Olivier Le Moal

We’re nearing the end of the Q3 Earnings Season for the Gold Miners Index (GDX) and one of the most recent companies to report its results was Wheaton Precious Metals (NYSE:WPM). Overall, the company had a solid quarter given the impact of significantly lower sales from its Penasquito silver stream related to the strike action by the National Union of Mine, Metal, and Allied Workers, and it also got some help from higher metals prices. Plus, its gold stream at Salobo and gold/silver streams at Constancia picked up much of the slack, with the latter asset expected to have a strong Q4 as well. The result is that Wheaton will deliver into FY2023 guidance despite the meaningful headwind, and the bigger picture continues to improve with the 10-year outlook of 850,000 gold-equivalent ounces [GEOs] on average in the period ending 2032 looking conservative. In this update, we’ll dig into the Q3 results and whether WPM is worthy of investment following the strike resolution at its most largest silver streaming asset.

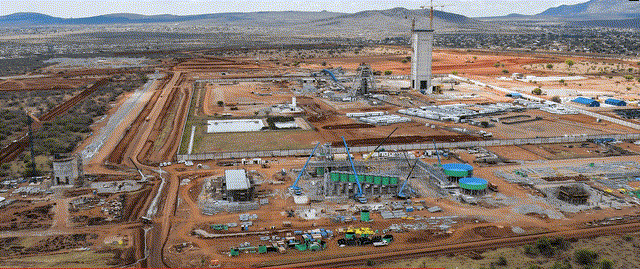

Blackwater Project Construction – Artemis Gold Website

Q3 Production & Sales

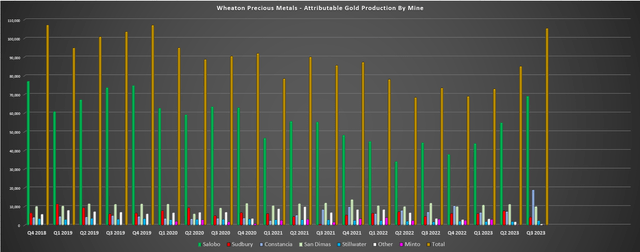

Wheaton Precious Metals (“Wheaton”) released its Q3 results last week, reporting quarterly attributable production of ~154,800 GEOs made up of ~105,400 ounces of gold, ~3.36 million ounces of silver, plus additional production from palladium and cobalt. This represented a significant increase in attributable gold production (+46%) driven by a meaningful increase at Salobo (~69,000 ounces vs. ~44,200 ounces) and Constancia (~19,000 ounces vs. ~7,200 ounces), offset by declines at San Dimas and Minto (offline). At Salobo, production improved materially because of higher throughput and recoveries with production from the third concentrator line, and attributable production will increase further for Wheaton as the asset ramps up to 32 million tonnes per annum by year-end and toward full capacity of 36 million tonnes by year-end 2024. Meanwhile, Constancia benefited from higher grades from Pampacancha, with milled grades of 0.21 grams per tonne of gold and 3.75 grams per tonne of silver and higher recoveries (74.8% and 73.2% vs. 61.9% and 62.5% for gold and silver, respectively).

Wheaton – Attributable Gold Production by Mine – Company Filings, Author’s Chart

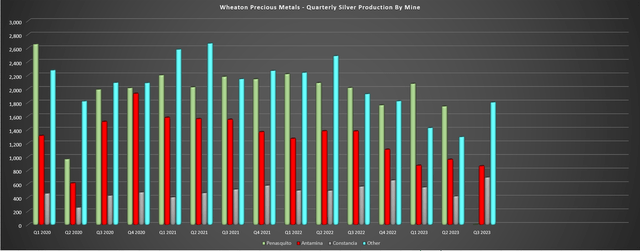

Unfortunately, the sharp increase in gold production was partially offset by lower silver production and sales, which is little surprise given the temporary suspension of operations at Penasquito. In fact, there was no production from Penasquito in the period and sales came in at just ~453,000 ounces (down over 70% year-over-year), with sales in the period related to the lag between production and deliveries. However, with Penasquito down for most of June and all of Q3 and only set to ramp up to full production by year-end, it’s unlikely that Wheaton will see any sales from this asset in Q4 and limited production. As the chart below shows, this had a meaningful impact on its attributable production which slid from ~5.82 million ounces to ~3.36 million ounces, and was down nearly 50% on a two-year basis (Q3 2021: ~6.35 million ounces) with the additional impact of the Keno Hill and Yauliyacu streams being terminated and the 777 Mine moving into care and maintenance. On a positive note, there’s no longer uncertainty related to Penasquito’s restart even if this has dented its attributable production and sales in H2-2023.

Wheaton Precious Metals Silver Production by Mine – Company Filings, Author’s Chart

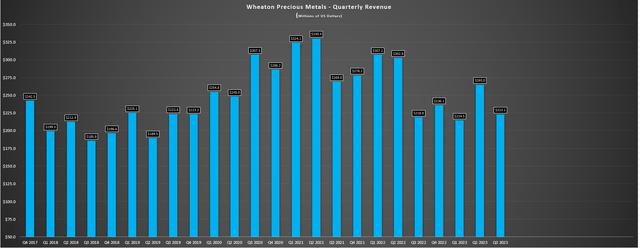

Despite the limited sales from Penasquito, though, Wheaton still grew revenue year-over-year to $223.1 million, helped by much higher metals prices after a period of depressed pricing in Q3 2022. In fact, its average realized gold price came in at $1,944/oz (Q3 2022: $1,728/oz) while its average realized silver price came in at $23.73/oz (Q3 2022: $21.02/oz), more than offsetting the violent bear market in palladium (PALL). This helped the company to end the quarter with ~$830 million in cash and ~$2.8 billion in liquidity despite the Penasquito and $90 million in upfront cash payments related to its Blackwater precious metals purchase agreement. And while on the topic of Blackwater, construction continues to progress well (overall construction 45% complete), with engineering and design over 95% complete, with the operator looking into advancing the Phase 2 Expansion earlier than initially planned (ramp up to 12 million tonnes per annum) with a study expected out early next year.

Wheaton Precious Metals Quarterly Revenue – Company Filings, Author’s Chart

Financial Results & Margins

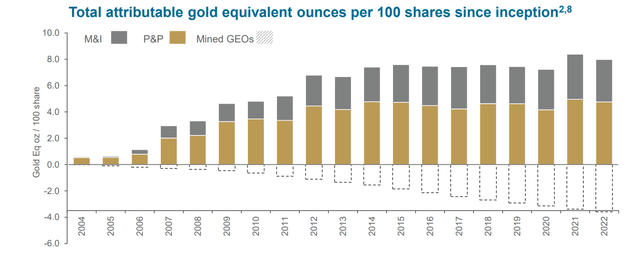

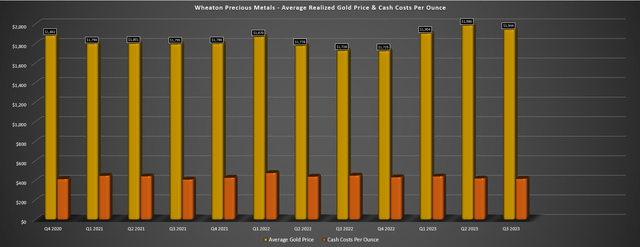

Moving over to Wheaton’s financial results, it has been insulated like its royalty/streaming peers from inflationary pressures that have dented sector-wide margins, with the company reporting meaningful margin expansion to $1,457/oz per GEO (~75% margins) with cash costs coming in lower year-over-year ($418/oz). Meanwhile, operating cash flow increases to $171.1 million (+11% year-over-year) with adjusted earnings of $121.5 million (+30%), helped by higher metals prices and despite an increase in PBND inventory. That said, its financial results were weaker on a year-to-date basis (earnings of ~$368 million vs. ~$401 million) partially because of the impact of Penasquito being offline, the timing of sales (affecting revenue) and higher G&A/stock-based compensation. Still, the company continues to enjoy superior per share growth to most of its sector peers because of its attractive business model, with total attributable GEOs per share held up exponentially since it began publicly trading as Silver Wheaton in 2004.

Wheaton Total Attributable Gold-Equivalent Ounces Per 100 Shares Held – Company Presentation

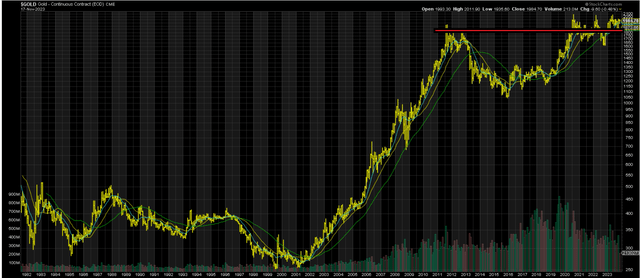

As for margins, we can see that they have continued to benefit from higher metals prices with cash costs remaining steady near the ~$400/oz level, and with gold soaring since its Q3 lows and silver perking up, the outlook for margins continues to be positive. Plus, from a big picture standpoint, the gold price continues to inch higher and the ~$1,800/oz level is looking more like a floor than the ceiling that it was ahead of the brutal secular bear market from 2013 through 2015. Hence, with static costs and the potential for a breakout in the next 12 months, Wheaton’s margins should trend even higher, allowing the company to continue funding growth with cash flow from its operations and what’s now a far more diversified portfolio than in the last cycle (2003-2011), evidenced by the company’s solid Q3 even without Penasquito.

Wheaton Precious Metals – Average Realized Gold Price & Cash Costs – Company Filings, Author’s Chart

Gold Price Long Term Chart – StockCharts.com

Recent Developments

Finally, looking at recent developments, it’s been a busy quarter and year for Wheaton on top of what’s already been a busy couple of years. This is because the company recently added three new streams subsequent to quarter-end on Platreef (PGM mine in South Africa), Kudz ze Kayah (polymetallic project in Canada), and Curraghinalt (gold project in Ireland). These three assets combined are expected to add well over 30,000 GEOs per annum over the first ten years, with Platreef being the most advanced and expecting first production in H2-2024 and with the potential for an accelerated ramp up of Phase 2 to much higher throughput rates. Looking at the Platreef stream, Wheaton acquired this (including Kudz Ze Kayah) from Orion for $450 million, with the Platreef stream entitling Wheaton to 62.5% of payable gold production until 218,750 ounces are delivered (step down to 50% afterwards), and 5.25% of payable PGM production until 350,000 ounces have been delivered (step down to 3.0% afterwards) at $100/oz for the first 428,300 ounces of gold and 30% of spot prices until ~485,000 ounces for PGM.

Platreef Construction Progress – Ivanhoe Website

On top of the most recent new additions, Wheaton also announced a 100% silver stream with a payment of 18% of spot until $115 million is repaid (22% thereafter) on the Mineral Park Mine in northwest Arizona, with upfront cash payments (staged) of $115 million. This deal is expected to provide an additional ~740,000 ounces of silver attributable to Wheaton over its life of mine, which would make this its #3 silver producer slotting in behind Antamina and Penasquito and ahead of Constancia. As it stands, production is expected in 2025 (construction expected to be completed in Q1 2025), with 2025 now expected to be a year of significant growth with commercial production from Blackwater, Goose, and potentially Mineral Park, a full year of throughput at ~36 million tonnes per annum at Salobo, and an increase in production from Marmato in 2025. Meanwhile, looking out to 2028, Wheaton could see production of 900,000+ GEOs according to the company.

Let’s look at the stock’s valuation and see if investors are getting a margin of safety for this industry-leading growth profile among large-cap peers.

Valuation

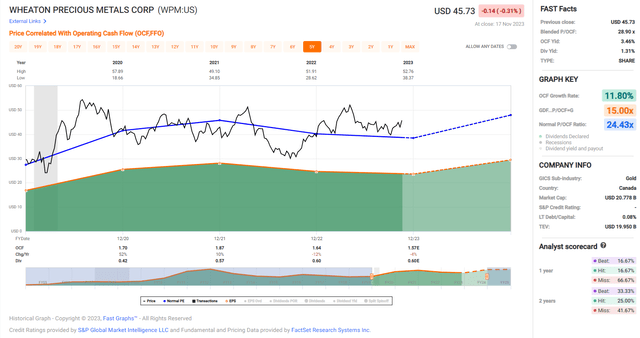

Based on WPM’s 5-year average multiple (~24.5x) and using FY2024 cash flow per share estimates of $2.05 (now that Penasquito is back online and ramping towards full capacity by year-end), I see a fair value for Wheaton of $50.20. This points to a 10% upside from current levels or ~11% on a total return basis when including WPM’s ~1.3% yield, which looks to have room to grow meaningfully this decade as new assets come online. However, although this points to further share-price upside for one of the lowest-risk vehicles for adding precious metals exposure to one’s portfolio, I still don’t see anywhere near enough of a margin of safety here. And using a minimum required 25% discount to fair value to justify starting new positions in large-cap royalty/streaming names, I see the ideal buy zone for WPM coming in at US$38.00 or lower.

WPM Historical Cash Flow Multiple – FASTGraphs.com

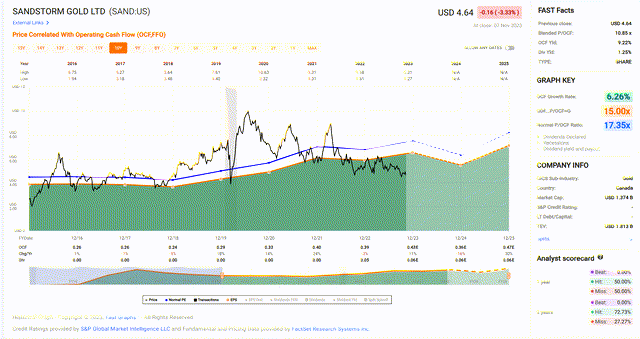

Obviously, there’s no guarantee that the stock trades down to this level near its 3-year moving average. However, we can see that the stock has regularly dipped below its long-term average multiple and these have been the better buying opportunities for the stock vs. paying up when it’s trading at a slight premium. So, while we can make an argument that the investment thesis for WPM is stronger than ever as it increases its diversification and accelerates its growth with a solid bang per buck (given the favorable environment), I continue to see more attractive bets elsewhere in the sector. And while there’s no question that Sandstorm Gold Royalties (SAND) has had its missteps and not executed nearly as well as Wheaton, it’s a name I continue to favor for leverage to precious metals prices given that it could have ~80% upside over the next three years if metals prices cooperate, trading at a P/NAV multiple of ~0.75x and with significant room for multiple expansion and ~11x P/CF (FY2025 estimates) vs. WPM at ~1.70x and ~19.0x (FY2025 estimates), respectively.

SAND Historical Cash Flow Multiple – FASTGraphs.com

That being said, WPM certainly has one major advantage vs. Sandstorm because of its scale and financial discipline, and taking advantage of some of this ~$2.8 billion in liquidity could potentially add another 50,000 GEOs of future attributable production per annum in a period where Sandstorm will need to focus on debt repayments and cannot transact outside of its MARA option. Hence, although SAND may be cheap, the scale of the major royalty/streaming is certainly a clear advantage because even if the environment remains competitive, SAND is sidelined like its smaller peers and may see this great environment pass it by as its acquisitions last year used up all of its available ammunition. In SAND’s defense, the environment was favorable last year when it transacted, but it’s become considerably more attractive with higher rates and even depressed valuations for developers and producers which means royalty/streaming deals are more attractive than selling equity when one has to do so at 50% to 80% off prices.

Summary

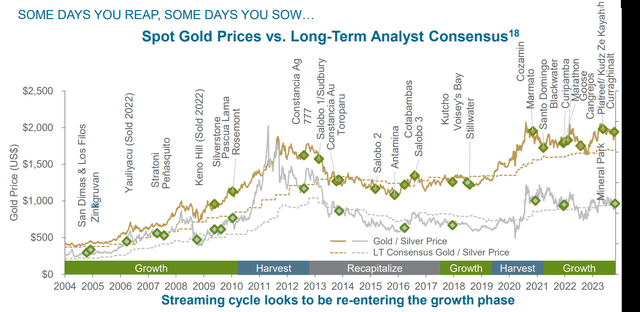

Wheaton had a solid quarter in Q3 with significant production increases from Constancia and Salobo offsetting the temporarily lower revenue from Penasquito (strike announced in June which is since resolved). This has set the company up to deliver the lower portion of its FY2023 guidance (600,000 to 660,000 GEOs) despite the significant setback, with the addition of a new setback following the news that Aljustrel will not produce zinc and lead concentrates from now until Q2 2025 because of the low zinc price environment (a minor contributor for Wheaton). On a positive note, the company has not rested on its laurels despite a busy couple of years for growth and continues to transact at a larger and hastier pace given the new opportunities becoming available. And as we’ve seen in the past, these periods of growth have paid off meaningfully for shareholders, with this being arguably an even better environment than 2018 (depressed equity markets, but also higher-cost debt.

Wheaton – Periods of Growth, Harvest & Reinvestment – Company Website

Notably, the standout attribute for Wheaton is that all of this growth (if it successfully comes online) will be accretive on a per share basis given that the company has added royalties (Black Pine) and streams using cash and debt, unlike share dilution (equity raises, M&A) like many of its smaller peers. In addition, the company has been quite judicious with where it invests, with most major deals working out nicely like Salobo, Penasquito, Antamina, Voisey’s Bay, and Constancia. Therefore, investors can be confident given WPM’s discipline that much of this growth will pan out and the company has leaped ahead of Franco-Nevada (FNV) from a growth and total precious metals exposure standpoint (especially if the Cobre Panama situation worsens) given WPM’s improved pipeline. So, with industry-leading growth, a low-risk business model, and a balance sheet to take advantage of the best environment in years to add new royalty/streaming assets, I would view any pullbacks below US$38.00 in WPM as buying opportunities.

Credit: Source link