Leon Neal/Getty Images News

Article Thesis

Block, Inc. (NYSE:SQ) reported its Q1 results and surprised the market with a better-than-expected performance. That being said, there are still profitability issues once we account for Block’s share issuance, and shares also aren’t cheap, which is why I’m not overly bullish on Block.

What Happened?

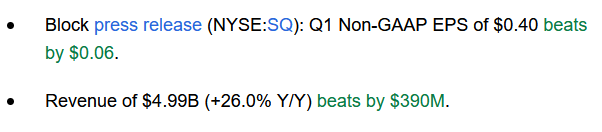

Fintech company Block, Inc. reported its most recent quarterly results, for its fiscal first quarter, on Thursday following the close of the market. The company’s headline numbers can be seen here:

Seeking Alpha

Both revenues and earnings per share came in ahead of expectations, with sizeable beats on both lines. The revenue growth rate of 26% was the highest revenue increase since the fourth quarter of 2021, which is a good result. That being said, the strong relative performance was made easy by the fact that revenues in Q1 of 2022 had been pretty weak, as Block experienced a 21% sales decline back then. On a two-year basis, i.e. in comparison to Q1 of 2021, Block’s revenue is actually down 1%, thus the 26% revenue increase during the most recent quarter shouldn’t be overinterpreted, I believe.

The market reacted positively to these results, as Block’s shares rose by 1%-2% in after-hours trading.

Profitability Remains An Issue

Block’s largest revenue source was its Cash App business, which generated $3.3 billion, or around two-thirds of Block’s total revenue. While short-sellers such as Hindenburg have claimed that Cash App’s user count could be overstated and that there is a problem with fraudulent accounts, the business has done well during the most recent quarter. Not only did Cash App’s revenue rise, but its gross profit contribution rose as well. Cash App generated a $930 million gross profit during the quarter, which is the highest over the last year and which was up by a compelling 49% year over year, although that growth rate slowed down from 64% during the previous quarter. Cash App’s non-Bitcoin revenue rose by 52%, which is very strong and which should be a positive, as the non-Bitcoin revenue is more important for Block’s shareholders due to being less cyclical. At least for now, it thus looks like Cash App is performing well, which is also indicated by the fact that its wallet count and its spend per wallet have increased, despite the rather harsh claims by Hindenburg.

Gross profit from Square rose as well, although not as much, as the $770 million gross profit contribution was up 16% year over year — the slowest growth rate over the last year, and this number was also lower compared to the previous two quarters, Q3 and Q4 of 2022. This was due to a decline in gross payment volumes across the Square platform over the last couple of quarters. While the macro environment and the ongoing economic slowdown likely play a role here, this is still an adverse trend that investors should keep an eye on — unless momentum improves, declining gross payment volumes could continue to impact Square’s gross profit contribution going forward.

For the first quarter, Block generated an operating loss of $6 million. That was the best result over the last year, as losses had been higher during the previous quarters. That being said, Block is still losing money, and yet, it is valued at close to $40 billion. For a money-losing company, that’s a rather high market capitalization, I believe. Block also shows what it calls adjusted operating earnings, where some items are excluded. This non-GAAP metric is positive, as Block generated an adjusted operating profit of $50 million during the quarter. That was better than during the previous quarters, but even when we take it at face value, a $200 million annualized profit is not very high for a $40 billion market capitalization. And that is a pretty optimistic estimate, as Block believes that operating profits, even with the adjustments the company makes, will be weaker going forward. The company’s guidance implies $115 million of adjusted operating losses for the current year, thus the company will lose around $55 million, on average, over the coming three quarters, at least according to the current guidance.

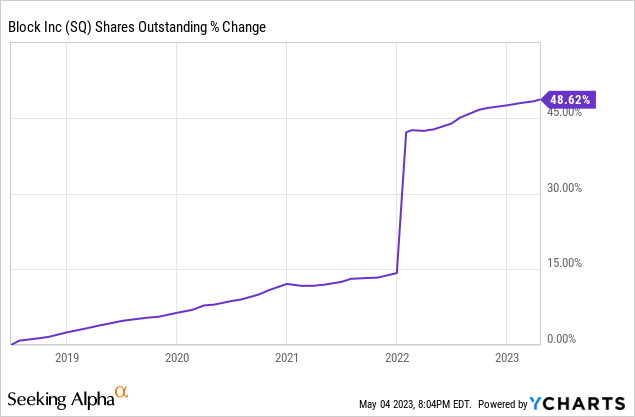

The company does not back its share-based compensation out of its adjusted operating loss/profit metric, which is a good thing. Share-based compensation results in a real cost to shareholders, as it dilutes their stake in the company. Block backs out the impact of share-based compensation when calculating its adjusted earnings per share, its adjusted net income, and its adjusted EBITDA. During the quarter, Block’s share-based compensation totaled $280 million, or more than $1.1 billion annualized. For a company with a sluggish share price, that seems like a rather high share-based compensation number, I believe. This is also reflected in the substantial increase in Block’s share count over the last year and over the last couple of years:

Block’s share count has soared by 50% over the last five years, and it does not look like dilution will end any time soon. Over the last year alone, Block’s diluted and basic share count has risen from 541 million to 602 million, which makes for an increase of 11% in a single year. With a dilution pace this high, Block’s revenue per share, earnings per share, EBITDA per share, and cash flow per share metrics are growing considerably slower than the company-wide revenue, profit, EBITDA, and cash flow. Unless Block’s share-based compensation spending slows down considerably, the hefty dilution pace will continue to impact Block’s per-share value negatively. We can also look at things differently: When Block’s share count is rising by 11% per year, the underlying market capitalization has to grow at a double-digit pace as well for investors to break even. If investors want to see a high-single-digit annual share price gain, Block’s market capitalization has to grow by around 20% per year. Since Block’s valuation is already pretty high, it’s far from certain that its market capitalization will grow this fast going forward — in fact, it may not grow at all, at least for some time.

With a market capitalization in the $40 billion range, Block looks like it is still priced for perfection, despite the hefty share price decline relative to the highs seen during the peak of the market euphoria two years ago. While the earnings multiple, based on current consensus estimates for 2023, seems at least somewhat reasonable, as it stands at around 35 today, that is not really telling us a lot, due to the aforementioned huge impact of Block’s share-based compensation, which is not factored into the Wall Street estimate. When we do not ignore Block’s share-based compensation, which seems sensible to me due to the massive pace of the ongoing dilution and since this has a real impact on shareholders, then the earnings multiple looks completely different — Block will most likely generate negative earnings per share when we acknowledge share-based compensation. While Block will likely announce a positive adjusted earnings per share number for 2023, basically all of that profit is generated by giving out shares to employees and management and ignoring the fact that this has a negative impact on shareholders.

Going back to the guidance for Block’s operating earnings, where share-based compensation isn’t ignored, the forecasted $150 million loss does not seem like it warrants a $40 billion market capitalization.

Block has shown compelling growth on a year-over-year basis in Q1, but that was made easy by the weak results from the previous year’s quarter. On a two-year stacked basis, growth was nonexistent. It remains to be seen what Block’s growth will look like over the coming years. While Cash App seems to have good momentum right now, it’s not guaranteed that this will remain the case. Since Block is unprofitable on a GAAP basis (or when we don’t ignore share-based compensation), I don’t believe that the $40 billion market capitalization makes for an especially attractive investment opportunity right now. I thus don’t think that Block is a buy, despite the better-than-expected Q1 report.

Credit: Source link