SrdjanPav

Thesis

Coursera, Inc. (NYSE:COUR) is a prominent online learning platform that provides millions of learners worldwide with diverse skill development opportunities through various educational offerings. Given the growing influence of automation, the widening skills gap, and the increasing trend toward online learning, I anticipate that Coursera’s extensive platform positions it favorably to capture a substantial Total Addressable Market (TAM) of $155 billion. Moreover, despite ongoing macroeconomic challenges impacting the Enterprise segment, the strength exhibited in Coursera’s other segments, and the management’s focus on increasing profitability is a positive for investors. Hence, I am bullish and assign a buy rating to COUR.

Q2 Review and Outlook

Coursera had a strong second quarter in 2023, surpassing expectations with a 23.2% year-over-year revenue growth. The exceptional performance was mainly driven by the Consumer segment, which saw a 24.8% year-over-year revenue increase, reaching $87.0 million. Additionally, the Degrees segment also had a strong quarter, growing by 10.2% year-over-year to $12.5 million. Moreover, the Enterprise segment grew 24.0% year-over-year to $54.2 million. The strong revenue performance, disciplined expenses, and a one-time contract amendment benefit resulted in an adjusted EBITDA of ($2.9 million). This represents an EBITDA margin of (1.9%). Coursera ended the quarter with approximately $716.9 million in cash and no debt. Following Coursera’s strong performance in the first half of 2023, management raised its full-year 2023 revenue guidance to a range of $617 million to $623 million, up from the previous guidance of $600 million to $610 million.

The standout performers for FY23 continue to be the Consumer and Degrees segments, showcasing the enduring appeal of consumer credentials and accelerated growth in Degrees after a return to growth in 1Q23. Despite ongoing economic challenges affecting the Enterprise segment, Coursera’s strength in other areas led management to increase both their FY23 revenue and adjusted EBITDA guidance. Revenue growth has outpaced management’s expectations, and they find themselves with more revenue than they can invest productively, leading to a guidance update that prioritizes profitability. While some investors might question the decision not to accelerate further, I believe Coursera is making wise choices considering the economic climate.

Coursera in a good position to capitalize on the rise of online learning

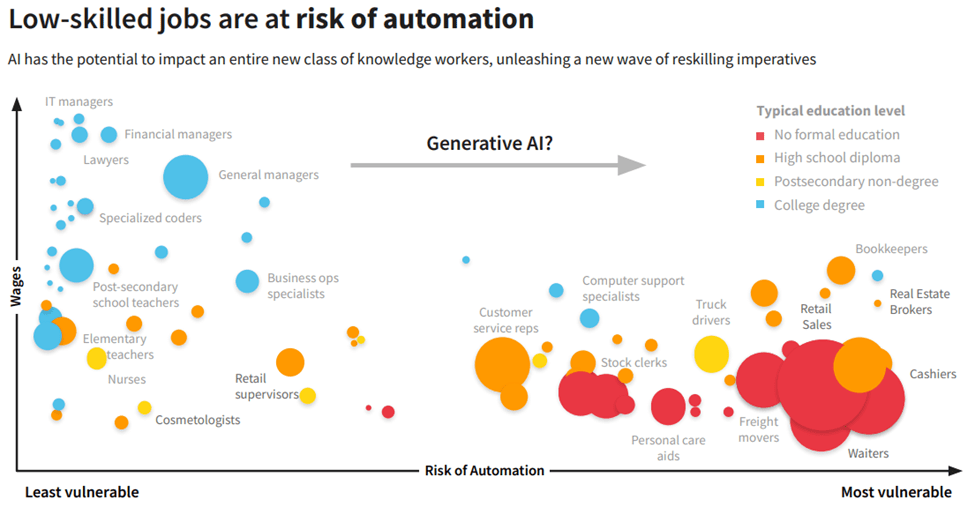

The COVID-19 pandemic acted as a significant turning point in the transition to online learning. It compelled students at all levels, from K-12 to higher education, to adapt to remote learning when schools and institutions closed down. Additionally, adult online learning saw a boost as unemployment rates surged, leading individuals to acquire new skills and update their existing ones in anticipation of job opportunities. When combining this with the fact that an estimated 50% of jobs are expected to be automated by 2030 and result in a projected 85- million-person IT-talent shortage, the need for effective online learning content is at an all-time high.

While these market dynamics present opportunities for various educational technology providers, I believe Coursera is exceptionally well-positioned to address the global skills gap. Coursera’s platform offers a comprehensive and high-quality range of content catering to four key markets: individual consumers, corporate enterprises, higher education institutions, and government organizations. With approximately 118 million registered learners, Coursera is strongly positioned to capture a significant share in a large Total Addressable Market of $155 billion.

Company Presentation

Coursera’s freemium business model positions it well for growth

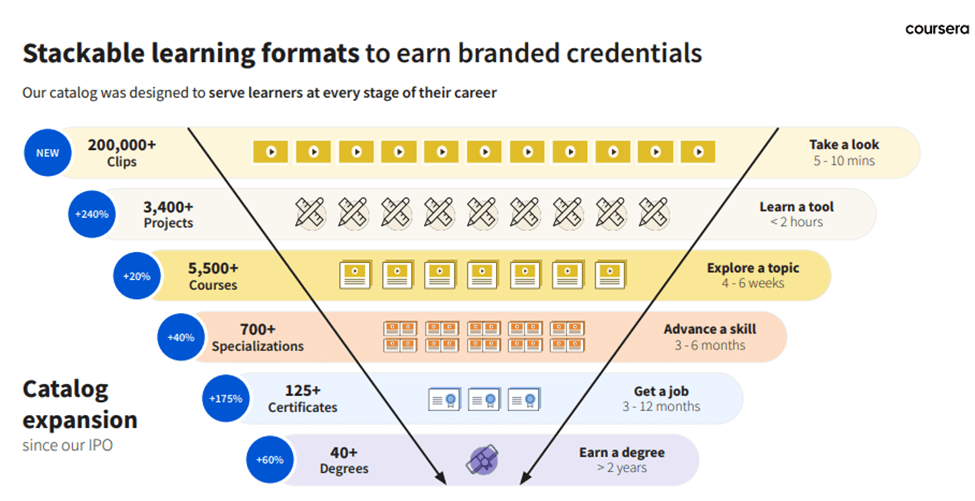

Coursera has established a strong presence among consumers by collaborating with more than 165 top universities and over 50 industry partners. Together, they have built an extensive content library comprising 3,400+ guided projects, 5,500+ courses, 700+ specializations, 125+ certificates, and 40+ degrees, all centered around developing relevant skills. This diverse portfolio of both free and paid content effectively attracts users to the platform. Notably, 75% of Coursera’s traffic is organic, a performance level comparable to other leading educational technology companies.

Once a user enrolls in a free course, Coursera employs in-course coaching features to maintain their engagement and motivation throughout the course. Additionally, Coursera utilizes its proprietary Skills Graph, which harnesses machine learning models and algorithms to monitor a learner’s progress relative to their peers. Based on this analysis, it suggests additional content to encourage users to become paying customers. This strategy has consistently driven increased revenue from various user cohorts since 2012.

Company Presentation

Valuation

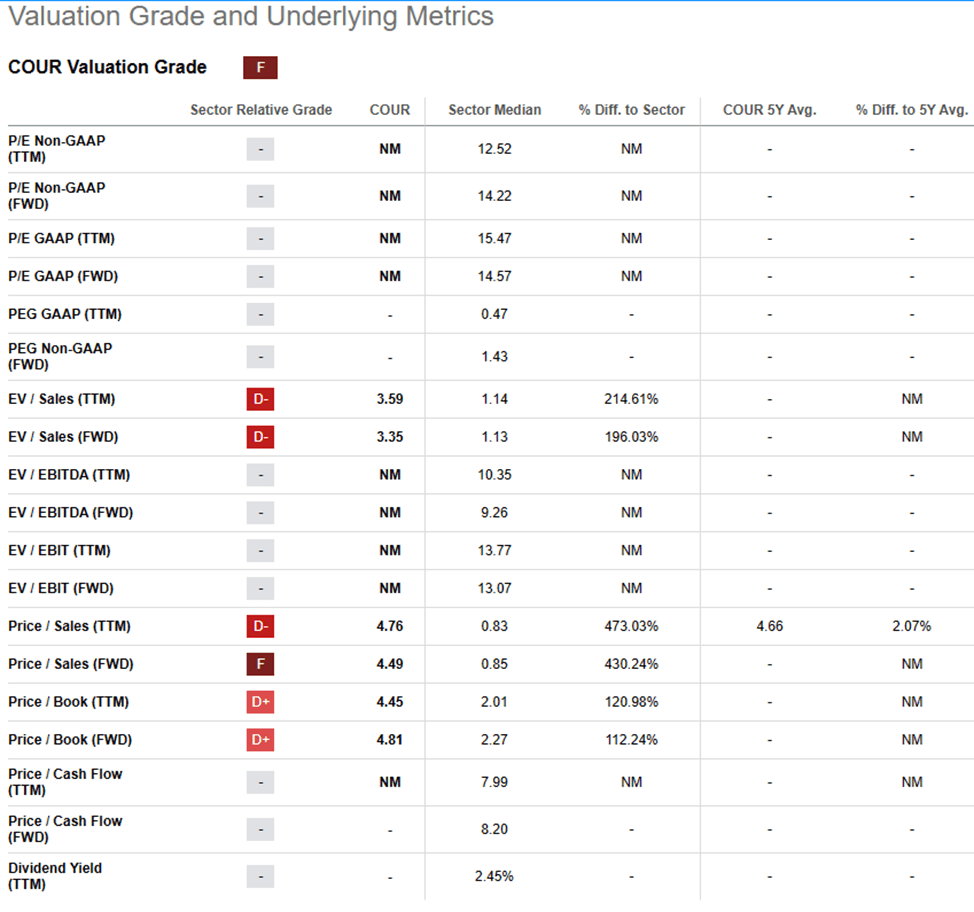

At first glance, Coursera’s current valuation may appear relatively high, standing at approximately forward 3.3 times Enterprise Value to Sales estimate. This might raise concerns considering its mid-20s growth rate, 55% gross margins, and the absence of profitability. However, when delving deeper, there are several factors that suggest the potential for upside from these levels.

In the consumer segment, I anticipate that the introduction of new specializations, certifications, guided projects, and increased market penetration will lead to more free users converting to paid learners. For the enterprise segment, reskilling and upskilling are increasingly becoming strategic priorities for C-suite executives, which bodes well for Coursera for Business. The adoption of Coursera for Campus and Coursera for Government is expected to be boosted by the conversion of participants from Campus Response and Workforce Recovery programs. In the degrees segment, I anticipate growth being driven by an increase in the number of available programs. Hence, I expect the multiple to re-rate upwards in the long-term and assign a buy rating to the stock.

Seeking Alpha

Investment Risks

Most of the educational content available on Coursera is developed and provided by well-known universities and corporate collaborators. If Coursera fails to keep attracting these partners or if these partners stop contributing content, it could harm the company’s attractiveness to customers. Such a scenario could lead to challenges in customer acquisition and retention across all three of its business segments, ultimately resulting in revenue challenges. Moreover, regulatory changes in the Online Program Management sector, particularly related to revenue-sharing agreements, have the potential to negatively affect Coursera’s Degrees segment revenue and its ability to introduce new educational programs to the market.

Conclusion

Coursera is a prominent online education platform that offers a wide range of skill development opportunities to millions of learners worldwide. The COVID-19 pandemic has accelerated the shift to online learning and Coursera is well-positioned to address the global skills gap, offering comprehensive content for consumers, enterprises, universities, and governments. With 118 million registered learners the company is well positioned to capitalize on the $155 billion market opportunity. Hence, I am bullish on the long-term prospects of the company and assign a buy rating to the stock.

Credit: Source link