adventtr

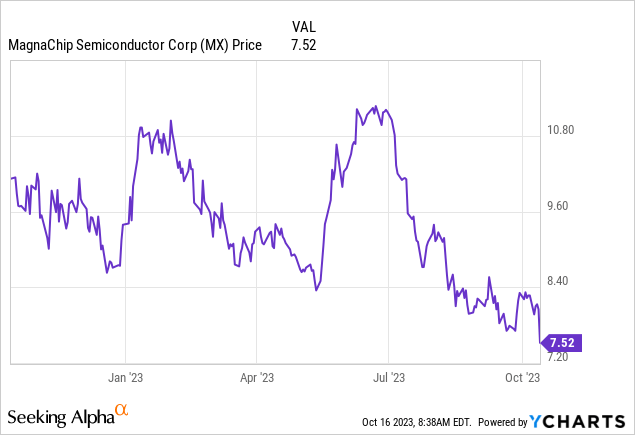

Magnachip Semiconductor Corporation (NYSE:MX) is a long-time holding of mine, and it is time to review where things stand. The stock has gotten massacred recently. There are legitimate reasons for bailing on this, but I’d argue there are also very good reasons to stay on board. Short-term momentum is definitely against you, as evidenced by the share price:

Meanwhile, if I pull up a semi-ETF, iShares Semiconductor ETF (SOXX), it is up 36.99% for the year.

The market expected a negative print in the last earnings report; it came in a bit higher. However, I think the selloff occurred because, previously, some revenue recovery was expected for the back half of 2023. That’s now looking like it will be mid to back half of 2024.

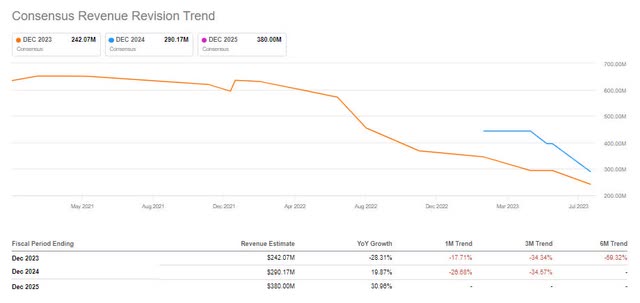

The company is still expected to report negative earnings in the next two quarters. Full-year 2024 analysts expect revenue to recover quite a bit from ~$240 million to $290 million for 2024 (the low estimate is $265 million). For 2025, only one analyst has put up a guess, but it’s for $380 million.

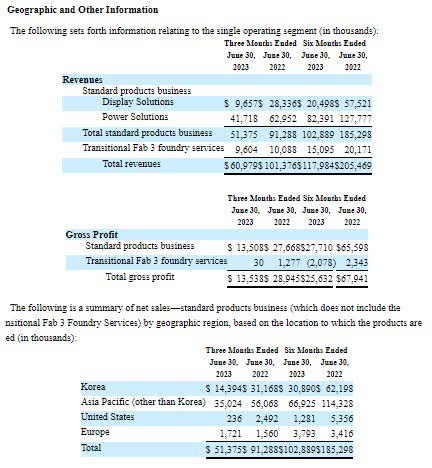

I agree the postponement of a recovery looks bad and falls short of the picture painted in several previous calls. Things aren’t always predictable. Especially in lumpy and cyclical businesses. But to observe any recovery of either the display or power solutions, you have to squint really hard (filing here):

Segments MX (MX 10-Q)

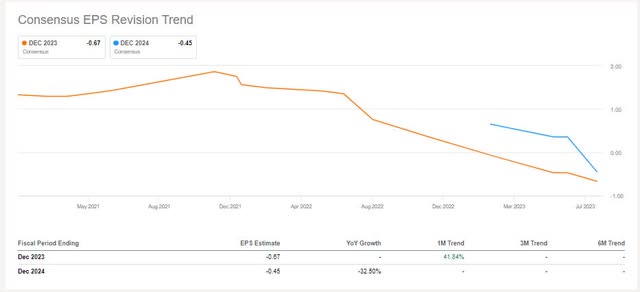

The few analysts that are left looking at the business continue to revise targets downwards:

Analyst estimates earnings MX (seekingalpha.com)

Same for revenue targets:

Analyst estimates revenue MX (Seekingalpha.com)

Management’s story has been that wafer shortages caused the company to miss key product launch windows in H2 2022. It hasn’t recovered from that impact yet.

Previously (which I discussed here), management claimed that a display customer would likely complete qualification by the end of 2022. They guided towards production for new products to start end of Q1 2023. On the recent earnings call, the story is more or less consistent but delayed (emphasis mine):

…I am happy to report today that our first chip was successfully qualified by this customer in December and we will begin shipping towards the end of Q1 2023.

At our new global Tier 1 panel customer, we delivered our second OLED DDIC project sample in Q1, but due to spec changes by the customer, we revised and shipped a second chip at the end of June. We aim to receive final qualification in a few months and anticipate production at the end of the year.

Additionally, we have sampled the third chip in Q2, which has been evaluated by the global panel customer, and is now at the design-in evaluation stage by a smartphone maker for first half 2024 launch.

Further, with our new global panel customer, we continue to collaborate on new projects. In Q2, we began developing a fourth OLED DDIC project for our global panel maker that has the potential to contribute revenue around mid-year 2024.

Additionally, we started work on a mass-market OLED display driver, fifth chip, aimed at expanding market share of the low-to-mid-range OLED smartphone display market, which we expect to drive revenue growth in the second half of 2024 and beyond.

In response to an analyst question, the CEO confirmed it expects to ship products to 2-3 Chinese OLED panel customers by the end of ’24.

On the power solutions front, things aren’t nearly as bad, and sequentially, revenue was actually up slightly if we’re ignoring inflation (~2%). Previously, guidance for the quarter wasn’t exactly upbeat. Now, things sound a bit better. Among other things, management said (emphasis mine):

As we stated in our last quarter call, we believe we hit the bottom in Q1’23 and we saw progress in inventory on hand. The demand improvement in Q2 was broad-based. For instance, we saw a revival in demand for TVs, solar, and lighting markets.

Additionally, we continued our strong momentum of design activities in Q2 propelled by our robust product portfolio across automotive, industrial, and computing applications, in particular. Notably, 35% of the design-ins and wins are attributed to new products and customers, while more than 17% emerged from new applications. One key design win was at a leading home appliance maker in Korea, with production slated to begin in Q3’23.

And the company actually expects further growth for Q3:

In summary, in our Power business, our product design-in/win rate is stronger than ever and we’re rolling out next-generation power products throughout this year. Looking ahead, we are seeing some improvements in our customer base, and we expect further sequential growth in Q3.

Recovery at Magnachip has definitely been delayed, and I get that shareholders are done waiting.

It is harder to believe management, given it didn’t start shipping when it did; this doesn’t seem to be a case of growth not materializing but delayed growth.

Meanwhile, given the net cash present here, I think the share price is extremely low. There is around $4.2 dollars in net cash per share (based on my rough estimate of shares outstanding given the buyback program). There is no debt to speak of.

The company bought back $25 million in stock last quarter, and the board announced another $50 million program. That’s a giant and very aggressive buyback pace vs. a market cap of $302 million. Management resisted aggressive buybacks for a long time (rightfully so in hindsight). This could have been because bidders were circling to buy the company, and they’ve now gone away, OR management is finally optimistic a turnaround is near, OR they understand now how powerful of an EPS driver it is to cancel undervalued stock.

I also like that the company is separating the company officially into a Display and Power business through separate legal entities.

On the one hand, it also seems to indicate hopes of a near-term sale of the company has gone away. This could also help explain the weakness in the stock with any remaining arbs giving up. This indicates management now deems it more likely to sell a segment to a strategic company than the entire company. Or at least wants to make it easier to do something like that.

We are currently working through the process of separating the business, so they will have a distinct ERP, enterprise resource planning and accounting systems. The process is expected to be completed at the end of 2023 and go live in January 2024. Post-separation, the Board and Management team will continue to oversee both businesses. This internal separation is aimed at enhancing transparency, accountability, business flexibility as well as business focus and strategic optionality, and we look forward to providing further updates on our upcoming earnings calls.

It also seems to indicate hopes of a near-term sale of the company have gone away. This could also help explain the weakness in the stock, with any remaining arbs giving up. This indicates management now deems it more likely to sell a segment to a strategic company than the entire company. Or at least wants to make it easier to do something like that.

Not long ago, private equity wanted to take this company private at ~$30 per share. With MX stock trading at 1) $7.5 per share, $4.5 in cash 2) management showing a remarkable and powerful change of heart regarding buybacks and corporate governance, and 3) some tentative signs we could be on the cusp of a revenue recovery.

I still think Magnachip Semiconductor Corporation is a strong buy, although I’ve been on the wrong side of this trade for a long time. I expect the long-term trend for earnings and sales to ultimately reverse while the company is valued as if it is permanently and grossly impaired.

Credit: Source link