pandemin

Leading midstream MLP Enterprise Products Partners or Enterprise (NYSE:EPD) reported a good earnings release amid tough sector headwinds yesterday (May 2).

Enterprise demonstrated strength in the petrochemicals segment. However, EPD also cautioned it was attributed “more due to a supply shortage than stronger demand.”

As a result, Enterprise still needs to navigate the near-term demand headwinds that continue to buffet EPD and its peers. Accordingly, the recovery in China’s industrial demand has been lackluster.

While China’s consumer spending is a bright spot for its domestic economy, its “softness in production is a reflection of a global slowdown.” Therefore, the recent manufacturing PMI release indicating a “surprise decline” in April likely spooked energy investors.

Enterprise highlighted that “China has recovered quicker than expected on the LPG demand.” However, the company also cautioned that “future quarterly demand may drop off.”

The MLP also cautioned in its assessment of “near-term mixed signals,” even though it remains optimistic about the MLP’s prospects “in the medium to long term.”

As such, we assessed that long-term EPD investors are unlikely to be worried about Enterprise’s ability to continue bolstering its distribution growth moving ahead.

Enterprise reminded investors that “the US petrochemicals industry has a structural feedstock advantage.” In addition, management stressed that refining in the US is “competitive and technologically capable.”

As such, it believes that “US production is expected to continue to grow,” and Enterprise is well-positioned to continue growing its production and ability to “export hydrocarbons out of the US to points all over the world where they’re needed.”

Notably, Enterprise reminded investors that the MLP is slated to put into service about “$3.8B of assets” in 2023, supporting its EBITDA growth prospects.

Enterprise also communicated its growth CapEx range of between $2.4B to $2.8B, suggesting that the MLP is confident of its medium-term outlook. In addition, management accentuated that the increase in projects was not attributed to “cost overruns or delays on projects.”

Instead, it indicates the MLP’s “confidence in potential opportunities for growth” as Enterprise leverages its world-class distribution system while benefiting from export growth.

As such, Enterprise is expected to meet full-year expectations of $9.2 billion in EBITDA. However, it represents a slight decline relative to FY22’s $9.31B in adjusted EBITDA.

Wall Street estimates suggest that Enterprise could post an adjusted EBITDA of $9.39B in adjusted EBITDA for FY23, up less than 1% YoY.

EPD posted an adjusted EBITDA of $2.32B in FQ1, largely in line with expectations. As such, it does put some pressure on the MLP’s ability to bolster its distributable cash flow or DCF per share in FY23.

The consensus estimates penciled in a DCF per share projection of $3.5 for FY23, down 0.8% from the previous year.

Despite that, Enterprise’s distribution per unit of $1.96 (annualized) is well covered by its DCF per share estimate.

As such, Enterprise’s ability to continue raising its distribution per unit in the range of “5%-6% regularly” doesn’t seem to be at risk.

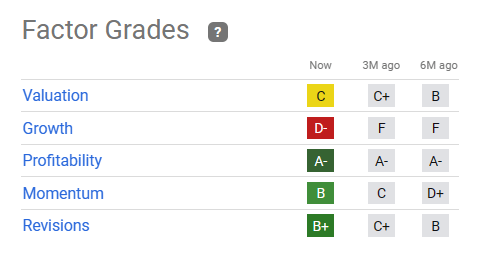

EPD quant factor ratings (Seeking Alpha)

EPD’s valuation seems to be fairly valued at the current levels. Seeking Alpha Quant reflected a C valuation grade for EPD.

However, concerns over its growth factors (D-) are a headwind that investors must consider, as discussed in its ability to bolster adjusted EBITDA growth in FY23.

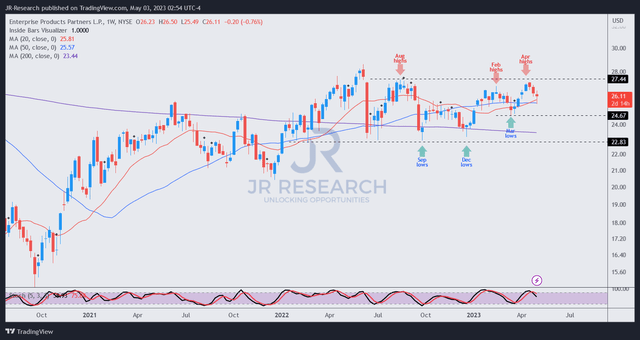

EPD price chart (weekly) (TradingView)

EPD’s price action remains constructive, as dip buyers returned in early March as EPD sold off due to the banking crisis triggered by the collapse of Silicon Valley Bank (OTC:SIVBQ).

Management also demonstrated its unit-picking prowess by buying back units at an “average price of $24.89 per unit, for a total cost of $17 million.” The repurchase levels were close to the lows seen in March, suggesting that management likely saw value in its units back then.

We assessed that buyers have also returned this week to support EPD as it attempts to fend off recent selling pressure due to the decline in underlying crude oil prices.

Despite its fair valuation, EPD’s NTM distribution yield of nearly 8% is attractive. With a wide economic moat and constructive price action, investors looking to buy the recent dips should consider adding more exposure here.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Credit: Source link