Nikada

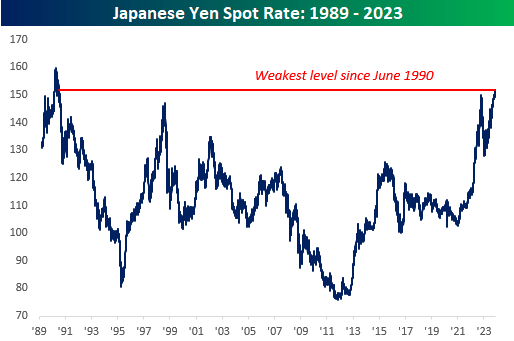

In the currency markets this morning, the big story is the Japanese yen falling to a new low. At the current level of 151.90, a dollar now buys more yen than it has at any point since June 29, 1990. That’s not a typo. 1990! From 1990 to October 2011, the yen rallied to as low as 75 yen per dollar, but over the course of the last 12 years, it has lost half of its value, and a dollar now buys twice as many yen as it did then. 34 years and nothing to show for it.

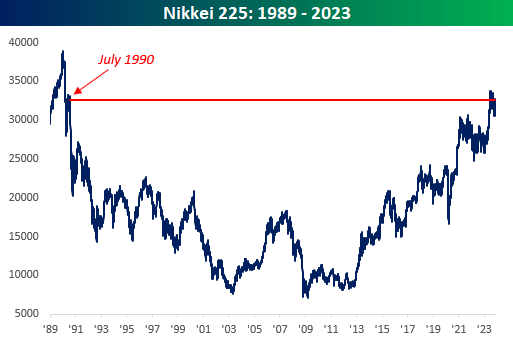

Like the yen, Japan’s Nikkei 225 has also had a roller coaster move in the last 34 years. After losing more than 80% from its December 1989 high to its October 2008 low, Japan’s benchmark equity index has rallied more than 350%, taking it to levels that before this summer, it hadn’t traded at since July 1990. Again, Japan’s equity market has had its ups and downs over the last 34 years, but after all the time and effort, besides dividends, the Nikkei has nothing to show for it. Rip Van Winkle only fell asleep for 20 years, but if a Japanese investor fell asleep 34 years ago and woke up today, they may look at the paper and not even notice.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link