mihailomilovanovic/E+ via Getty Images

Investment thesis

Willscot Mobile Mini Holdings (NASDAQ:WSC) leases, sells, delivers, and installs mobile solutions and storage products with an emphasis on modular space and portable tank solutions. WSC generates the vast majority of its income from the United States, 93%, followed by Canada and Mexico. Earnings for 1Q23 were announced by WSC last week, and I was pleasantly surprised by their performance. Strong performance relative to expectations was accompanied by better-than-expected guidance, which, if management can deliver as forecast, should lead to a positive reaction in the stock price this year. WSC has been cautious about 2H23 volumes, but the company noted that their order books and customer backlogs are still healthy. Tighter lending in the non-resi sector, in my opinion, will force businesses to reevaluate their spending priorities and postpone some projects, but onshoring and infrastructure investments should provide continuing tailwinds. The results are encouraging, but I think it’s important to keep an eye on WSC for the next quarter or two to make sure the company stays on track to meet its guidance and maintains the momentum seen in 1Q.

1Q23 results

For 1Q23, EBITDA was $247 million, which is significantly higher than the $215 million consensus estimate. Improvements in Storage’s segment margins and revenue are the main driver for this beat. Notably, the Storage division’s $216 million in earnings beat estimates thanks to 30.1% average monthly rates. More importantly, the $110 million in EBITDA generated by the Storage division was significantly above the $50 million expected by consensus. However, the Modular division’s revenues of $350 million were slightly below the consensus estimate of $354 million, although the Modular division’s EBITDA performance of $137 million exceeded the consensus estimate, with margins of 39.2%

Growth outlook

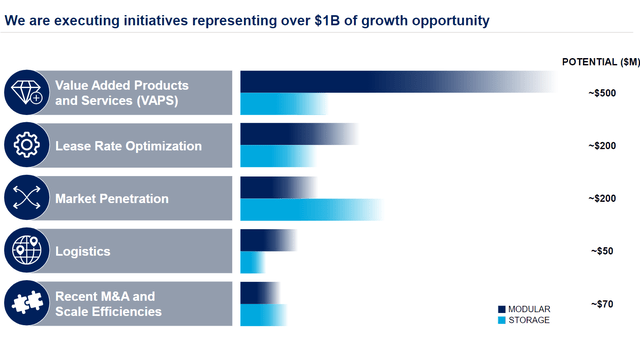

2023 is without a doubt a year of volatility and uncertainties, and even with 5 months into the year, the remaining 7 months still seem like a black box. Despite the encouraging 1Q23 results, I appreciate that management is proceeding with caution in 2023, despite the fact that they note the strength of their order books and customer backlogs. In that sense, management reiterated their macro outlook. While I anticipate the Retail remodel deferrals to be a headwind to UOR in the coming quarters, I anticipate that the positive impact from pricing and VAPS will play a part to neutralize this headwind. My main worry is that the non-resi markets will suffer as a result of the tighter lending conditions caused by the rising rates environment. The result is that costs are being adjusted upward to account for increased inputs and capital expenditures, and project schedules are being extended. On the other hand, I think on-shoring, re-shoring, and infrastructure activity will provide significant tailwinds for WSC in FY24. WSC should be in a good position to reap the rewards of these endeavors because of their operational expertise, size, and resources. As such, if we look at FY24/25, the former headwind should normalize and see budgets come back online – WSC then gets a boost of projects with easy comps (vs a weak FY23). This combined with the latter tailwind seem make the growth outlook seem positive. I think the current pricing spread tailwind will continue to benefit WSC, which is a key reason why management is still projecting double-digit expansion for the year. The current spread at WSC is 35% for spot rates and 20% for storage products under contract. In my opinion, VAPS will be the long-term catalysts for the AMR growth. To put it in perspective, the growth opportunity presented by VAPS to WSC is $500 million, or half of the total $1 billion opportunity.

WSC

Balance sheet and cash flow

Management’s cautious outlook is reflected in their efforts to increase cash flow by postponing the purchase of storage units in response to the delay of retail remodels. Along with the moderating inflation, the increased efficiency of WSC’s modular refurbishments should provide a further CAPEX tailwind. All of these factors are resulting in lower necessary CAPEX, which is boosting free cash flow. Looking at WSC historical cash flow, CAPEX has increased from the $150+million range to $481 million in FY22. The new net CAPEX guide is in the range of $250 to $300 million, which implies a $180+ million tailwind to FCF. I expect to this CAPEX eventually normalize to historical range. With a more solid cash flow profile, it provides management with the necessary flexibility to conduct deals. Notably, management believes there is a healthy M&A pipeline, and we should expect to see an increase with tuck-in volume from 2022 levels.

Conclusion

WSC delivered strong 1Q23 earnings and guidance, While uncertainties and potential headwinds remain, WSC’s expertise, size, and resources position them well for growth opportunities in onshoring, re-shoring, and infrastructure investments. The company’s cautious approach to CAPEX and cash flow provides flexibility for M&A activity. Overall, WSC appears to be in a positive growth trajectory, but monitoring the company’s performance in the coming quarters is prudent to ensure they maintain their momentum. As such, I recommend a hold rating for now.

Credit: Source link