mbbirdy

Thesis

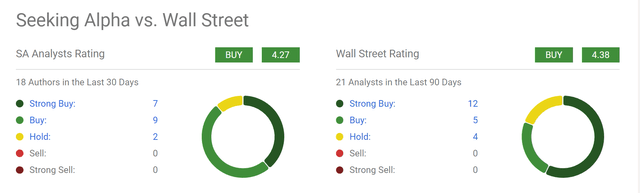

For many investors, Wall Street opinions are synonymous with herd mentality and short-term orientation. However, in the case of Enterprise Products Partners (NYSE:EPD) here, I will argue for their BUY rating as seen in the chart below. As a popular energy ticker on the Seeking Alpha platform, a total of 18 SA authors wrote on EPD in the last month. And their ratings are a very positive BUY, with a rating score of 4.27. Wall Street’s rating is even stronger. A total of 21 Wall Street analysts covered the stock in the past 90 days. A total of 12 of them (i.e., 57% of them) gave a “strong buy” rating and no one gave a sell or strong sell rating. And their overall rating score is 4.38, even higher than the average ratings from Seeking Alpha authors.

Source: Seeking Alpha

The remainder of this article will elaborate on my reasons for agreeing with the Wall Street rating this time. And the key points of my analysis are:

- I see the Q2 earning misses to be only temporary noise. From its Q2 earnings report, the misses were largely the results of lower natural gas processing margins (which were caused by lower NGL prices) and lower sales on its EFS Midstream System due to the expiration of minimum volume commitments at the end of June 2022. The NGL gas prices will be notoriously volatile in the near term and the expiration of volume commitment is incidental.

- Looking past these temporary noises, I see a business with stable fundamentals across almost all metrics. In particular, I see stable profitability and growth ahead. As to be detailed in a later section, the company is in strong financial shape and best poised to continue investing in growth CAPEX in the sector.

- Yet, EPD’s valuation is at a discount compared to many of its peers. The gap between its fundamentals and valuation multiples creates a wide margin of safety and the potential for outsized returns in the next few years.

Healthy and Stable Profitability Ahead

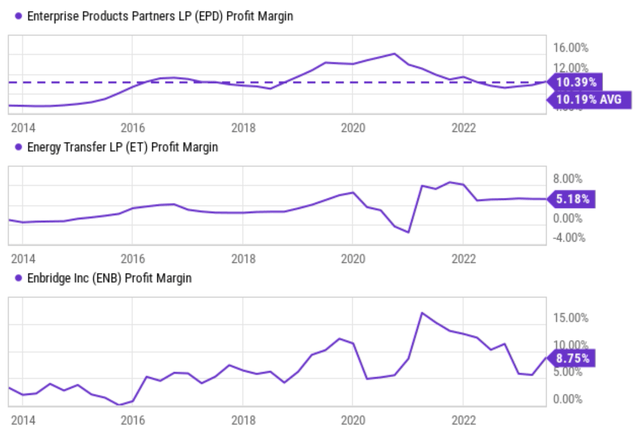

EPD has been enjoying healthy and stable profitability as seen in the chart below. As seen, its average profit margin in the past decade is about 10.2%. Its current margin hovers around 10.4%, which compares favorably to both its historical average and also peers such as ET and ENB. Also, note that its margins are a lot more stable than these peers and the pandemic was a good demonstration of such stability.

This is largely due to its leading scale and excellent diversified income streams as an MLP. EPD is involved in about every segment of the energy market. Geographically, it does not operate only in one or two regions. It is involved in almost every major domestic shale play. Thanks to these strengths, EPD is resilient to issues in any given specific area or segment. As an example of such strength, even during the COVID pandemic, when many other MLPs either eliminated or sharply reduced their distributions, EPD maintained its impressive track record of continuous dividend raises.

Source: Seeking Alpha

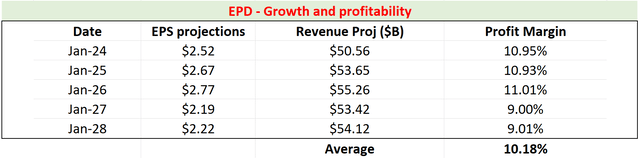

Looking ahead, I see its healthy and stable profitability continuing. The next table below displays my projection of its profit margin. The projection is made based on consensus estimates of its projected EPS and revenues between 2024 and 2028. Note that in this table, I assumed its outstanding shares (or units) to remain fixed at the current level of 2.196 billion units. As seen, its margin in the next 5 years is projected to average 10.2%, very consistent with its current level and also its historical level.

Source: author based on Seeking Alpha data.

Best poised to reinvest also

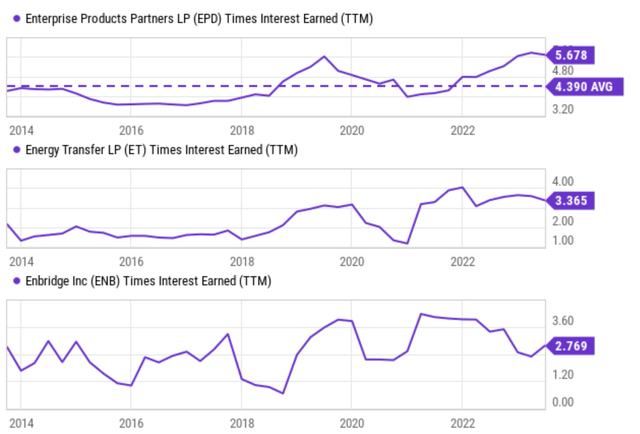

Besides competitive and stable profitability, EPD also enjoys one of the strongest balance sheets in the sector among the major players. As you can see from the following chart below, its current financial strength is near the peak level in a decade in terms of interest coverage ratio. Its interest coverage ratio has fluctuated from about a low of 3.4x to as high as 5.7x (the current level) in the past decade with an overall improving trend. Its current coverage ratio of 5.7x is far above its historical average of 4.4x and also far above other major players in the sector such as ET (3.36x) and also ENB (2.76x).

The combination of profitability and financial strength leaves management with plenty of capital allocation flexibility to reinvest in growth. And management has indeed expressed its commitment to continuing to strengthen the company’s strategic capabilities. For example, in its recent Q2 earning report, management just reaffirmed its FY23 CAPEX outlay. Quote:

We continue to expect organic growth capital investments for 2023 will be in the range of $2.4 billion to $2.8 billion. We expect sustaining capital expenditures for 2023 will be approximately $400 million.

Source: Seeking Alpha data.

Valuation and projected returns

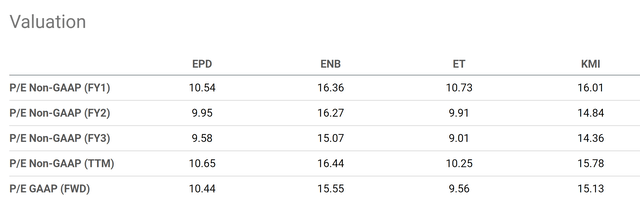

Despite the above superior profitability and financial strength, EPD is trading at discounted valuation multiples compared to its peers. As seen in the chart below, its FY1 P/E is about 10.5x and would further drop to the single digits for FY2 and FY3. While peers like ENB and KMI are trading at a more reasonable mid-teens P/E (around 15x). To provide another reference point, EPD’s median P/E in the past 5 years has been around 14.3x.

Source: Seeking Alpha data.

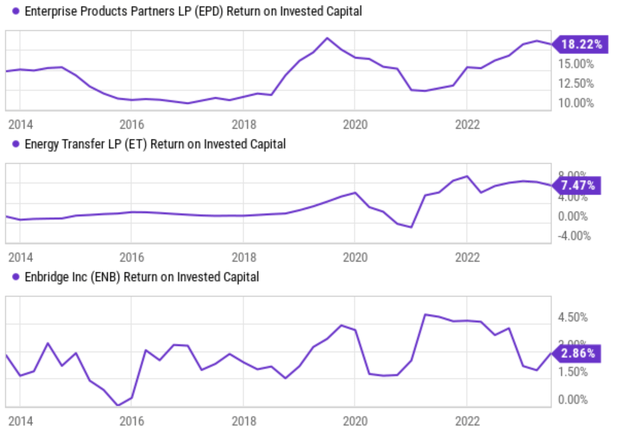

Such a large valuation discount, when combined with its growth potential, creates a large total return potential in the next few years. As mentioned above, management just reconfirmed its CAPEX commitment. Taking the middle point of their range ($2.6 billion), the commitment translates into a reinvestment rate of ~33%. And EPD’s return on invested capital is currently around 18% (see the next chart below 0 again far superior to its major competitors). With a 33% reinvestment rate and an 18% return on capital, a growth rate of 6.5% can be expected. Assuming the P/E multiple expends from the current ~10X level to its historical average of 14.3x in 5 years, such expansion would create another 7.5% annual return. Thus, my total return projection is around 14% per year for the next five years.

Source: Seeking Alpha data.

Other Risks and Final Thoughts

Now risks. Besides the risks generic to the energy sector (such as environmental concerns and policy risks), the large fluctuation of energy prices could cause large volatility risks for EPD stock prices. Especially as mentioned above, natural gas prices are even more volatile than oil prices (which are extremely volatile already) and EPD has a significant exposure to natural gas and NGL. EPD is also engaged in other smaller sub-segments (e.g., propylene and octane enhancement). The sales margins and volumes in these sub-segments are more difficult to predict and data are less available to most investors.

To conclude, I see the positives easily outweigh the uncertainties under current conditions. In a nutshell, I see a business with above-average profitability and financial strength trading at below-average valuation multiples. Such a gap between its fundamentals and valuation metrics creates outsize return potential and my projected annual return is around 14%. Finally, the current dividend already provides more than ½ of the projected return potential. Coming from a dividend champion, this adds another layer of safety margin to the investment.

Credit: Source link