Phiromya Intawongpan

The kind of inflationary environment we have seen over the past few years has made it difficult for dividend stocks or ETFs to sustain a positive real yield. But that’s changing. And not just because inflation is declining, but because the current inflation trends indicate the possibility of margin expansion.

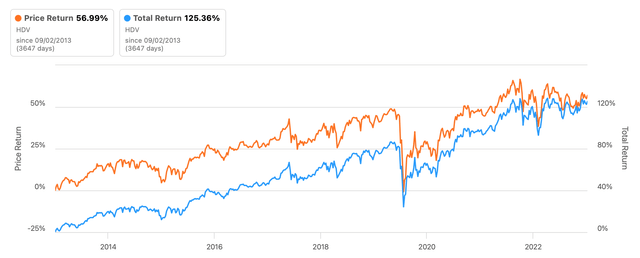

It’s with this as the backdrop that I look at the iShares Core High Dividend ETF (NYSEARCA:HDV) here. The fund with assets under management [AUM] of USD 10.6 billion focuses on 75 “established, high-quality U.S. companies”, as its description puts it. The fund’s total returns of 125.4% over the past decade aren’t bad at all, significantly improved by its growing dividends over the years (see chart below).

Over 2023 so far, in particular, its total returns are positive only on account of dividends, which will be the focus of this article.

Returns (Source: Seeking Alpha)

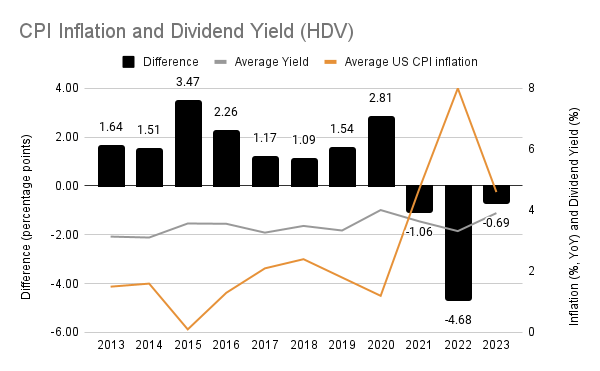

Negative real dividend yield during high inflation

The ETF’s trailing twelve-month [TTM] dividend yield of 4.1% isn’t bad either. But here’s the challenge. Average CPI annual inflation in 2023 alone (up to July) is 4.6%, which is higher than the yield. A negative real dividend yield is a downer since it indicates that the purchasing power from dividend income is being eroded.

That this situation has continued for the past three years now (see chart below) makes it worse. Over the past three years, CPI inflation in the US has been well over the Fed’s 2% target rate, averaging 5.8%. HDV’s dividend yield has averaged at around 3.6% over this period.

Source: Investing.com, Author’s Estimates

However, it’s worth noting that the difference between inflation and the dividend yield is the lowest it has been in the past three years, as the chart above shows. Further, in times of more reasonable inflation rates, as seen in the years from 2013 to 2020 in the chart, the real yield has been consistently positive.

Also, there’s a caveat here. Since the dividend yield calculation takes into account the current price for HDV, the real yield could look very different in cost. For instance, an investor who bought the ETF 10 years ago would have a present dividend yield of 4.8%. The real yield is still negative, but less so.

Real dividend yield set to turn positive

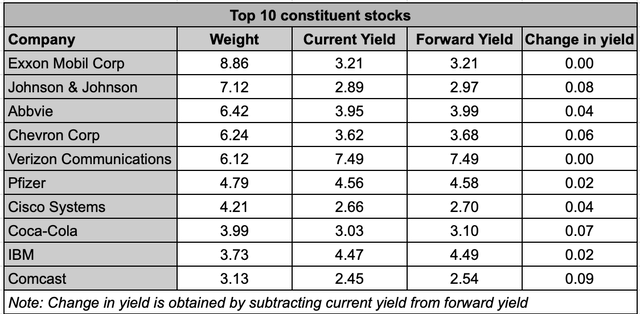

With inflation to average at 3.2% for the full year 2023 and at 2.5% in 2024 as per the Fed’s projections, the real yield can now finally turn positive. The forward dividend yield for HDV’s top 10 constituent stocks, which make up over 54.6% of its total holdings, ranges between 2.5-7.5% (see chart below). Unweighted, it averages at 3.9%.

Source: Seeking Alpha, Author’s Estimates

But even if we were to consider the weighted average, assuming that the remaining constituents’ dividend yield would stay static at the ETF’s 2022 year-end level of 3.56%, the forward yield for HDV still winds up at 3.8%. The key point here is that no matter how we look at it, there would be a positive real yield from investing in it now.

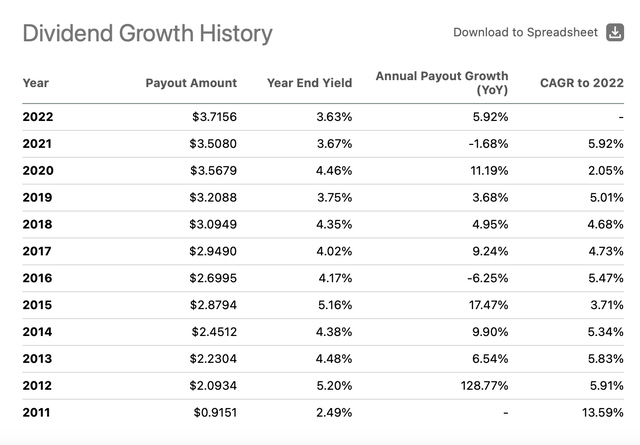

Expanding margins can push up dividend growth

I reckon that the dividend yield can be even higher. For one, HDV has grown its dividends in eight of the past 10 years (see table below). Its 10-year compounded annual growth rate [CAGR] for dividends is at a healthy 7.1%. The 5.1% growth indicated by the calculation above is not only smaller than the 10-year CAGR, but it’s also lower than the five-year dividend growth CAGR of 6.3%.

Source: Seeking Alpha

There’s a possibility that this dividend growth can come from higher margins. The idea sits oddly at a time when the US economy still has some recession risk, though, increasingly, there’s talk of a ‘soft landing’ since the release of healthy second-quarter GDP numbers.

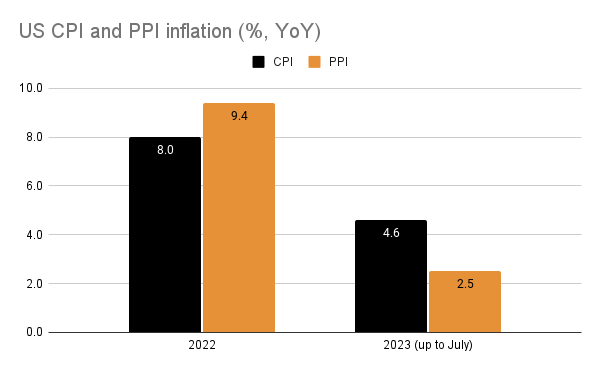

But there’s something specific going on with inflation, in that producer prices have fallen way faster than consumer prices, in contrast with the trend last year (see chart below). This means that margins can expand, even if revenue growth isn’t quite brisk.

Source: Investing.com, Author’s Estimates

In fact, five of the top 10 constituent stocks have already seen operating margin expansion in the latest quarter across sectors like healthcare, information technology, communications and consumer staples. Notable among these are info tech stocks like IBM (IBM) and Cisco Systems (CSCO), which have seen a margin expansion of 3.4 and 3.2 percentage points respectively in the latest quarter compared to the same quarter last year.

The potential drag

However, it’s not all a positive story. Three of the 10 big holdings have seen a sharp decline in margins. Two of them are the energy stocks Exxon Mobil (XOM) and Chevron (CVX), where a margin decline was to be expected considering the drop in energy prices. Pharmaceutical company AbbVie (ABBV) however saw weaker margins as revenues fell on increased competition.

That said, all three companies with shrinking margins, and the one remaining, Verizon Communications (VZ), which saw unchanged margins, all show positive forward dividend growth. Also, the fund’s holdings themselves can change over time. For instance, earlier this year when the company released the annual report, only three of the 10 big holdings were on the list at the time (see page 6 of link).

What next?

iShares Core High Dividend ETF looks attractive at present, for both its past performance and its future potential. It has a history of a decent dividend yield, which has grown over time. In recent years it has been a struggle to get a positive real dividend yield, considering the high inflation rates, but that’s set to change.

Already, the gap between inflation and the dividend yield has declined to the lowest in three years. Going by its past dividend growth and the forward yields of its biggest holdings, it appears that the investment is set to increase purchasing power from passive income earned.

The potential for a higher dividend yield is also backed by expanding margins for five of its 10 biggest holdings in the latest quarter. If the gap between producer price inflation and CPI inflation in the US continues to rise, further margin expansion for some of its holding companies is possible. Of course, energy stocks, in particular, are seeing the reverse trend, so that’s something to bear in mind. But HDV is really the investment to make a long-term source of passive income. And from that perspective, it looks good. I’m going with a Buy on it.

Credit: Source link