historical returns for the index can be attributed to only a handful of them. As an investor, I am always curious how to identify these drivers of outperformance.

I want to present 3 strategies that theoretically could identify winning aristocrats and lead to better performance than the dividend aristocrat index. These strategies work best with a buy-and-hold long-term investing approach as will be evidenced by the results. They are based on quantitative models that do not consider qualitative data; therefore it is prudent that further due diligence is performed on all chosen stocks.

The Most Undervalued Strategy

Strategy number 1 is a focus on valuation and more specifically it targets the potentially most undervalued dividend aristocrats. In theory, this is a long-term strategy since it may take some time to fully see the reward of leveraging a valuation approach. My preferred method for valuation is dividend yield theory, mainly for its simplicity. Unlike other valuation methods, dividend yield theory does not require making assumptions aside from assuming that a given stock will revert back to its long-term trailing dividend yield.

This valuation technique works best for mature businesses with long histories of dividend growth, making the dividend aristocrats an ideal pool of companies to value using this technique.

Selecting the 10 most undervalued dividend aristocrats each month and adopting a buy-and-hold investing approach can lead to long-term outperformance when/if the targeted stocks return to fair valuation. It may take a few months or even years to see if this strategy actually pays off. I predict that it will underperform NOBL for the first few months while we wait for bargain stocks to return to fair value.

|

Month |

Most Undervalued |

NOBL |

SPY |

|

Aug 21 |

0.49% |

1.87% |

2.98% |

|

Sep 21 |

-2.99% |

-5.69% |

-4.66% |

|

Oct 21 |

3.63% |

5.95% |

7.02% |

|

Nov 21 |

-2.19% |

-1.76% |

-0.80% |

|

Dec 21 |

10.37% |

6.54% |

4.63% |

|

Jan 22 |

1.04% |

-4.08% |

-5.27% |

|

Feb 22 |

-1.94% |

-2.59% |

-2.95% |

|

Mar 22 |

3.40% |

3.86% |

3.76% |

|

Apr 22 |

-2.14% |

-3.42% |

-8.78% |

|

May 22 |

3.11% |

0.31% |

0.23% |

|

Jun 22 |

-7.30% |

-6.73% |

-8.25% |

|

Jul 22 |

5.00% |

6.56% |

4.55% |

|

Aug 22 |

-3.25% |

-2.78% |

-4.08% |

|

Sep 22 |

-11.39% |

-9.15% |

-9.24% |

|

Oct 22 |

10.07% |

10.31% |

8.13% |

|

Nov 22 |

6.99% |

7.12% |

5.56% |

|

Dec 22 |

-5.41% |

-4.12% |

-5.76% |

|

Jan 23 |

4.83% |

3.23% |

6.29% |

|

Feb 23 |

-3.33% |

-2.36% |

-2.51% |

|

Mar 23 |

-0.86% |

0.99% |

3.71% |

|

Apr 23 |

3.06% |

2.12% |

1.60% |

|

May 23 |

-7.87% |

-5.90% |

0.46% |

|

Jun 23 |

7.17% |

8.08% |

6.48% |

|

Jul 23 |

3.27% |

2.59% |

3.27% |

|

Aug 23 |

-3.82% |

-2.34% |

-1.63% |

|

Sep 23 |

-7.37% |

-5.72% |

-4.74% |

|

Oct 23 |

-5.21% |

-3.49% |

-2.17% |

|

Nov 23 |

8.35% |

6.60% |

9.13% |

|

Dec 23 |

6.99% |

3.91% |

3.78% |

|

2021 Partial |

9.05% |

6.54% |

9.06% |

|

2022 |

-3.91% |

-6.50% |

-21.65% |

|

2023 |

3.35% |

6.75% |

25.23% |

|

TOTAL |

8.29% |

6.34% |

7.00% |

|

Alpha over NOBL |

1.94% |

||

|

Alpha over SPY |

1.29% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the most undervalued strategy.

The portfolio beat NOBL in November by 1.75% and trailed SPY by 0.78%. December thus far is looking even better, the portfolio is up 6.99% (price only return) through December 22nd, while NOBL is up only 3.91% and SPY is up 3.78%. Year-to-date the portfolio is still trailing NOBL and grossly underperforming SPY. However, since inception, the portfolio slides back ahead of both NOBL and SPY by 1.94% and 1.29%, respectively.

At its peak, this strategy was ahead of both NOBL and SPY by double-digit gains. While such outperformance is not something I am expecting out of this strategy, it has shown merit when stock valuations revert to historical means.

The portfolio consists of 41 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split among the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock.

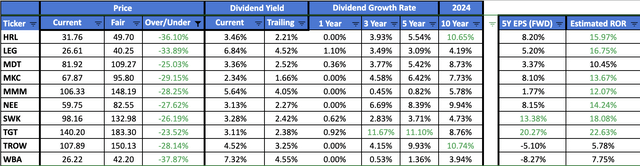

Here are the 10 most undervalued dividend aristocrats chosen for the month of January 2024. The table below shows potential undervaluation (column Over/Under) for each of the 10 chosen aristocrats. The image below is taken from a new spreadsheet I recently created where I am self-computing the 5-year trailing dividend yield. Previously I used Seeking Alpha as a source for the historical yield.

Created by Author

The top 10 list has one change compared to the prior month. Essex Property Trust (ESS) drops off and is replaced by Target (TGT).

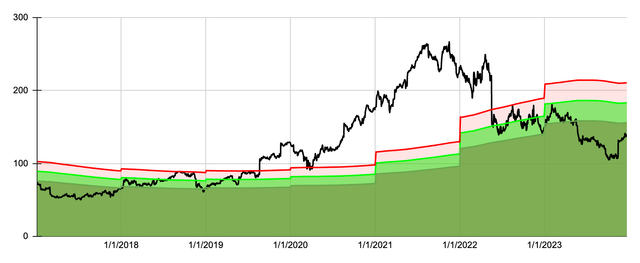

Here is a closer look at the dividend yield theory valuation for Target which looks approximately 24% undervalued.

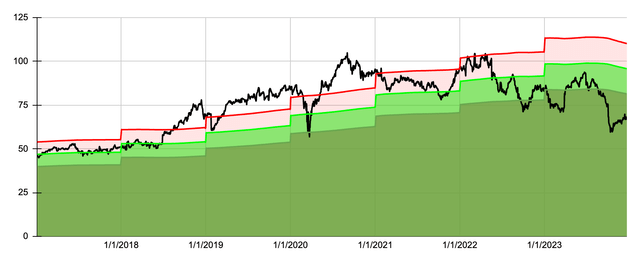

In the image below the black line is the actual price since November of 2016. The light green shaded area represents a 0 to 15% undervalued zone. The dark green area represents an undervaluation in excess of 15%. The light red shaded area represents a 0 to 15% overvalued zone.

Created by Author

The Fastest Expected Growth Strategy

Strategy number 2 is a focus on dividend aristocrats that are expected to grow the fastest in the near future. Historically, there has been a correlation between earnings per share growth and share price appreciation. Companies that have grown their earnings faster have also seen higher total returns. One way to gauge how fast earnings for a company will grow is to leverage analyst forecasts. For this strategy, I decided to use a discounted five-year EPS growth forecast combined with a return to fair valuation and the dividend yield to identify the 10 best aristocrats poised for the best total return in the future.

|

Month |

Fastest Growth |

NOBL |

SPY |

|

Aug 21 |

5.12% |

1.87% |

2.98% |

|

Sep 21 |

-4.42% |

-5.69% |

-4.66% |

|

Oct 21 |

5.92% |

5.95% |

7.02% |

|

Nov 21 |

-2.06% |

-1.76% |

-0.80% |

|

Dec 21 |

7.09% |

6.54% |

4.63% |

|

Jan 22 |

-4.42% |

-4.08% |

-5.27% |

|

Feb 22 |

-0.10% |

-2.59% |

-2.95% |

|

Mar 22 |

3.71% |

3.86% |

3.76% |

|

Apr 22 |

-2.19% |

-3.42% |

-8.78% |

|

May 22 |

0.12% |

0.31% |

0.23% |

|

Jun 22 |

-8.94% |

-6.73% |

-8.25% |

|

Jul 22 |

6.09% |

6.56% |

4.55% |

|

Aug 22 |

-2.69% |

-2.78% |

-4.08% |

|

Sep 22 |

-11.37% |

-9.15% |

-9.24% |

|

Oct 22 |

13.68% |

10.31% |

8.13% |

|

Nov 22 |

6.14% |

7.12% |

5.56% |

|

Dec 22 |

-7.53% |

-4.12% |

-5.76% |

|

Jan 23 |

9.41% |

3.23% |

6.29% |

|

Feb 23 |

-3.01% |

-2.36% |

-2.51% |

|

Mar 23 |

-1.79% |

0.99% |

3.71% |

|

Apr 23 |

0.37% |

2.12% |

1.60% |

|

May 23 |

-7.21% |

-5.90% |

0.46% |

|

Jun 23 |

11.17% |

8.08% |

6.48% |

|

Jul 23 |

3.00% |

2.59% |

3.27% |

|

Aug 23 |

-1.86% |

-2.34% |

-1.63% |

|

Sep 23 |

-7.33% |

-5.72% |

-4.74% |

|

Oct 23 |

-5.30% |

-3.49% |

-2.17% |

|

Nov 23 |

9.81% |

6.60% |

9.13% |

|

Dec 23 |

5.63% |

3.91% |

3.78% |

|

3.08% |

3.21% |

||

|

2021 Partial |

11.62% |

6.54% |

9.06% |

|

2022 |

-9.86% |

-6.50% |

-21.65% |

|

2023 |

11.03% |

6.75% |

25.23% |

|

TOTAL |

11.72% |

6.34% |

7.00% |

|

Alpha over NOBL |

5.37% |

||

|

Alpha over SPY |

4.71% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the fastest expected growth strategy.

The portfolio outperformed NOBL by 3.21% in November and SPY by 0.68%. December thus far is looking just as good, through December 22nd the portfolio is up 5.63% (price only return) while NOBL is up 3.91% and SPY is up 3.78%. Year-to-date the portfolio remains ahead of NOBL by 4.28% but trails SPY by 14.2%. However, since inception, the portfolio maintains a modest level of alpha over both benchmarks, 5.37% over NOBL and 4.71% over SPY.

The fastest expected growth portfolio is currently the best-performing of the 3 strategies. At one point it was trailing the most undervalued strategy by a wide margin but 2023 has seen market trends shift in favor of growth stocks. Although a more growth-oriented focus doesn’t always fair well when the entire market is crashing.

The portfolio consists of 37 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split amongst the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock. People’s United was removed from the portfolio in April 2022, as the company was acquired by M&T Bank (MTB); the value of the position was reinvested equally amongst the 10 chosen aristocrats for April.

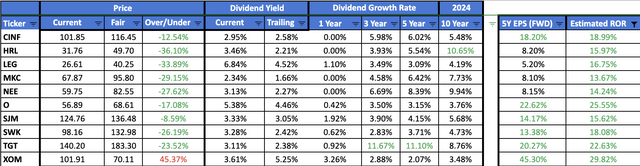

Here are the 10 dividend aristocrats poised for the best total return for the month of January 2024. The table below shows the expected growth rate (column EPS + Valuation) for each of the 10 chosen aristocrats.

Created by Author

The top 10 list has three changes compared to the prior month. Brown-Forman (BF.B), Essex Property Trust (ESS) and PPG Industries (PPG) drop off and are replaced by Hormel (HRL), McCormick (MKC) and J.M. Smucker (SJM).

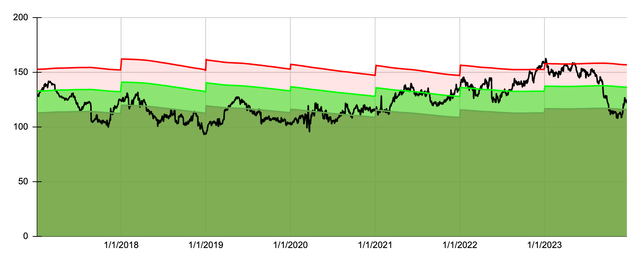

Here is a closer look at the dividend yield theory valuation for Hormel which looks approximately 36% undervalued.

Created by Author

Here is a closer look at the dividend yield theory valuation for McCormick which looks approximately 29% undervalued.

Created by Author

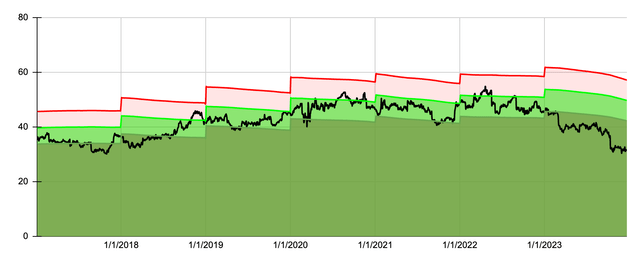

Here is a closer look at the dividend yield theory valuation for JM Smucker which looks approximately 9% undervalued.

Created by Author

The Blended Strategy

Strategy 3 is a blend of the first two strategies, with a focus on the fastest expected growth but applied only to undervalued aristocrats. A blend of undervaluation and expected growth could narrow down the best aristocrats between the two strategies. The most undervalued aristocrats may not necessarily be poised for the fastest growth. Additionally targeting only undervalued aristocrats can offer a margin of safety in that securities are purchased for fair or better prices.

|

Month |

Blended |

NOBL |

SPY |

|

Aug 21 |

2.64% |

1.87% |

2.98% |

|

Sep 21 |

-3.42% |

-5.69% |

-4.66% |

|

Oct 21 |

2.70% |

5.95% |

7.02% |

|

Nov 21 |

-2.56% |

-1.76% |

-0.80% |

|

Dec 21 |

10.07% |

6.54% |

4.63% |

|

Jan 22 |

-0.71% |

-4.08% |

-5.27% |

|

Feb 22 |

0.49% |

-2.59% |

-2.95% |

|

Mar 22 |

3.48% |

3.86% |

3.76% |

|

Apr 22 |

-5.04% |

-3.42% |

-8.78% |

|

May 22 |

1.28% |

0.31% |

0.23% |

|

Jun 22 |

-6.23% |

-6.73% |

-8.25% |

|

Jul 22 |

4.56% |

6.56% |

4.55% |

|

Aug 22 |

-3.29% |

-2.78% |

-4.08% |

|

Sep 22 |

-10.88% |

-9.15% |

-9.24% |

|

Oct 22 |

9.97% |

10.31% |

8.13% |

|

Nov 22 |

6.38% |

7.12% |

5.56% |

|

Dec 22 |

-5.32% |

-4.12% |

-5.76% |

|

Jan 23 |

4.15% |

3.23% |

6.29% |

|

Feb 23 |

-3.45% |

-2.36% |

-2.51% |

|

Mar 23 |

-0.31% |

0.99% |

3.71% |

|

Apr 23 |

2.31% |

2.12% |

1.60% |

|

May 23 |

-6.64% |

-5.90% |

0.46% |

|

Jun 23 |

8.48% |

8.08% |

6.48% |

|

Jul 23 |

3.38% |

2.59% |

3.27% |

|

Aug 23 |

-2.63% |

-2.34% |

-1.63% |

|

Sep 23 |

-7.33% |

-5.72% |

-4.74% |

|

Oct 23 |

-3.54% |

-3.49% |

-2.17% |

|

Nov 23 |

9.21% |

6.60% |

9.13% |

|

Dec 23 |

5.53% |

3.91% |

3.78% |

|

2021 Partial |

9.18% |

6.54% |

9.06% |

|

2022 |

-7.04% |

-6.50% |

-21.65% |

|

2023 |

7.70% |

6.75% |

25.23% |

|

TOTAL |

9.32% |

6.34% |

7.00% |

|

Alpha over NOBL |

2.97% |

||

|

Alpha over SPY |

2.31% |

The table above shows the monthly and annual returns for the buy-and-hold portfolio of the blended strategy.

The portfolio beat NOBL in November by 2.61% and SPY by 0.08%. December is thus far looking even better, the portfolio is up 5.53% (price only return) through December 22nd, while NOBL is up 3.91% and SPY is up 3.78%. Year-to-date the portfolio is now ahead of NOBL by 0.95%, but it continues to trail SPY by a wide margin. Since inception, the portfolio is once again ahead of both NOBL and SPY by 2.97% and 2.31%, respectively.

The blended strategy was an attempt to merge the best of the most undervalued and fastest expected growth strategies. For the longest time this was the worst performing strategy, however, following November this portfolio slides ahead of the most undervalued portfolio.

The portfolio consists of 42 unique present and former dividend aristocrats. I track this portfolio by investing $1,000 each month equally split amongst the 10 chosen aristocrats for that month. The positions are never trimmed or sold and all dividends are reinvested back into the issuing stock. People’s United was removed from the portfolio in April as the company was acquired by M&T Bank; the value of the position was reinvested equally amongst the 10 chosen aristocrats for April.

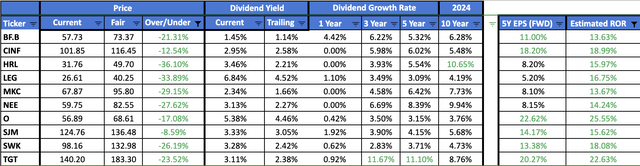

Here are the 10 dividend aristocrats chosen for the blended strategy for January 2024. The table below shows potential undervaluation (column Over/Under) and the expected growth rate (column EPS + Valuation) for each of the 10 chosen aristocrats.

Created by Author

The top 10 list has three changes compared to the prior month. Essex Property Trust (ESS), 3M (MMM) and PPG Industries (PPG) drop off and are replaced by Hormel (HRL), McCormick (MKC) and J.M. Smucker (SJM).

Performance Review

We have already seen how the buy-and-hold strategies are performing in December so now let’s look at how the chosen stocks for the month are doing as well. The 10 chosen aristocrats for the most undervalued strategy are up 9.94%, and performing the best. The fastest expected growth strategy selections are up 5.25% and the blended strategy selections are up 6.06%. The fastest expected growth strategy is off to the best start this year, seeing positive gains in 8 out of the 12 months thus far. The individual selections are also faring much better than the long-term buy-and-hold portfolios, with the year-to-date return being 28.27% through December 22nd. However, I still believe that a buy-and-hold approach is the optimal investing path to take with these strategies.

Here is a comparison of the buy-and-hold portfolios and the individual monthly selections for each strategy. As you can see the buy-and-hold portfolios are still performing much better than if we bought and sold the 10 chosen aristocrats each month. A buy-and-hold approach is also a much more tax-friendly investing strategy.

|

Type |

Most Undervalued |

Fastest Growth |

Blended |

NOBL |

|

Individual |

-0.56% |

18.00% |

11.33% |

6.34% |

|

Buy-and-Hold |

8.29% |

11.72% |

9.32% |

6.34% |

|

O/U |

8.85% |

-6.29% |

-2.01% |

0.00% |

Final Thoughts

I personally believe each of the 3 strategies outlined above can theoretically beat the dividend aristocrat index over a long period of time. These strategies are based on simple principles of valuation and expected returns, and they are easy to understand and implement. Investors should keep in mind that selecting individual stocks carries more risk than investing in an index. The simplest and possibly the safest way to invest in the dividend aristocrats is to purchase shares of NOBL. The fund finished 2021 with a fantastic return, performed much better than the S&P in 2022, and has an annualized rate of return of 9.90% since inception.

2023 is shaping up to be an interesting year for dividend strategies. The S&P 500 had a very poor return in 2022 and seemed to be bouncing back this year, not so much since August but the index remains positive year-to-date and looks to finish the year quite strong. Dividends aristocrats fared much better in 2022 but got off to a poor start this year. The aristocrats are making up some ground here in the last quarter but I think it’s a little too late to mount a comeback against the S&P. Dividend investing is a marathon, not a sprint and you will find yourself in a slow period from time to time. The best course of action is to stick with your long-term strategy so long as it still fits your long-term objectives.

The dividend aristocrat data in the images of this article came from my live Google spreadsheet that tracks all of the current dividend aristocrats. Because this data is updated continuously throughout the day, you may notice slightly different data for the same company across the images. Also, some of my returns may be off by a few basis points from those you’ll see from other sources on the web.

Credit: Source link