ipopba

Jackson Financial Inc. (NYSE:JXN) is a $2.8-billion market cap bank that primarily offers annuities to retail investors in the U.S. The company operates through 3 business segments, according to the latest 10-Q filing [“Corporate and Other” excluded]:

- Retail Annuities [72% of total sales] segment offers diverse retirement products, including variable annuities, fixed index annuities, and payout annuities, distributed to high-net-worth investors and the mass market;

- Institutional Products [5.8%] segment includes Guaranteed Investment Contracts (GICs), funding agreements, and medium-term note funding agreements. Its financial performance depends on earning a spread between investment rates and interest credited on these products:

- Closed Life and Annuity Blocks [20.1%] segment comprises acquired blocks of business, including life insurance and annuities. Its profitability is influenced by proper pricing, underwriting, and earning a rate of return on supporting assets.

Jackson Financial sells its products through a distribution network that includes independent broker-dealers, banks, financial institutions, and insurance agents. The company was formerly known as Brooke (Holdco1) Inc. and changed its name to Jackson Financial Inc. in July 2020.

In Q1 2023, Jackson showcased quite mixed financial performance as far as I see it. The company reported adjusted operating EPS of $3.15, which was 7% and 24.8% lower QoQ and YoY, respectively. Despite facing losses on operating derivatives due to fluctuations in equity markets and interest rates, Jackson’s risk management strategy effectively protected spread income from the impact of lower interest rates, according to the management’s commentary during the most recent earnings call.

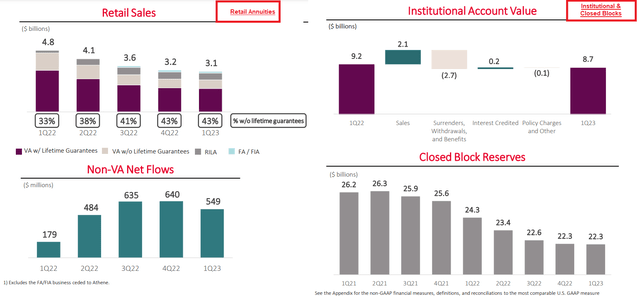

In the Retail Annuities segment, sales reached a substantial $3.1 billion during the quarter. Notably, variable annuity sales remained steady, while there was remarkable growth in fixed and fixed-indexed annuity sales. This segment benefited from variable expenses and lower asset-based commissions, which led to a commendable 7% decline in operating costs. Moreover, the introduction of Registered Index-Linked Annuities (RILA) through Market Link Pro was a key contributor to the company’s distribution expansion and diversification strategy, generating impressive sales of $533 million during Q1. The Institutional segment also demonstrated its significance, reporting sales of $649 million, emphasizing its role in providing diversification benefits and supporting statutory capital generation.

JXN’s IR materials, author’s notes

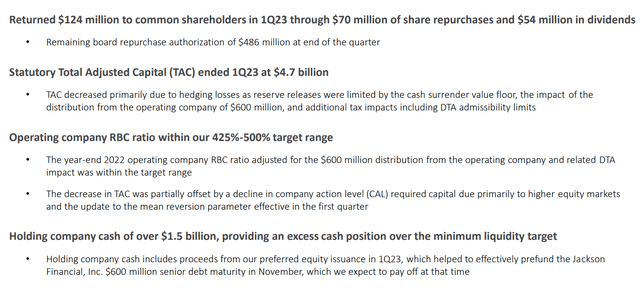

Strategically, Jackson’s focus on capital return proved to be a cornerstone of its success. The company displayed a strong commitment to its shareholders, already returning $124 million through dividends and share repurchases during Q1.

JXN’s IR materials for Q1 FY2023

Moving forward, Jackson aims to achieve an even more substantial capital return of $450 million to $550 million for the full year, reinforcing its dedication to delivering value to its investors, according to the earnings call transcript generously shared by Seeking Alpha Premium.

Also, JXN made strategic moves to enhance its market positioning, capitalizing on the higher interest rate environment. Attractive changes to its traditional variable annuity product offerings aligned with pricing and return requirements, creating opportunities for growth and meeting the needs of clients and financial professionals. The growing success of Jackson’s RILA market – RILA 1Q23 account value has increased over 8x when compared to 1Q22 – played a pivotal role in its distribution expansion and diversification strategy, forging valuable partnerships with financial professionals and their clients.

However, management’s positive outlook didn’t impress the market much. Wall Street analysts revised their Q2 2023 estimates downward immediately after the earnings call, and the stock itself fell more than 15% on its Q1 report release, continuing its local downward trend:

TrendSpider Software, author’s notes

Adding fuel to the fire was the recent news that JXN faced a hacking attack. According to the 6-K report, it was a cybersecurity incident involving a software vulnerability at a third-party vendor called Pension Benefit Information, LLC, which Jackson uses to search databases and identify beneficiaries for insurance policies. The vulnerability allowed an unknown actor to access PBI’s systems and obtain personally identifiable information of approximately 700,000 to 800,000 of Jackson’s customers.

The company states that, based on their preliminary assessment, they do not believe the incident will have a significant negative impact on their business, operations, or financial results. But in my opinion, the negative sentiment itself had already formed and put further pressure on the JXN share.

Although the company is currently going through a series of difficulties due to hedging losses on freestanding derivatives in the first quarter and cybersecurity risks, this test appears to be temporary for JXN.

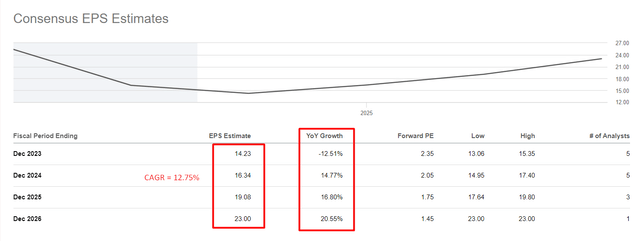

First, judging by Wall Street estimates, which have been falling lately, the Q1 numbers were the low point in terms of EPS. In Q2, EPS should be $3.49, up 10.8% QoQ and 38.65% YoY. Also, we see stabilization but an upward trend in full-year EPS numbers over the next 4 years [CAGR = 12.75%]:

Seeking Alpha data, author’s notes

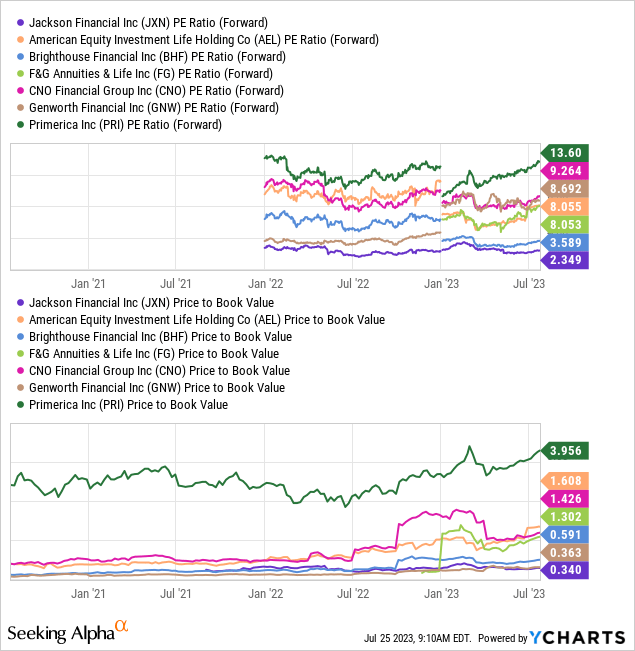

Second, JXN’s valuation is too cheap to ignore. And that’s not because the company’s P/E ratio is <2.4x and the company today trades at just 0.34 of its book value [the lowest multiples in its peer group].

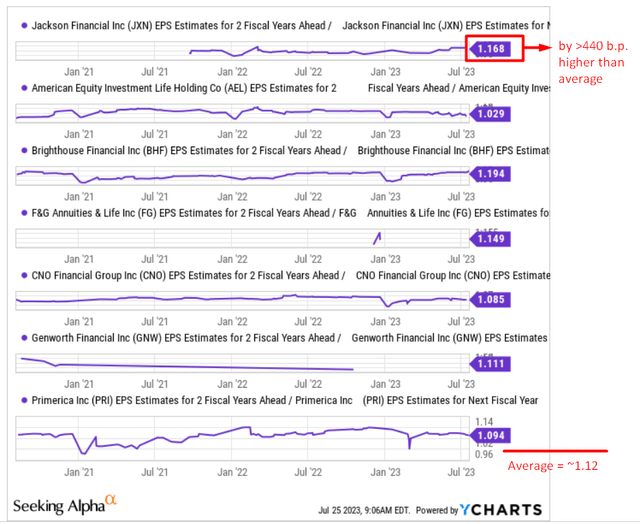

Such modest multiples could explain the deterioration in future EPS. However, this isn’t the case for JXN, as my calculations suggest that the company’s EPS growth rate in FY2025 will be 440 basis points higher than its peers’ ones:

YCharts, author’s notes

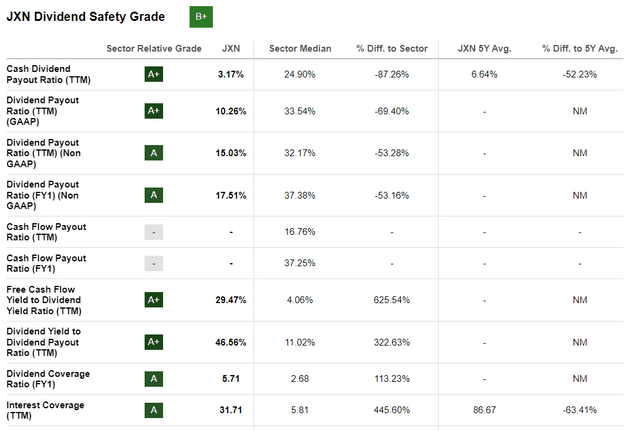

Third, if we assume that the hedging losses in Q2 and Q3 aren’t repeated on a similar scale as in Q1, then the current next-year dividend of 7.42% looks more than stable judging by what the dividend safety ratios look like:

Seeking Alpha Premium

Risk Factors To Consider

Of course, investing in JXN stock entails various key risks that I’d like to point out before concluding.

Firstly, the company’s business is sensitive to interest rate changes, which may impact demand and pricing for annuity products, affecting revenue and profitability.

Secondly, market fluctuations due to economic conditions, geopolitical events, and investor sentiment can cause the value of JXN’s stock to fluctuate. Additionally, being in a heavily regulated industry, JXN faces regulatory and legal risks that could affect its operations and financial performance. Competition, economic downturns reducing annuity demand, investment performance, credit risks, longevity risks, and changes in regulations relevant to insurance and annuities also pose potential impacts on JXN’s financial performance and operations.

Lastly, the risk of cybersecurity breaches and data theft could lead to reputational damage, regulatory penalties, and financial losses for the company. We don’t know the real impacts of the June 2023 incident – we’ll see how JXN’s financials are doing by looking at Q2 results on August 8, 2023.

The Bottom Line

Based on all the above, and despite all the risks, I think the worst may already be over for JXN. The sharp sell-off in the stock [-32% off-high currently] has returned JXN to the cheapness it had before the phenomenal rally during the second half of 2022. I think that the continued development of Jackson’s RILA market, which has already shown its fruits in the first quarter, will allow the bank to maintain a fairly stable position in the industry and continue to buy its shares from the market at large discounts to book value, without forgetting the dividends.

So I rate JXN as a “Buy” today.

Thanks for reading!

Credit: Source link