THEPALMER/E+ via Getty Images

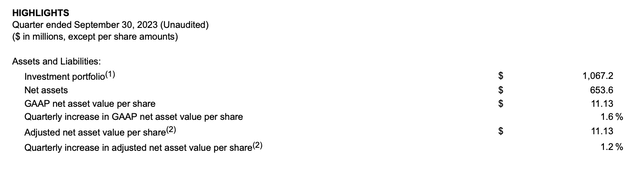

Stability and underwriting quality will be even more critical in calendar 2024 as the Fed now looks done with further rate hikes to close what’s been a core driver of growth for BDCs with highly floating credit portfolios over the last two years. I’m looking to maintain my investments in BDCs that are seeing stable and rising net asset value from earning net investment income that is far in excess of their dividend whilst maintaining strong portfolio quality to minimize loans on non-accrual status. Whilst PennantPark Floating Rate Capital (NYSE:PFLT) has been able to increase its NAV by 24% over the last year from the end of its fiscal 2023 fourth quarter, ending September 30, 2023, the per share metric has dipped. NAV per share came in at $11.13 at the end of the fourth quarter, a roughly 49 cents per share decline from the year-ago figure, but a 1.6% increase sequentially.

PFLT Fiscal 2023 Fourth Quarter NAV Earnings Release

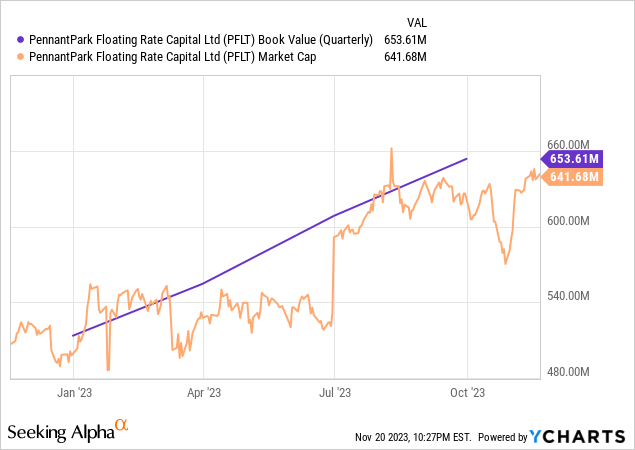

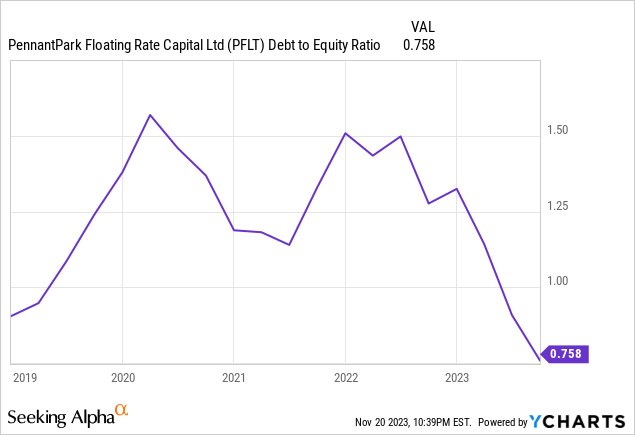

BDCs regularly tap their equity to optimize their capital stack. This is accretive when the common shares are trading at a premium to NAV as defined by book value. However, PFLT has traded at a discount to NAV for much of 2023 and has issued new shares throughout the year with the BDC’s shares outstanding ending the fourth quarter at 59.3 million, up 53.4% from 38.6 million shares at the end of its year-ago comp. This staggering growth in basic weighted average shares outstanding has been transformative to PFLT’s overall risk profile as its debt-to-equity ratio dropped to 0.76x, a more than 5-year low. The BDC has been tapering this ratio lower over the last two years.

Deleveraging And Investment Income

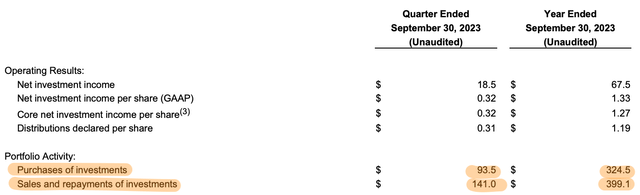

PFLT’s debt-to-equity ratio has essentially been cut in half since the start of calendar 2022, an extremely defensive positioning against what’s been an incredible ascent of interest rates over the last two years. The BDC’s $1.07 billion investment portfolio at the end of its fourth quarter was down $38 million sequentially with PFLT pushing through sales and repayments of investments of $141 million over and above new investments of $93.5 million. For the full year investment exits at nearly $400 million was ahead of new investments of $325 million to lead to a $75 million decline in net investment for its fiscal 2023. Net investment income of $18.5 million, around $0.32 per share meant the 3-month aggregate of the monthly distribution was 104% covered, a 96% payout ratio.

PFLT Fiscal 2023 Fourth Quarter NAV Earnings Release

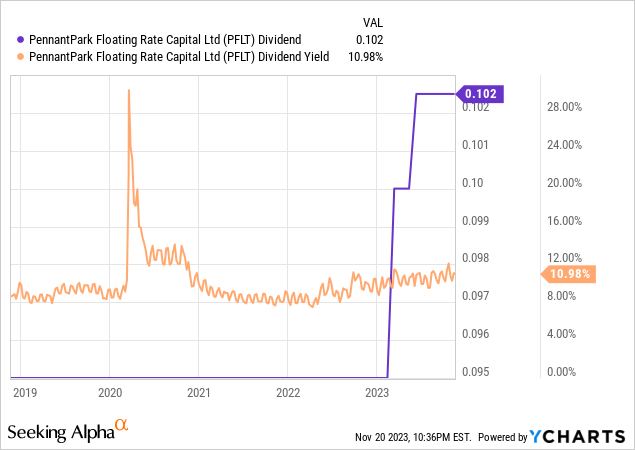

PFLT has an attractive monthly cash dividend distribution schedule and last declared a $0.1025 per share payout, in line with its previous payout for what’s currently an 11.3% annualized forward dividend yield. PFLT has raised its dividend twice since the pandemic and comes with a 3-year compound annual growth rate of 1.72%, around 74% lower than its sector median of 6.52%. The prior five years saw zero dividend growth with the current Goldilocks macroeconomic backdrop of interest rates at 22-year highs of 5.25% to 5.50% and GDP growth ahead of market expectations, US 2023 third quarter GDP growth at 4.9% was ahead of consensus by 60 basis points, providing optimal conditions for the BDC to drive total investment income higher.

Fed Moves, Non-Accrual Loans, And Dividend Outlook

The 25 basis point interest rate hike back in July was likely the last of the current hiking cycle. Hence, whilst the Fed will maintain a hawkish tone at upcoming FOMC meetings by stressing the possibility of further interest rate hikes, the market has essentially fully ruled this out. The CME’s 30-Day Fed Funds futures pricing data has placed the probability of a further rate hike at close to zero with 100 basis points in cuts expected roughly a year from now by December 2024. Critically, PFLT’s portfolio credit quality remained stable with no new non-accruals in the fourth quarter and with a 2.1x weighted average interest coverage ratio.

The BDC is diversified across 131 companies in 45 different industries with its credit portfolio 100% floating rate and with a 12.6% weighted average yield. PFLT had three loans on non-accrual status at the end of the fourth quarter, around 1% of its portfolio at cost and 0.2% at fair value. Hence, the aggregate of an extremely low debt-to-equity ratio, low loans on non-accrual status, and repayments running ahead of new investments paint a vivid picture of a stable BDC defensively preparing for more material economic disruption. This has in the short term likely limited the scope of net investment income growth, but the BDC would be extremely well placed in the scenario that the US falls into a recession. I’d like to see NAV start to grow on a per-share basis rather than just a nominal basis before recommending PFLT as a strong buy, but this is a stable ticker. The outlook for dividend growth is low though against the greater than 90% payout ratio.

Credit: Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TNKUC4COBFICBL3OM7N553YBSI.jpg)