Justin Sullivan/Getty Images News

Lucid (NASDAQ:LCID) is preparing to launch its new vehicle in 2024, and market participants have high hopes that the Gravity SUV will reinvigorate the company, saving it from the brink of collapse.

Much like Lucid’s Air sedan, the Gravity is a handsome vehicle. The exterior is sleek and sexy, the interior is ultra-luxurious, and the pure EV boasts solid specifications.

The projected range is 440 miles, with peak horsepower of over 800 hp, seating up to seven people, and a 0-60 time under 3.5 seconds. Also, it should start at about $80,000, making it a worthy competitor to Tesla’s Model X and other high-quality full-size 100% EV SUVs.

However, despite the Gravity being an impressive vehicle, Lucid is in big financial trouble, and the new car may not save it. In the first half of 2023, Lucid delivered only 2,810 of its niche Lucid Air vehicles while losing more than $1.5 billion. This dynamic equates to a staggering $550,000 loss per sold vehicle.

Lucid Is No Tesla

Lucid is a niche automaker and may never reach a significant scale. Lucid is certainly not the next or the new Tesla. Tesla did something remarkable and revolutionary. It was the first automotive start-up to succeed in the U.S. in many decades.

Moreover, Tesla pioneered the EV industry, building significant competitive advantages and continuously widening its moat. Tesla made starting a massive auto company look easy, but it is anything but that in this capital-intensive, ultra-competitive space.

On the other side of the equation, the established American, Japanese, and European automakers have made significant strides in the EV space, flooding the market with quality, competitively priced 100% EV sedans and SUVs.

Now, Lucid is between a rock and a hard place. It has excellent vehicles but lacks adequate infrastructure, an efficient logistics network, profitable mass production ability, significant demand, and other instrumental elements. There’s no indication that Lucid will become profitable soon, and there is no reason why a new vehicle will change this fact.

On the contrary, the new Gravity SUV opens Lucid up to new production costs and potential problems requiring more capital. This dynamic could result in accelerating losses, adding to the losses mounting from the Air sedan. Therefore, Lucid may remain a niche automaker. The stock doesn’t seem attractive until the company demonstrates it can mass produce its vehicles, becoming much more efficient with scale.

Also, Lucid burns so much money that we need to see almost a 180-degree turn regarding production efficiency and general cost management. There’s also no indication that the company is nearing this inflection point “u-turn.”

Last Quarter Was A Disaster

Q3 was another disaster for Lucid. The company’s revenues dropped off a cliff, declining by 30% YoY. This dynamic differs significantly from what a successful mass-market vehicle should be. This dynamic illustrates weaker-than-anticipated demand and limited production, resulting in significant losses for Lucid.

Lucid dropped its full-year 2023 delivery guidance to just 8,000-8,500 vehicles at the end of the third quarter. Tesla’s price cuts and competing EVs from legacy auto have dented Lucid’s demand even more than expected.

Last year, the company boasted about “strong demand,” saying it had 37,000 vehicle reservations to fulfill. We’ve seen those reservation numbers dwindle in more recent reports, illustrating softening demand.

Enemic Demand for the Air – Why Would the SUV be Different?

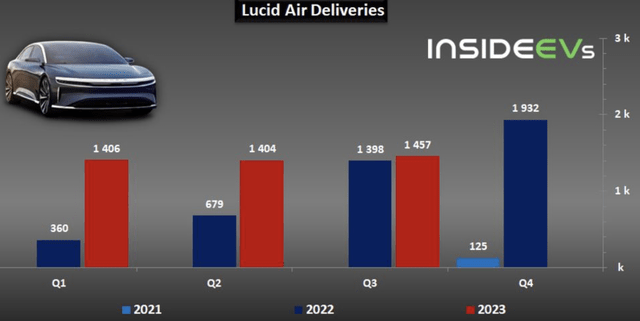

Air deliveries (InsideEVs.com )

The Air’s deliveries topped out in Q4 2022 and have been relatively flat. This sales dynamic is highly disappointing for Lucid, as the new sedan should have sold like hotcakes. Instead, we see stagnant unit sales with a significant drop in revenues. The high-end SUV market is similar to the high-end sedan market. There’s no reason to believe the Galaxy’s sales will be far superior to the Air’s. Instead, introducing a new vehicle now seems like a desperate Hail Mary that may fail.

It is shocking how much money Lucid loses. Lucid’s operating loss was $753 million just last quarter, equating to a staggering $517,000 loss per delivered vehicle. This dynamic illustrates an operating margin that’s negative several hundred percent.

Lucid’s Loss Statement

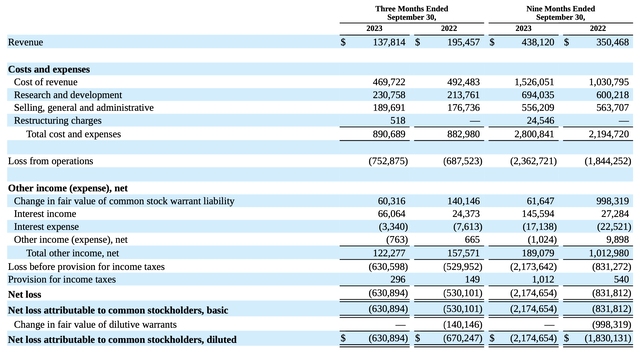

Lucid loss statement (ir.lucidmotors.com)

Lucid is highly inefficient. Last quarter, it had a gross margin loss of $470 million on revenues of just $138 million. Despite the 30% YoY revenue drop, Lucid’s operating expenses increased from Q3 last year. Also, I want to point out that Lucid delivered more vehicles than a year ago but, due to lower prices, experienced a significant decline in revenues.

The losses are mounting, and there is no end in sight. Lucid has lost $2.17 billion on a net basis in the first three quarters of the year. This dynamic represents a loss increase of over 20% from last year. We will likely see a net loss of $2.8-3 billion for the year.

The Bottom Line: Too Many Unanswered Questions

What’s next for Lucid, a $4-5B loss in 2024? How will a new SUV fix Lucid’s gross inefficiency problem? Where will the capital come from to fill the massive financial gaps and fund operations? Will Lucid continue diluting its sock? What will the PIF (Saudi sovereign wealth fund) do? Will the Saudis back out of their Lucid investment? Unanswered questions equate to substantial risk.

Indeed, the company must answer many questions for investors. However, one thing remains clear. Establishing a profitable car company from the ground up is challenging, especially in this ultra-highly competitive environment. On top of the industry-specific difficulties, we remain in a sluggish economic climate, a negative dynamic for a company in Lucid’s place.

Lucid is exceptionally unprofitable, burning through approximately $230 million each month. It faces challenges on the manufacturing and administrative sides of its business. Introducing a new capital-intensive vehicle may contribute to more inefficiency, increasing losses as the additional production ramp-up begins. Therefore, despite the hype surrounding the Gravity, we could see more share dilution and a lower stock price for Lucid as we advance. Despite the Gravity SUV’s prospects, Lucid remains a sell.

Credit: Source link