bombermoon/iStock via Getty Images

My Thesis

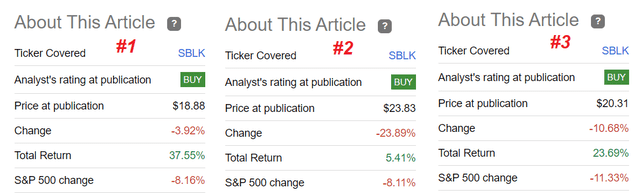

The beauty of investing in dividend-paying companies is that despite the potential downside, investors are protected from potential declines in a general market correction or overall industry downturn if operations continue to generate sufficient cash flows. I have only written about Star Bulk Carriers Corp. (NASDAQ:SBLK) 3 times as a standalone ticker, and here you can see what the profitability of my bullish calls look like:

Seeking Alpha, my past coverage of SBLK stock

Past returns should not be extrapolated into the future, but this example of SBLK confirms all the above points. The most important thing in selecting high-yield dividend stocks is to guess with the cycle (if the stocks are cyclical) and not overpay for them. My thesis today on SBLK is that the company meets these criteria – the current cycle should allow Star Bulk to pay high yields for some time, and the current valuation is still quite attractive against the backdrop of pessimistic analyst forecasts.

My Reasoning

Star Bulk Carriers Corp. is a shipping company that transports bulk cargoes globally, such as iron ore, minerals, grains, and fertilizers. It has a fleet of 128 dry bulk vessels, including different types of ships from 52 000 to 210 000 DWT. Additionally, the company provides vessel management services. It was founded in 2006 and is headquartered in Marousi, Greece.

SBLK’s IR webpage

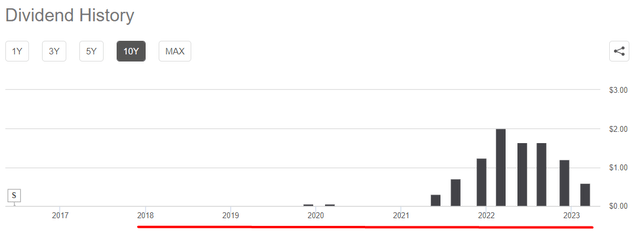

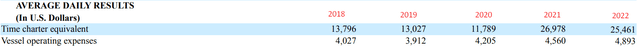

How much dividends the company pays depends entirely on the state of demand in the bulk carrier market and how the Time Charter Equivalent Rate (TCE) – a measure of the average daily net revenue performance of their ships – responds to that state. Chronologically, the correlation of dividends with TCE rates for the company has been as follows:

Seeking Alpha, author’s notes SBLK’s 20-F, author’s notes

A doubling of TCE against a background of relatively equal operating expenses has a multiplier effect on earnings because of the existing operating leverage – the company starts generating so much cash that it has no choice but to use it for dividends (in the case of SBLK) or to buy back shares.

Since this also works in reverse, SBLK stock, like the entire dry bulk carrier sub-industry, is under heavy selling pressure from those who believe the recent bull cycle is over. And that opinion has a point – the Baltic Dry Index has fallen sharply from its late 2021 highs and is now at 2018-19 levels, and at that time, as we can see from the chart above, SBLK paid no dividends at all.

Investing.com, author’s notes

However, there are several nuances here that complicate such a straightforward conclusion.

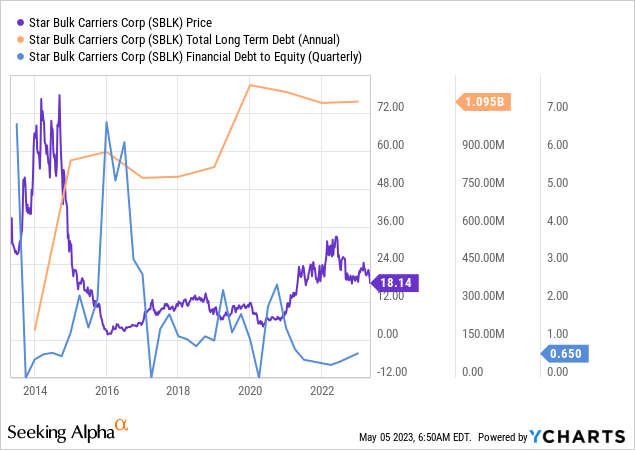

First, yes, the debt on the company’s balance sheet has increased in absolute terms. But the average number of vessels for the last period has also increased by 46% and 14.2% since 2018 and 2019, respectively. At the same time, the company’s debt-to-equity ratio has become much lower – today’s creditworthiness is much better than it used to be, and therefore it becomes easier to refinance existing debt when needed, and terms are likely to be more favorable. More vessels – more revenue, and the existing operating leverage gives higher operating profit, far above previous levels.

Second, the current situation with the supply of dry bulkers is in stark contrast to what it was quite recently. S&P Global writes that with the limited orderbook we face in this sub-industry, annual dry bulk fleet growth will slow to 2.8% in 2022, 2.5% in 2023, and 2.1% in 2024, compared with 3.4% in 2021. In recent months, dry bulk shipping rates have been volatile due to slower economic growth and weakness in China’s real estate sector. However, deferred contracts for the second half of 2023 have been well-supported, as China’s policies shift to support economic growth. There is optimism that a change in China’s “zero-COVID” policy will finally improve the market fundamentals, but caution remains for the near term, particularly in Q2 2023. Overall, the medium-term outlook for the dry bulk market is positive, based on S&P Global’s models:

S&P Global [March 14, 2023]![S&P Global [March 14, 2023]](https://static.seekingalpha.com/uploads/2023/5/5/53838465-16832846807132616.png)

SBLK’s management also noted during the latest earnings call [Q4 2022], that the supply outlook looks good, with limited new ship orders and some older ships being scrapped. The demand for dry bulk shipping was affected by the war in Ukraine, weaker Chinese imports, and a slowdown of global economic activity. The most negative things are expected to ease in 2023 due to the reopening of the Chinese economy and a shift to longer trade routes – demand is set to soar. So the management believes that the long-term outlook for dry bulk shipping remains positive.

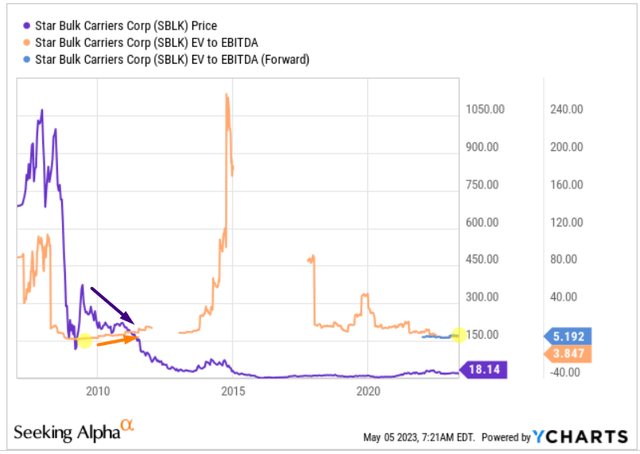

Third, in my view, the TTM and forwarding valuation multiples – EV/EBITDA in particular – have fully absorbed the risks of a cycle reversal, as they are close to the 2010 lows. The main difference, however, is that back then, bulk carrier deliveries increased sharply, leading to a decline in TCE rates and, consequently, a multiple expansion that can be explained by the cycle.

YCharts, author’s notes

But now, in contrast to 2010/11, the supply of ships is practically no longer growing:

S&P Global [March 14, 2023], author’s notes![S&P Global [March 14, 2023]](https://static.seekingalpha.com/uploads/2023/5/5/53838465-16832864019097378.png)

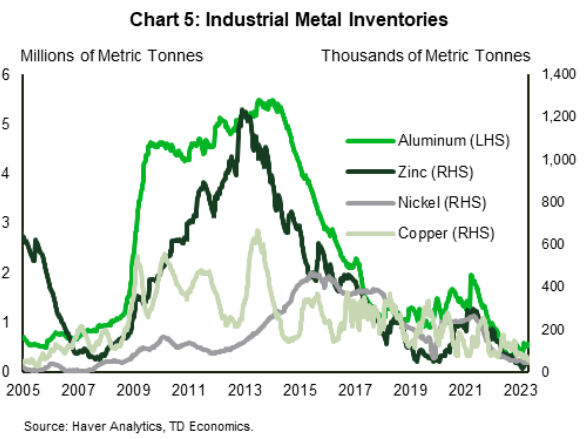

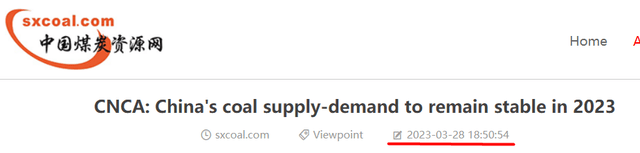

At the same time, after the outbreak of the coronavirus, China has no more sufficient reserves of key metals/minerals – they have to be replenished somehow, so I think the demand for the services of SBLK and its peers should remain stable.

TD Ameritrade sxcoal.com, author’s notes

Looking at SBLK stock in the shorter term, I see the conditions for investors to pay attention to it again.

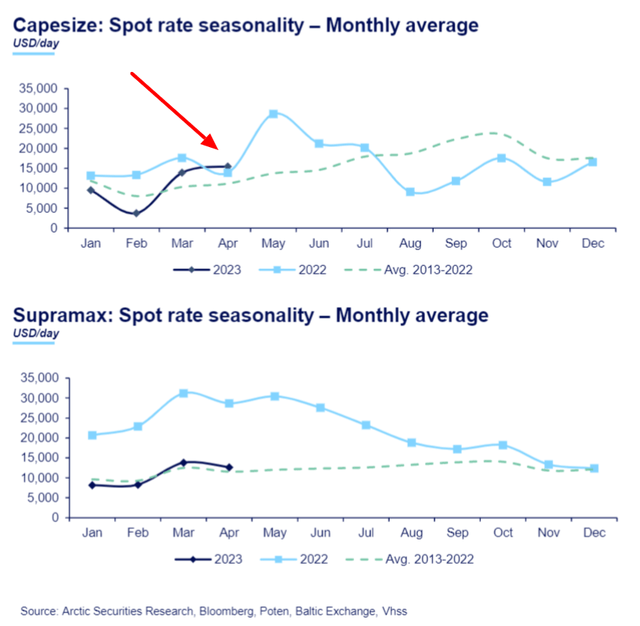

First, if we are indeed back to normal, then the Baltic Dry Index and freight rates should continue to recover through the end of October, based on the seasonal dynamics from 2013 to 2022:

Arctic Securities, shared via Twitter by @ed_fin

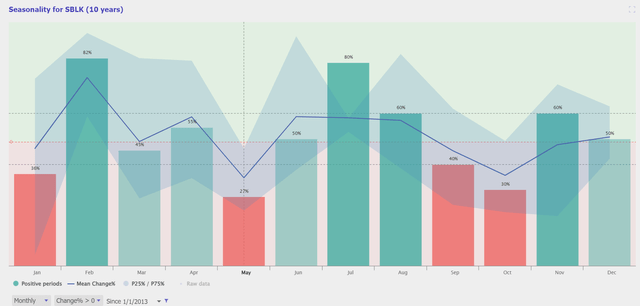

Second, SBLK stock’s seasonality for the same 10-year period shows that May is one of the best months for buying – this is the seasonally worst month in terms of performance, after which SBLK started to recover already in June/July:

TrendSpider Software, SBLK, 10 years

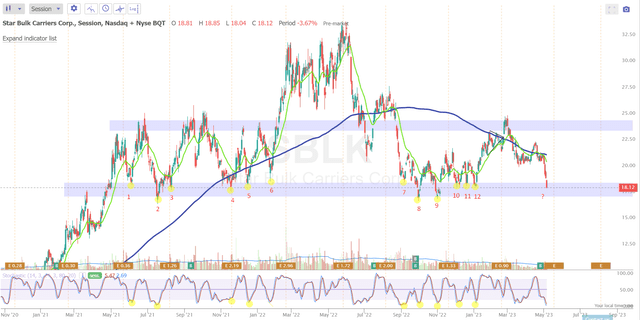

Third, the technical analysis of the stock suggests that SBLK may be trying to establish itself at its important support level, which it has repelled 12 times since the beginning of 2021:

TrendSpider Software, SBLK, author’s notes

The stochastic indicator, which shows the strength and direction of a probable short-term movement in the future, is now in the zone of a probable reversal – as in 9 cases out of the 12 reversals mentioned above.

Based on the symbiosis of long-term and short-term positive factors, I conclude that SBLK stock is most likely oversold at current levels and that its dividend yield does not need to be compared to past cycle reversals as it is likely to remain significantly higher than currently priced-in.

Risks To Consider

While it is possible for a stock’s price to reverse course and move in the opposite direction, it is difficult to accurately predict when and why this may occur. So I may be wrong in trying to time SBLK right now. Dollar-cost averaging should help in this case.

Also, keep in mind that investors in dry bulk shipping companies may be hurt by a reversal in the shipping cycle in several ways. First, a decline in freight rates can lead to lower revenues for shipping companies, which can hurt their profitability and cash flow. Second, a downturn in the shipping cycle can lead to a decrease in the value of vessels, which can negatively impact the balance sheets of shipping companies that own a large fleet of vessels.

There’s also a risk that if SBLK is unable to generate sufficient cash flow from its operations to service its debt, it may need to issue additional debt or equity to meet its obligations. This can dilute the value of existing shares and further increase the company’s financial leverage, making it even more vulnerable to changes in market conditions. No dividends in this case.

Your Takeaway

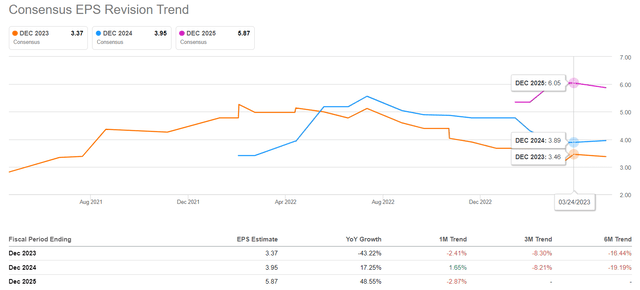

Despite the risks that exist, I believe we will see positive revisions to the consensus earnings numbers going forward, as they appear too pessimistic at the moment given the rising freight rates for various types of bulk vessels.

Seeking Alpha, SBLK’s EPS revisions

In this article, I have described the main points why I think SBLK is a fundamentally undervalued company, and looking at EPS expectations, I understand that the market does not even want to think about it. The exceptions are individual analysts, such as Stifel’s team, who recently raised their price target to $30:

Stifel’s team [April 24, 2023], shared by the Twitter account ed_fin![Stifel's team [April 24, 2023], shared by the Twitter account ed_fin](https://static.seekingalpha.com/uploads/2023/5/5/53838465-16832877664342368.png)

I remain cautious about the potential risks of a recession and economic slowdown, particularly in emerging markets. Nonetheless, I believe that SBLK is currently too undervalued to ignore. Therefore, it may be worthwhile to take a look at this stock, considering both short-term and long-term perspectives.

Credit: Source link