Althom

Research Brief

In today’s analysis, I will be covering Huntington Banchares (NASDAQ:HBAN), which is in the banking sector, and regional banks subsector. It is the parent behind the Huntington National Bank brand.

The company had its most recent quarterly earnings result on July 21st, and that will be the reference data used in some parts of today’s analysis.

For readers less familiar with this company, some relevant points to mention from their website are: trades on the Nasdaq, headquartered in Columbus Ohio, roots date back to 1866, more than 1,000 branches in 11 states. Offers full-service banking including personal / business / commercial / brokerage /wealth/ insurance solutions.

A few key peers of this company include Regions Financial (RF) and M&T Bank (MTB).

Research Methodology

To determine a holistic rating for this stock of buy, sell, or hold, I split my research into the following 5 categories: dividends, valuation, share price, earnings growth, capital strength.

Each category has equal weight. If I recommend the stock in at least 4 of 5 categories, it gets a buy rating. 3 out of 5 will get a hold rating, and below that earns a sell rating.

This process is aimed to simplify things, focus on financial fundamentals, and to analyze an equity from multiple angles.

Dividends

In this category, I will discuss whether this stock should be recommended for dividend-income investors, by analyzing official dividend data from Seeking Alpha.

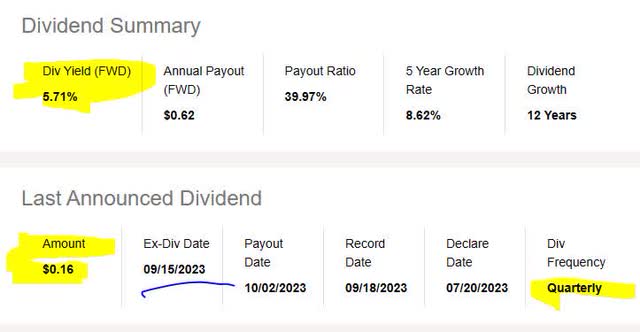

As of the writing of this article, the current dividend yield is 5.71%, with a payout of $0.16 per share on a quarterly basis. Relevant to dividend investors could also be the upcoming ex-date on Sept. 15th, which could be an opportunity.

Huntington – dividend yield (Seeking Alpha)

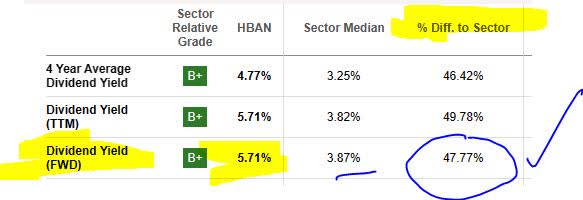

In comparing the yield vs the sector average, this stock is above the sector average by 48%. I think that is a positive for the dividend investor to think about in terms of this stock vs the overall sector it is in.

Huntington – dividend yield vs sector average (Seeking Alpha)

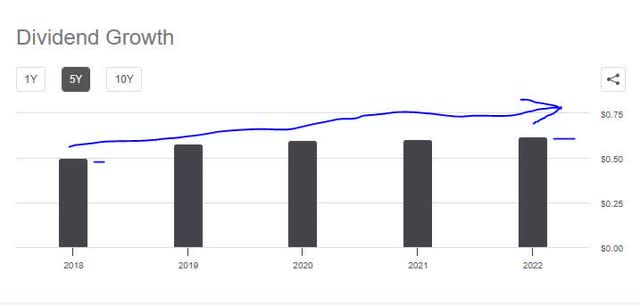

Next, in comparing the current dividend to the last 5 years, this company has been on a steady uptrend when it comes to dividend growth. I think this is also a positive for dividend investors as it points to the historical capacity of this company to return capital back to shareholders, though not necessarily a guarantee of future dividends.

Huntington – dividend 5 year growth (Seeking Alpha)

Based on the evidence found, I would recommend this stock in the category of dividends. In the section on share price later on, I will show how annual dividend income can play a role in putting together my investment idea for this stock.

Valuation

In this category, I will discuss whether this stock presents an attractive valuation for investors who are value-oriented. To analyze this, I will use today’s valuation data from Seeking Alpha and specifically the forward P/E ratio and forward P/B ratio.

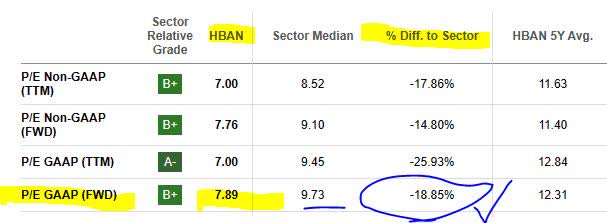

This stock’s forward P/E ratio shows the price being 7.89x forward earnings, which is almost 19% below the sector average that is hovering closer to 9.7x forward earnings. I am looking for a valuation in a range that is up to 30% below the average and up to 5% above average. In this case, this stock is reasonably valued on price-to-earnings.

Huntington – P/E ratio (Seeking Alpha)

This stock’s forward P/B ratio shows the price being 0.92x forward book value, which is 8% below the sector average that is hovering around 1x forward book value. My benchmark is a valuation in a range that is up to 30% below the average and up to 5% above the average. In this case, this stock is reasonably valued on price-to-book value.

Huntington – P/B ratio (Seeking Alpha)

In comparing to one of its listed peers, Regions Financial, Regions is somewhat in line with this stock and somewhat higher valuation, as it is priced at 7.9x forward earnings and 1.09x book value.

Since Huntington is reasonably valued on both valuation ratios, I would therefore recommend it in the category of valuation, based on the evidence researched.

Share Price

In this category, I will decide if the current share price presents a value buying opportunity or not.

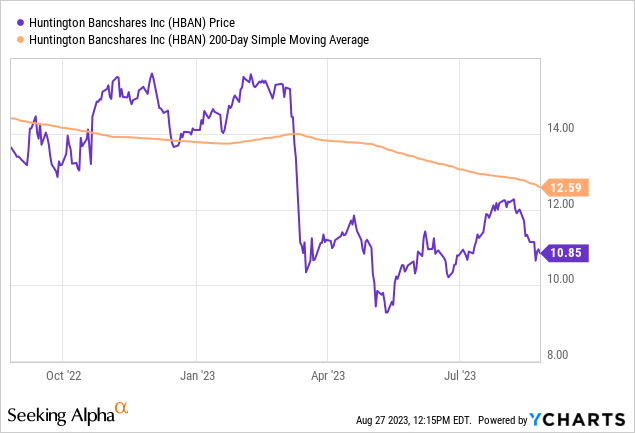

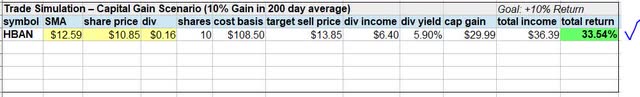

First, I pulled the most recent YChart as of this article writing. It shows a share price of $10.85 and compares it to its 200-day simple moving average “SMA” of $12.59, tracked over the last year.

Then, I created a simple trade scenario in which my profit goal is a +10% return on capital invested.

I simulate buying a fictitious 10 shares at the current share price shown above, hold the shares for 1 year in which time I earn the full-year dividend income, and then sell the shares to generate a capital gain. This scenario assumes the SMA will go up by 10% in a year and that will be my target sell price.

The following spreadsheet illustrates this trade, which projects a 33.54% positive return.

Huntington – investing idea – simulation 1 (author analysis)

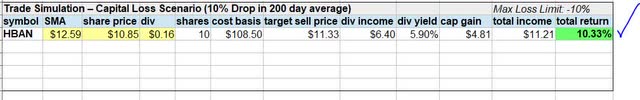

However, I also need to have a risk tolerance and plan for potential capital loss as well. In the following scenario, I anticipate a -10% negative return on capital, which is my maximum risk tolerance.

It is the same as in the first trade however now I assume the SMA will drop by 10% in a year and this will be my sell price if I have to sell at that time. The following spreadsheet illustrates this trade, which projects a 10.33% positive return.

Huntington – investing idea – simulation 2 (author analysis)

Because the two trading simulations met profit goal and remained within risk tolerance, I would recommend the current share price as a buying opportunity, considering it priced just right.

This investing idea, however, may not fit all investors’ portfolio goals or risk tolerance, and should only be considered an oversimplified way to think about this stock as a long-term investment and in terms of potential gains as well as potential losses that could occur.

Earnings Growth

In this category, I will analyze the earnings growth trend for this company over the last year, using data from the income statement on Seeking Alpha as well as the most recent company quarterly earnings release, presentation and commentary.

First off, given that the current interest rate environment has provided tailwind, I would argue, to interest-income assets for some firms, the benefit is clear when looking at the YoY net interest income growth for this bank, which has shown a steady growth since June 2022 in this revenue category.

Huntington – net interest income YoY (Seeking Alpha)

However, I am looking for solid firms with revenue diversification beyond just interest income, and this firm seems to have it. Its non-interest income also grew on a YoY basis.

Huntington – non interest income (Seeking Alpha)

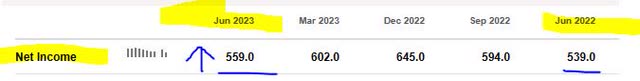

Importantly to mention, as I consider a sign of managing expenses efficiently as well, is the bottom line. Consider that this firm saw a YoY increase in net income, but also a general positive trend since June 2022.

Huntington – net income YoY (Seeking Alpha)

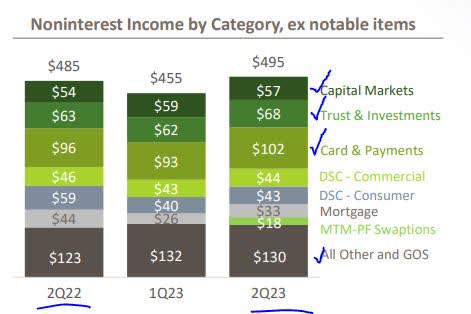

The following graphic shows not only diversification across non-interest income categories, but also YoY growth across 4 key segments.

Huntington – non interest income YoY by category (company quarterly presentation)

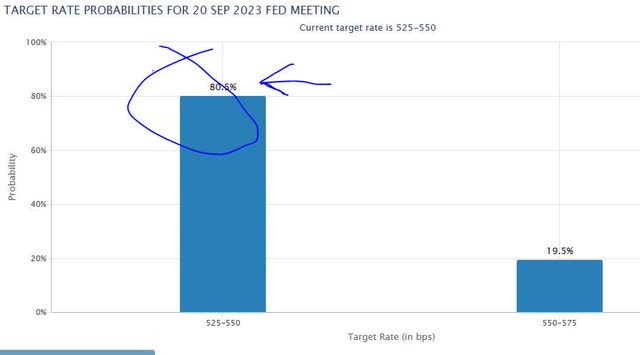

One thing that in my opinion will continue to favor this firm from a forward perspective is the rate environment. According to CME Fedwatch, the consensus among rate traders seems to favor the Fed keeping steady with its “target rate” of 525-550 basis points after the next September meeting.

Fed rate hike probability (CME Fedwatch)

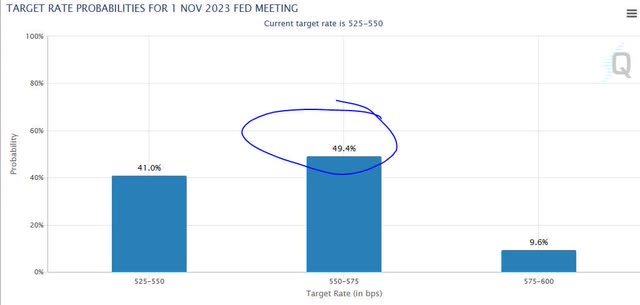

However, there is growing sentiment that after the November meeting rates will actually get hiked again, according to the chart below.

Fed rate hike probability – November (CME Fedwatch)

Based on the evidence, I would recommend this stock in the category of earnings growth, particularly its potential to continue growing interest income in the next few quarters.

Capital Strength

In this category, I will analyze the capital strength for this company using data from the recent quarterly presentation and earnings release, that shows financial viability of this firm.

A key metric in banking is the CET1 ratio, and this bank although a regional one still has a CET1 near 10%, and according to the chart below it has been growing and projected to continue doing so, a good sign in my opinion.

Huntington – CET1 ratio (company quarterly presentation)

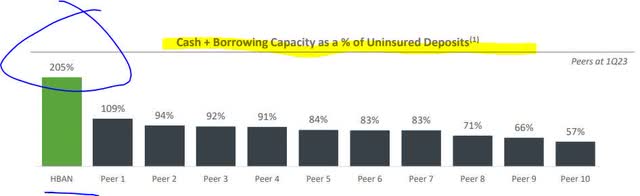

Further, because the issue of uninsured deposits became a hot topic this spring amid a few regional bank failures, it is important that I mention that Huntington claims to have cash & borrowing ability that is 205% of its uninsured deposits, so I take that as a good sign, especially compared to some of its peers it compared itself to in the following chart.

Huntington – ability to cover uninsured deposits (company quarterly presentation)

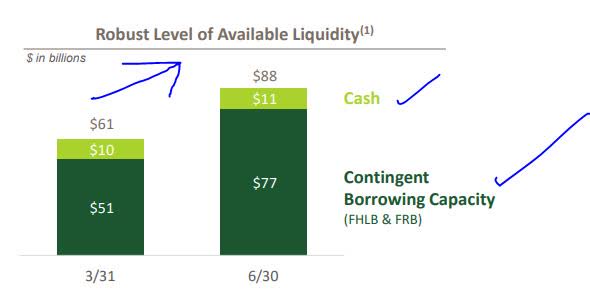

In addition, also a good sign is increasing liquidity capacity on a QoQ basis, with $88B in available liquidity from both cash and the bank’s borrowing facilities such as the FHLB and Fed. Keep in mind that even regional banks have a variety of liquidity options they can tap into if needed, and it is important to note that the Fed plays a key role in attempting to prevent a liquidity issue at such banks as it may cause a contagion systemically.

Huntington – liquidity (company quarterly presentation)

Based on the evidence, I would recommend this stock in the category of capital strength.

Rating Score

Based on passing 5 of my 5 rating categories above, this stock earned a strong buy rating today. This rating is more bullish than the consensus from analysts and more bullish than the quant system, as shown by the graphic below.

Huntington – ratings consensus (Seeking Alpha)

Risk to my Outlook

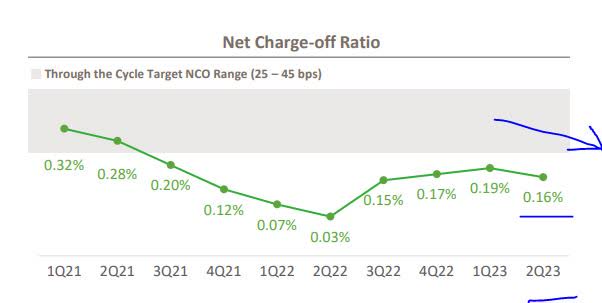

My bullish outlook on this stock could be impacted by media reports of a growing trend of net charge-offs and bad debt sitting in the banking industry, and Huntington in theory should not be immune to this risk either.

Consider a recent Aug. 23rd article by industry portal Risk.net, which highlighted this issue in detail.

Net charge-offs at US banks climbed further in the second quarter, as the growing size of unrecoverable debt continues to weigh on lenders’ balance sheets. Aggregate rates across 14 US banks analysed by Risk Quantum rose 21% over the three months to end-June, compared with an increase of 14% in the first quarter.

This backdrop could make many investors and other analysts consider my rating overly optimistic on this bank and not bearish enough.

However, my counterargument in favor of Huntington lies in their own data. For example, their net charge-offs were declining for a long time then hit a peak in 1Q23, but now appear to me to be on a downward trend again, with the most recent data showing a net charge-off ratio of just 0.16%

Huntington – net charge-offs (company quarterly presentation)

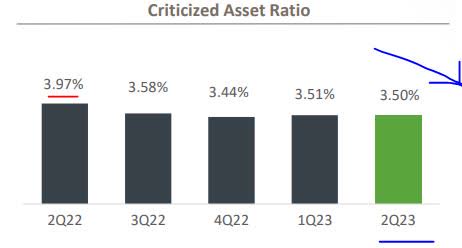

Further, there is shown a decline in the criticized asset ratio, another positive. An easy way to think about “criticized assets” are those that can be classified as doubtful, loss, or substandard.

Huntington – criticized assets (company quarterly presentation)

Based on the evidence researched, I think the risk of net charge-offs and bad assets should not be impactful to my bullish outlook, after looking at them more closely for this bank specifically.

Analysis Summary

To wrap up today’s analysis, let’s go over the key points discussed:

This stock received a strong buy rating today.

Its positive points included: capital strength, earnings growth, share price, valuation, dividends.

Headwinds: none significant to mention.

The risk of net charge-offs and bad assets has been addressed and deemed to not be impactful.

My concluding thoughts on this stock are that is a hidden gem among the regionals, and has proven it can hold up during the spring banking sector turbulence, emerging from Q2 with even better numbers. I’ll be adding this one to my watchlist of regionals, and I expect its Q3 to also have successful performance figures.

Credit: Source link