Editor’s note: Seeking Alpha is proud to welcome Charles Manih as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Nikada/E+ via Getty Images

Tecnoglass has recently achieved impressive sales and earnings growth figures, surpassing its industry peers. This success can be attributed to the company’s strong business model and effective execution of its strategic goals. The recent dip in the stock price seems excessive to me, and I believe it presents a great opportunity for new investors.

Company’s Overview

Tecnoglass Inc. (NYSE:TGLS) is a specialized small-cap company ($1.55B market capitalization) that focuses on the production of architectural glass, windows, and associated aluminum products for the residential and commercial construction sectors. Headquartered in Barranquilla, Colombia, the company operates across various regions, with over 95% of its revenues generated from the United States.

Emphasizing vertical integration, TGLS manages the entire process from design and manufacturing to distribution and installation of its products for both commercial and residential properties. While the majority of TGLS projects have been concentrated in Florida, accounting for 91% of the company’s total US revenue in 2022, the company’s strategic vision involves expanding its footprint along the East Coast cities where there is a substantial demand for its products, owing to the challenging weather conditions prevalent in these areas.

Although historically focused on commercial properties, Tecnoglass has significantly augmented its presence in the residential real estate market, which contributed to 43% of the company’s total sales in 2022.

In my opinion, Tecnoglass has built strong qualitative strengths, including:

- Full integration: The company attained this by acquiring different businesses throughout the supply chain. This enhances the company’s control over product delivery.

- Well established business: As per the company’s Q3 report, Tecnoglass boasts over 40 years of experience and holds a prominent position as the leading glass transformation company in Colombia. In 2022, it ranked as the third-largest glass fabricator catering to the United States, according to Glass Magazine. The company’s products are found in some of the most iconic buildings in Miami (One Thousand Museum), New York (Paramount and Via 57 West), and others.

- Commitment to Sustainability: As per the company’s Q3 report, Tecnoglass has been committed to UN Global Compact Principles since 2017, and In 2021, the management has actively participated in a program aligning with Sustainable Development Goals, aiming for carbon neutrality as per the Colombian government’s strategy by 2050. This emphasis on Environmental, Social, and Governance (ESG) issues positions the company attractively for consideration by major ESG funds.

Competitive Analysis

The company prides itself on being a provider of high-quality products at competitive prices. Its manufacturing facility located in Colombia has enabled the company to maintain low production costs, thereby yielding relatively high profit margins. Moreover, its fully integrated business model has effectively mitigated the impact of supply chain disruptions, which many other companies faced during the pandemic period.

For comparative analysis, I believe the following three companies serve as viable peers to Tecnoglass:

- Apogee Enterprises, Inc. (APOG): With a market capitalization of $986 million, Apogee specializes in the production of architectural glass and related metals utilized in the construction sector.

- PGT Innovations, Inc. (PGTI): With a market capitalization of $1.79 billion, PGTI’s core products include aluminum frame windows and doors.

- Quanex Building Products Corporation (NX): Valued at a market capitalization of $945 million, NX’s primary product line encompasses glass spacers, extruded vinyl profiles, and door screens.

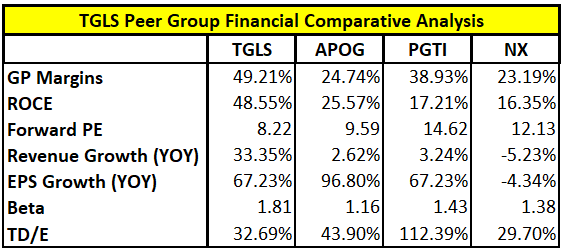

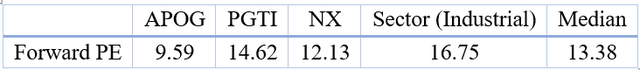

The below table illustrates some of Tecnoglass Financial’s parameters relative to its peer group:

Seeking Alpha, Author

It is evident that Tecnoglass has surpassed its peers on various fronts. Notably, its gross profit margin of 49% stands remarkably higher than that of its counterparts. Furthermore, in terms of profitability, Tecnoglass has achieved a remarkable 48.55% return on common equity, setting the benchmark among its industry peers.

Digging into the valuation aspect, the price-to-forward-earnings ratio for Tecnoglass emerges as the most modest, indicating a potential undervaluation of the stock price. Moreover, Tecnoglass has exhibited superior growth in revenues, surpassing the growth rates observed among its industry peers. The earnings growth is aligned with the company’s peer group.

However, from a risk assessment perspective, it is essential to note that Tecnoglass’s stock beta is the highest among its peers, indicating a comparatively elevated market risk. Nevertheless, when considering the credit risk, the company’s total debt-to-equity ratio stands at approximately 32%, aligning favorably with the industry standard, thus suggesting a relatively low credit risk.

Stock Performance

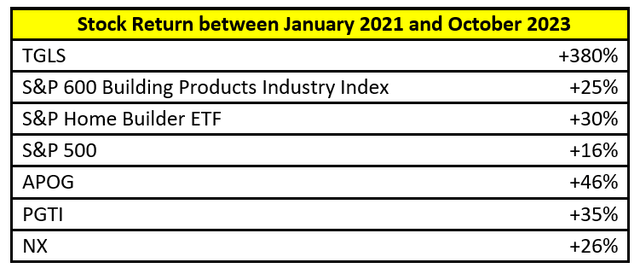

Throughout the preceding two years, the company’s stock has demonstrated a remarkable performance, surpassing not only the broader market but also its specific industry and peer group. From January 2021 to October 2023, the TGLS stock price observed a substantial surge, climbing by an impressive 378%. Comparatively, during the same time frame, the S&P 500 and the S&P 600 Building Products Industry Index exhibited relatively modest growth, at 15.58% and 25% respectively.

Furthermore, it is noteworthy that TGLS stock has notably outshone the stock performance of its peer companies over the same two-year period, further highlighting the company’s exceptional market performance and resilience.

Seeking Alpha, Author

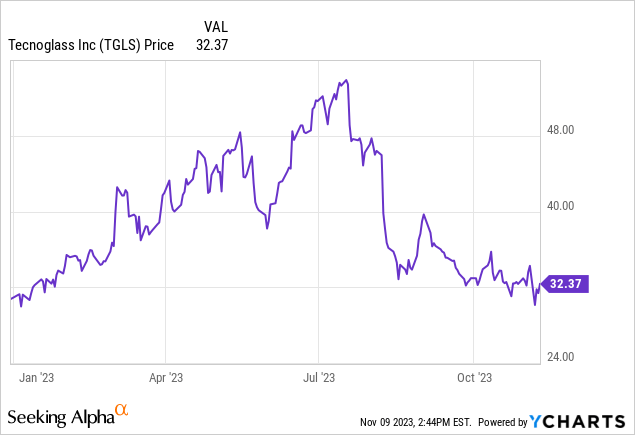

The notable outperformance of the stock over the past two years has been undeniable. Nevertheless, recent price movements have shown a pullback, with the earlier momentum that propelled the stock from $20 to nearly $55 gradually subsiding. Consequently, the stock has experienced a steady decline, reaching levels as low as the $28 mark after its third quarter earnings call on November 6.

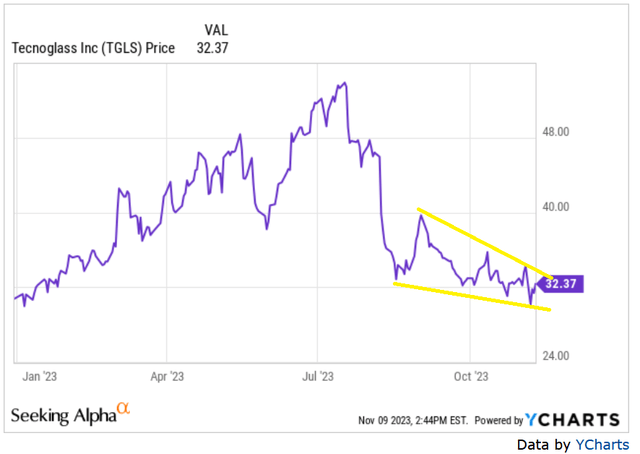

Looking at the technical side, it seems to me that since late August, the stock price has been forming a falling wedge pattern, which means the resistance line is steeper compared to the support line. Such a pattern often implies the likelihood of a price increase and a subsequent breakthrough of the resistance line.

YCharts

Stock Valuation

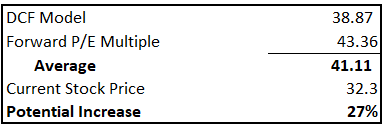

In determining a fair value for the stock, I employed two methods, the Price to Forward Earnings multiple and the discounted cash flow model.

Price-to-Earnings Multiple Analysis

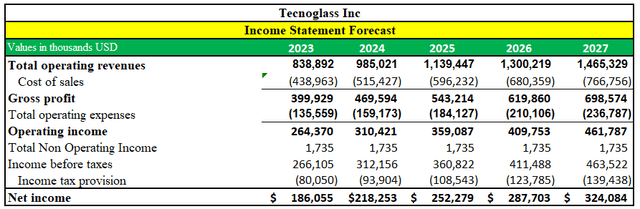

The below table illustrates forward P/E ratios for the company’s peer group and the industrial sector.

Seeking Alpha, Author

To factor in the additional risk associated with Tecnoglass, particularly concerning the country-specific risk, I have implemented a 20% discount on the current median P/E ratio. Consequently, the revised justified P/E ratio stands at 13.38 multiplied by 0.8, equating to 10.70.

Consequently, based on the adjusted P/E ratio and the estimated annual earnings of $4.05, the fair value of the stock price is $43.36.

Discounted Cash Flow Valuation

In conducting the Discounted Cash Flow (DCF) analysis, I calculated the fair value of the firm’s equity by discounting the future Free Cash Flow to Equity (FCFE) by the required rate of return on TGLS equity.

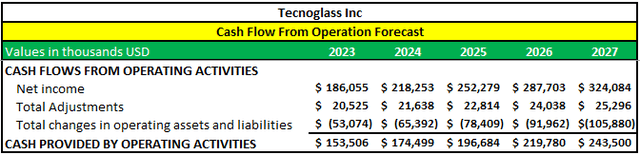

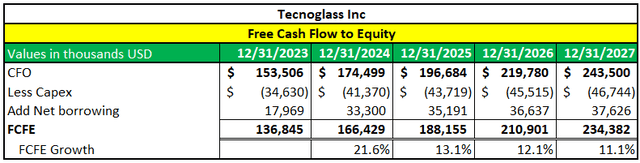

In 2023, the revenues include the earnings from the first three quarters along with the anticipated revenues from the fourth quarter. The revenue growth between 2018 and 2012 averaged around 17.9% (CAGR). In anticipation of the projected slowdown in the construction market, I assumed that the growth rate would decrease by 10% each year from 2024 to 2027. Operating expenses are expected to increase in line with the sales, while the gross profit margin, non-operating expenses, and tax rates are assumed to remain unchanged.

Company Data, Author

In projecting the Cash Flow from Operations (CFO), we expect items tied to sales, like obsolete inventory and trade accounts receivable, to grow at the same rate as sales. Meanwhile, items that are not directly correlated with sales are expected to remain unchanged.

Company Data, Author

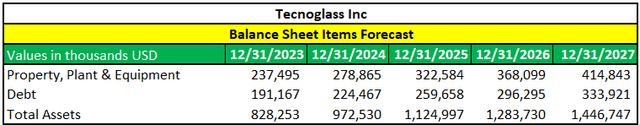

I expect property, plant, and equipment to expand in line with sales. Asset items linked to sales, like inventory and receivables, will also increase in accordance with the sales growth, while non-sales-related items will stay constant. Debt will maintain a similar proportion to assets as it was in 2022, roughly around 23%.

Company Data, Author

The projected Free Cash to Equity is given below:

Company Data, Author

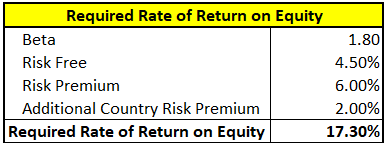

Using the Capital Asset Pricing Model (CAPM), the required rate of return on TGLS equity is 17.30%.

Seeking Alpha, Author

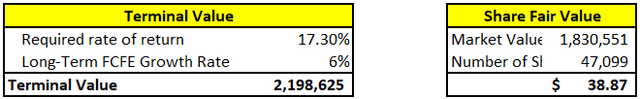

Assuming a long-term growth in FCFE of 6%, the estimated fair value of the stock is $38.87.

Company Data, Author

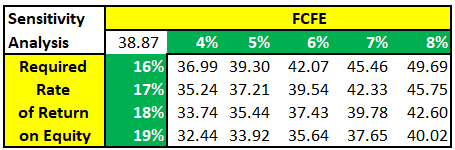

Upon revisiting our assumptions regarding the FCFE growth rate and the required rate of return, I find that the stock price falls within the range of $32.44 to $49.69.

Author’s Compilations

Combining the two valuation methods, I determine that the fair value of the stock is approximately $41.11.

Author’s Compilations

Risk Assessment

The aforementioned determination of the stock’s fair value is estimated on the currently available information, current market conditions, and underlying assumptions. It is crucial to recognize that these conditions are subject to rapid change, potentially influencing my findings. One such assumption is that the company’s anticipated growth in the upcoming years may decelerate due to sluggish economic growth, particularly within the construction sector. Nevertheless, the occurrence of a deep recession could significantly exacerbate the impact on the company’s earnings and subsequently affect its stock price.

The company’s exposure to the commercial real estate market could present challenges, considering the prevalent issues faced within this sector. However, I believe that the company’s recent expansion into the residential real estate market may serve to mitigate this risk, assuming the ongoing strength of the residential construction market, fueled by the persistent low inventory in residential properties.

Furthermore, an increase in interest rates is poised to exert a detrimental influence on the initiation of new construction projects. Yet, my underlying assumption is that the Federal Reserve has concluded its interest rate hike cycle, implying a negative, albeit not catastrophic, impact on the construction industry.

It is crucial to recognize that small-cap growth investments, including Tecnoglass, generally entail a higher level of risk compared to other investment styles. Consequently, the prudent approach for investing in TGLS is to incorporate it into a well-diversified portfolio that encompasses various investment styles.

Bottom Line

Tecnoglass has effectively surpassed its peers and the industry through the implementation of a successful business model built upon low-cost production, vertical integration, and the delivery of high-quality products. These core competencies have conferred a notable competitive advantage, resulting in substantial revenue and earnings growth, alongside elevated gross profit margins.

In line with its strategic initiatives, the company is actively pursuing two pivotal maneuvers. Firstly, the decision to expand beyond its Florida operations aims to mitigate concentration risks and unlock fresh avenues for growth. Secondly, an amplified emphasis on the residential real estate segment is projected to offer a relatively smoother operational landscape compared to the challenges inherent in commercial real estate operations.

From a risk management perspective, Tecnoglass has adeptly maintained prudent debt levels, a vital maneuver particularly within the current climate of elevated interest rates. However, owing to the cyclicality of the business, any deceleration in economic activities could potentially impede the company’s growth trajectory.

My technical analysis of the stock suggests the possibility of a bullish trend. On the other hand, from a fundamental analysis standpoint, the current stock price appears undervalued, especially when compared to the estimated fair price close $41. As a result, I give the stock a Buy rating, with a projected upside potential exceeding 28% above existing levels.

Credit: Source link