HeliRy

Note:

I have covered Imperial Petroleum (NASDAQ:IMPP, NASDAQ:IMPPP) previously, so investors should view this as an update to my earlier articles on the company.

History Of Dilution And Related-Party Dealings

For most of the past two years, Imperial Petroleum has diluted shareholders relentlessly in order to grow the company’s fleet.

Since the time of the company’s spin-off from former parent StealthGas (GASS) two years ago, Imperial Petroleum’s share count has increased from 4.8 million to 446.7 million, or almost 10,000% on a reverse stock split-adjusted basis.

Adding insult to injury, the majority of the added vessels have been acquired in expensive related-party dealings well above prevailing market prices.

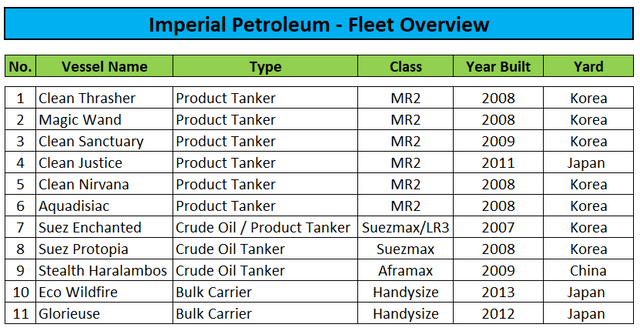

Over the past two years, the company has expanded its fleet from four to eleven vessels with an estimated market value of almost $300 million and this does not even account for vessels contributed or sold to recent spin-off C3is Inc. (CISS).

Regulatory Filings

Reversing Course With Buybacks And Insider Purchases

However, the company has reversed course in recent months with the announcement of a $10 million share repurchase program in early September and subsequent buybacks of common shares and warrants.

In addition, Arethusa Properties Ltd. (“Arethusa”), an entity originally affiliated with CEO Harry Vafias’s mother, recently acquired approximately 2.3 million common shares in the open market.

Earlier this month, all of the equity interests in Arethusa have been transferred to Mr. Vafias.

CEO Aligns Interests With Common Shareholders

Last week, an entity affiliated with the CEO converted its entire holdings of the company’s Series C Cumulative Convertible Perpetual Preferred Stock into 6.9 million new common shares at a conversion price of $2.02.

In aggregate, Mr. Vafias now owns approximately 35.5% of the company’s outstanding common shares, thus substantially aligning his interests with outside shareholders and making further dilutive stock offerings highly unlikely.

Warrant Exercises Likely To Be Imminent

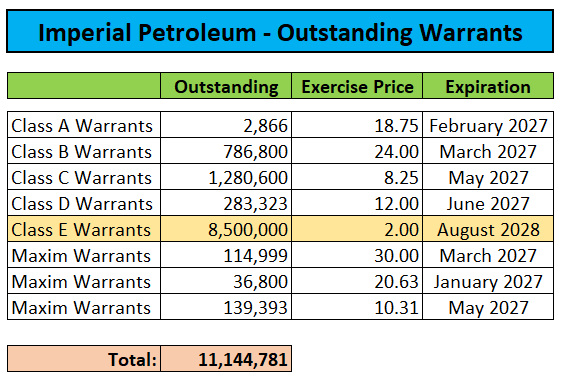

However, even after recent buybacks, there’s still a substantial number of potentially dilutive warrants outstanding:

Regulatory Filings

Particularly, the company’s Class E warrants are likely to be exercised now, which could result in some near-term selling pressure on the common shares.

Massive Discount To Net Asset Value Persists

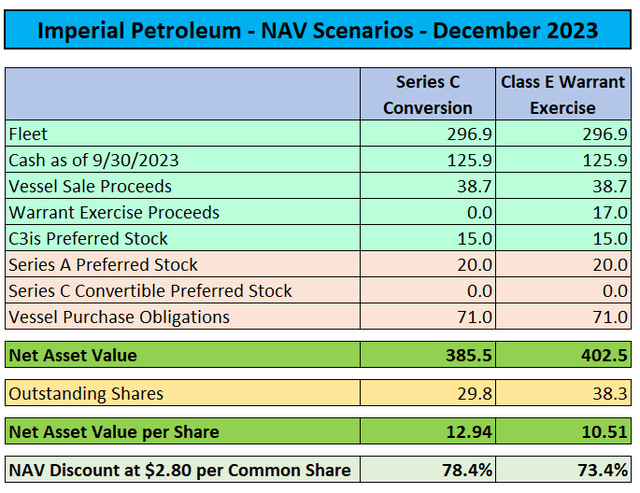

That said, even after the 150% rally from recent lows, Imperial Petroleum’s common shares are still trading at a massive discount to estimated net asset value (“NAV”) scenarios:

Company Press Releases / Regulatory Filings / MarineTraffic.com

Please note that the table above does not include any estimates for Q4 cash generation, which I would estimate at approximately $10 million even after taking into consideration the impact of scheduled drydocking during the quarter.

With the Class E warrants having moved well into the money in recent weeks, it is fair to assume near-term conversion, thus resulting in outstanding common shares increasing by almost 30% to 38.3 million. Full exercise would result in cash proceeds of approximately $17.0 million to the company.

However, even on a diluted basis, Imperial Petroleum’s common shares are still changing hands at an almost 75% discount to NAV.

Corporate Governance Remains A Concern

On the flip side, corporate governance remains a major concern. While dilutive common stock offerings are likely to be off the table for now, the company might still engage in unfavorable related-party dealings similar to the purchase of two handysize dry bulk carriers earlier this year from entities affiliated with Mr. Vafias which resulted in the issuance of the above-discussed Series C Convertible Preferred Stock.

At the current stock price, last week’s conversion resulted in a 40%+ gain for the CEO within just ten months and this number does not even account for the gain pocketed by Mr. Vafias from selling the dry bulk carriers to Imperial Petroleum at a premium to prevailing market prices at that time.

In addition, unlike the majority of U.S. exchange-listed tanker and dry bulk shipping companies, I do not expect Imperial Petroleum to pay a quarterly dividend anytime soon, if ever.

Valuation And Price Target

Given these issues, a substantial discount to the estimated net asset value appears to be warranted.

On the flip side, the company deserves some credit for its debt-free balance sheet and strong liquidity.

Moreover, with dry bulk charter rates having recovered significantly in recent weeks and prospects for the product and mid-sized crude tanker markets remaining decent going into 2024, particularly after the recent developments in the Red Sea, the company’s net asset value per share should increase further even without additional buybacks.

Assuming 2024 free cash flow generation of $40 million and second-hand vessel values remaining largely unchanged, diluted NAV per share would increase to approximately $11.50.

Assigning a 60% discount to the estimated year-end 2024 NAV would result in a price target of $4.60 thus providing for almost 65% upside from current levels.

Even when going with the present NAV number, the resulting price target of $4.20 still represents a 50% upside from Friday’s close.

Series A Preferred Shares – Juicy Yield

Income-oriented investors might consider taking a look at the company’s 8.75% Series A Cumulative Redeemable Perpetual Preferred Shares (IMPPP) which offer a juicy 10.1% yield at prevailing trading prices.

However, this series of preferred shares does not contain a conversion option and trading volume remains anemic.

Bottom Line

After an eighteen-month streak of relentless dilution, Imperial Petroleum has reversed course and started to engage in share and warrant buybacks.

Even more importantly, following last week’s preferred stock conversion, CEO Harry Vafias is now sufficiently aligned with common shareholders to largely rule out further dilutive stock offerings.

However, potential, additional related-party dealings might still result in Mr. Vafias extracting value from the company going forward.

Given recent, positive developments and considering the strong prospects of the product and mid-sized crude tanker markets going into 2024, I am reiterating my “Buy” rating on the company’s common shares while assigning a price target of $4.60.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Credit: Source link