NiseriN

Thesis

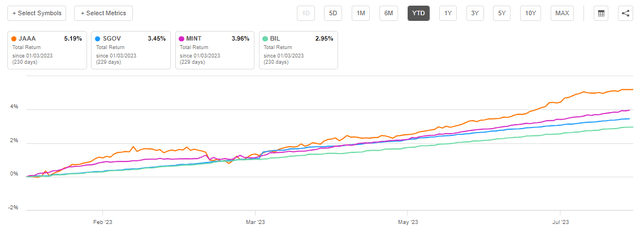

The Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) is a fixed income exchange traded fund. The vehicle aggregates a floating rate low risk asset class, and is up more than 5% this year with a modest -1% drawdown. JAAA has been a model fund in terms of risk/reward in 2023, containing all the necessary ingredients to make investors happy:

- Its collateral is floating rate, meaning that it has been able to capture and pass to investors higher yields

- The underlying securities have AAA ratings, meaning they have very low probabilities of default

- Its low duration and credit profile have generated a minute -1% drawdown in 2023

The name of the game in 2023 has been low duration for fixed income securities corroborated with a floating rate. A ‘higher for longer’ rates environment translates into higher floating rate yields for a longer period of time. I think that means that funds such as JAAA are set to continue to outperform for the next twelve months even the safest of securities, namely Treasuries (both fixed and FRNs).

In this article we are going to review JAAA’s analytics, look at its collateral, discuss why AAA CLOs yield more than Treasuries and articulate why this fund is a Strong Buy until the Fed starts cutting rates.

JAAA analytics

- AUM: $3.6 billion

- Sharpe Ratio: n/a (3Y)

- Std. Deviation: n/a (3Y)

- Yield: 6.2% (30-day SEC)

- Leverage Ratio: 0%

- Composition: Fixed Income – AAA CLO

- Duration: 0.08 years

- Expense Ratio: 0.22%

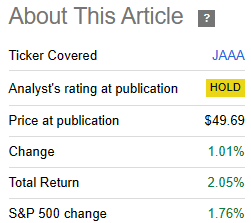

Performance since last rating

Since we last covered this fund in June, opining that investors should hold on to it clipping the dividends, the vehicle has produced a positive total return:

Prior Rating (Seeking Alpha)

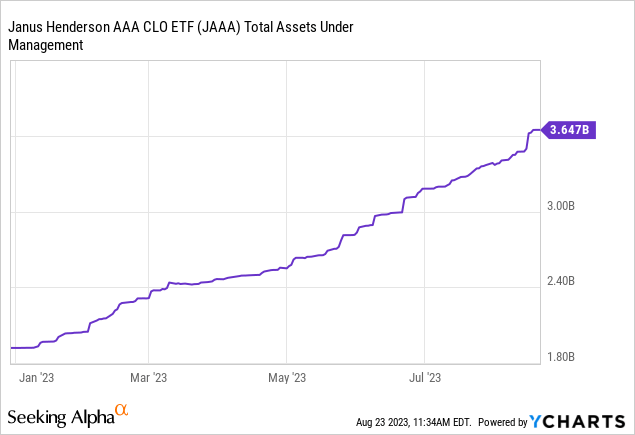

Rates have remained high in the front end of the curve, with no market sell-off or liquidity event to affect the underlying asset class. Furthermore, the fund has kept increasing assets at an extremely high pace, adding over $700 million in AUM:

Changes leading to a rating upgrade

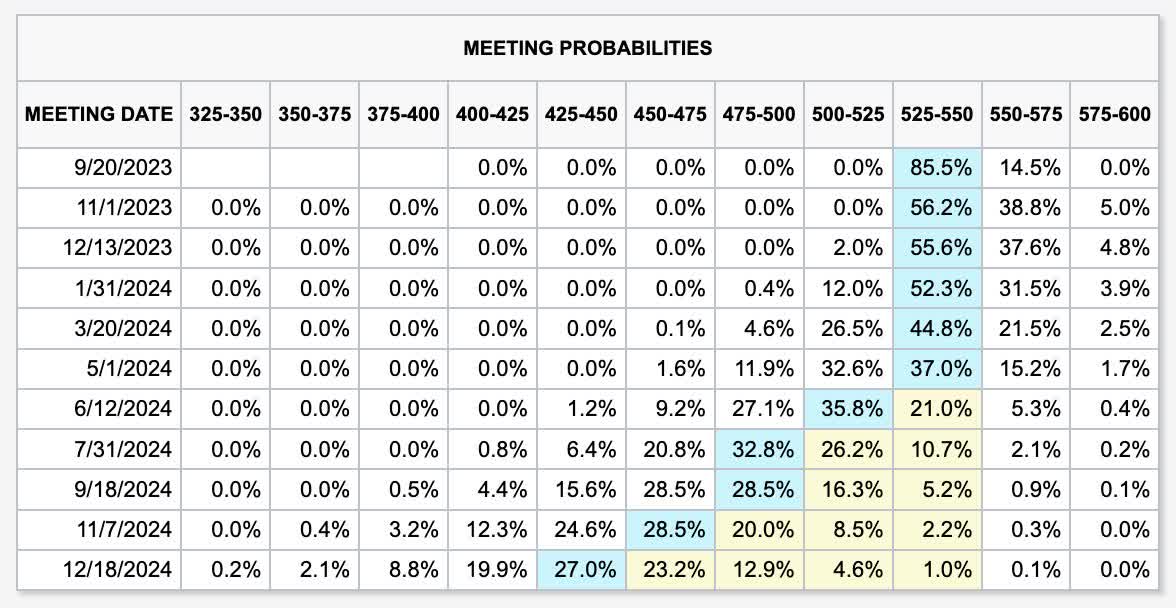

JAAA will keep being a great yielder as long as Fed Funds stay high. Its appeal resides in its floating rate nature and very low credit risk. With economic data having come in stronger than expected, the market has now dramatically shifted its expectations for the first Fed cut to June 2024:

Fed Cuts Market Pricing (CME)

This basically translates into JAAA providing very attractive yields for longer. The market is forward looking, and we saw a sell-off in floating rate assets in March/April when yields plummeted on the back of the regional banking crisis. The further out the first Fed rate cut priced by the market, the more appealing we think the yield and structure provided by JAAA.

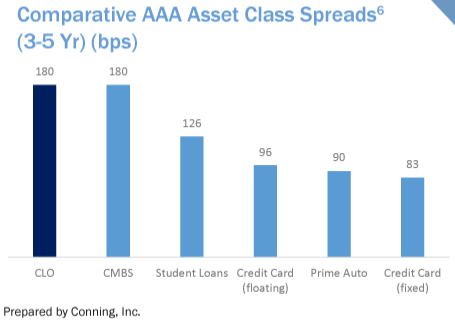

Why do AAA CLOs yield more than treasuries?

A retail investor might ask a fair question – ‘Why do AAA CLOs yield more than Treasuries, given they are both AAA?’. Not all asset classes are created equal, even if they have the same rating. A ‘AAA’ rating simply addresses a probability of default, but it does not give an opinion on a structural feature. For example if you were given the option to choose between buying a Treasury bond, a AAA corporate bond or a AAA CLO tranche, all yielding the same amount (call it 5.5% for our example), which one would you buy?

The thought process here is that a Treasury bond is a very simple, straight forward instrument that has an extremely deep and liquid market. Treasuries have been around for almost a century, so all market participants are very well versed with the analytics, performance and risks. Conversely a AAA corporate bond and a AAA CLO tranche have more nuanced risks. On the corporate side one has to look at industry, future profitability and potential for downgrades down the road. A CLO tranche becomes even more complicated and less liquid, via its tranched risk approach, SPV incorporation to obtain bankruptcy remoteness and waterfall cash-flow structure.

This writer has traded and managed CLOs, and from individual experience can say that the calculation agent (‘Trustee’) and accountants can most certainly make mistakes when they disburse cash for CLOs, especially for the distressed tranches. The general take-away here is that the more complex and illiquid a structure, the higher the non-default risks associated with that instrument. That is why AAA corporates and AAA CLOs will always trade at wide spreads to Treasuries:

Securitization Spreads July 2023 (Conning)

In the above graph, courtesy of Conning, we can see the various securitization types and their spreads over risk free rates.

Another interesting tidbit that is worth mentioning is that CLO issuance is done under Rule 144A:

The term Rule 144A refers to a legal provision that amends restrictions placed on trades of privately placed securities. This safe harbor loosens restrictions set forth by Rule 144 under Section 5 of the Securities Act of 1933 required for sales of securities by the Securities and Exchange Commission (SEC). Known as the Private Resales of Securities to Institutions, Rule 144A was introduced in 2012 and allows these investments to be traded among qualified institutional buyers (QIB)

Source: Investopedia

Basically in English, the SEC realized CLOs are complex securities, and has pushed for banks to issue and sell them to qualified institutional buyers only. As a retail investor you cannot go on your brokerage platform and buy a CLO bond for example. It is not registered with the SEC. So intrinsically this asset class has a known pool of investors. That is until the development of CLO ETFs.

We are of the strong opinion that the success of CLO ETFs such as JAAA will open the door for the wider adoption of this asset class, with tighter spreads in the near future due to this seismic adoption.

JAAA collateral

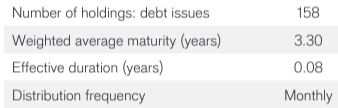

The fund contains 158 individual CLO securities, with an average maturity of 3.3 years:

Collateral (Fund Fact Sheet)

The fund has a very granular build, with no single issuer representing more than 3% of the collateral holdings:

Holdings (Fund Fact Sheet)

While each individual security contains hundreds of leveraged loans, it is prudent to allocate a small portfolio portion to each CLO security due to structural/management issues. Sometimes there are certain bonds that have poorly designed structures, and the market might trade them as weaker names.

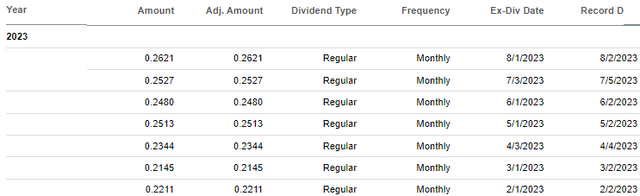

The 30-day SEC yield for this fund is not present on Morningstar, so we have calculated it ourselves by looking at the latest dividend distribution on Seeking Alpha:

Dividend History (Seeking Alpha)

If an investor multiplies 0.2621 by 12 and then divides by the prevailing price (50.19 as of the writing of this article), they will get a figure close to 6.2%.

JAAA performance

The fund has done extremely well this year when benchmarked against risk-free asset classes:

Performance (Seeking Alpha)

This name will continue to deliver outsized returns given its spread over treasuries, a spread which we think will not tighten significantly for the foreseeable future.

JAAA competitors

Unlike Treasuries, CLOs are not fungible. Each security has its own structure and risk/rewards. The market prices each deal based on the collateral (how liquid and traded it is) and on the manager. Each CLO fund needs to be analyzed on its own collateral pool, granularity and risk/reward analytics.

One of the most important aspects is liquidity, and size does matter here. JAAA is by far the most established and liquid player in the asset class with an ever-increasing AUM that now has surpassed $3 billion. An investor looking for a slightly higher spread but not fully comfortable with the CLO asset class needs to ensure trading liquidity is ample to avoid gap-down in a market sell-off situation. As mentioned above CLOs do not trade on an exchange, and bid/ask spreads will widen in a risk-off scenario.

Conclusion

JAAA is a AAA CLO fund. The vehicle aggregates bonds that have been issued via Rule 144A and cannot be purchased directly by a retail investor via a brokerage account. This structural feature explains the high spread of the asset class over Treasuries, and has helped the fund outperform this year.

With a short duration of only 0.08 years, JAAA has been able to successfully pass higher yields to investors in a rising rates environment. The fund has a robust, granular build, and will continue to deliver as rates stay higher for longer. Expect a total return exceeding 6% for the next 12 months (utilizing today’s Fed Funds futures curve). This fund is a Strong Buy until the first Fed rate cut.

Credit: Source link