Darren415

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of July.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

Preferreds finished up on the week, consistent with a broader rally in the income space. Month-to-date, the higher-beta Tech, BDC and mREIT preferreds are in the lead.

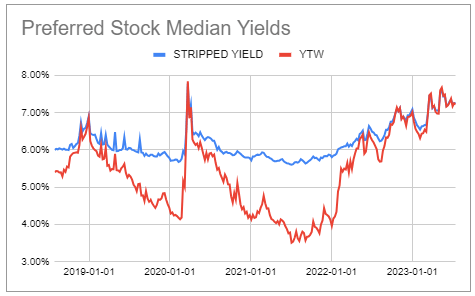

Preferreds have rallied steadily since their March drop and have recovered about half of the drawdown. Yields remain at an attractive level, supported by stable longer-term Treasury yields even as credit spreads have tightened.

Systematic Income Preferreds Tool

Market Themes

We allocate quite a bit to bonds of various sectors, in order to provide stability and resilience for our Income Portfolios while generating attractive high single-digit yields. The BDC Saratoga (SAR) bonds came up on the service which we discuss in more detail here. As many investors know, the company’s leverage is unusually high for a BDC which has created a concern about its bonds for some investors.

The leverage of the company is indeed high by BDC standards at 2.4x vs. around 1.1x average. However, there are three key factors here. One, is that SAR bond yields tend to trade well above the average BDC yield. In other words, the leverage differential is taken into account by the market. So the standalone fact – that SAR bond leverage is higher than the average BDC – is not very meaningful outside of the additional compensation that these bonds carry.

Two, there is a tiny credit facility on the balance sheet versus the average BDC having a credit facility that makes up around half of all borrowings. This is important because the credit facility gets paid out first before the bonds. So the smaller the credit facility, the more assets the bonds get to divvy up. This mitigates the overall higher level of leverage for SAR.

As a sidenote, another benefit of having a tiny credit facility is that SAR has no related bank covenants so it’s actually in a decent position from a forced liquidation scenario vs. the average BDC. Its asset coverage ratio is fairly low at 157% so this does bear watching.

Three, the company has done a very good job managing its portfolio quality. Its NAV has moved higher over time, rolling over the 2015 Energy crash and the 2020 COVID period. It also has net realized gains, a tough gig for a low-equity allocation portfolio. This is arguably a more important metric than leverage itself.

Overall, we would rather see a lower leverage figure for the company, in part because it would drive a rally in the bonds. However, we must also not discount the mitigating factors that push in the other direction.

Market Commentary

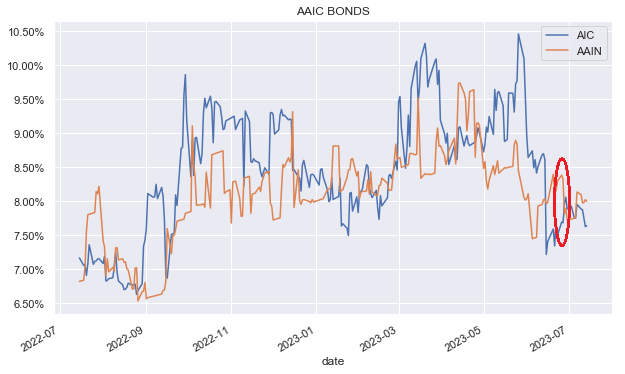

Over the last couple of weeks we made a couple of changes in our senior security stance. First, we rotated between the two mortgage REIT AAIC bonds, specifically, from AIC to AAIN to pick up additional yield for a slightly longer maturity. AAIN has tended to trade at a lower yield so this reversal was a good time to switch to AAIN.

Systematic Income

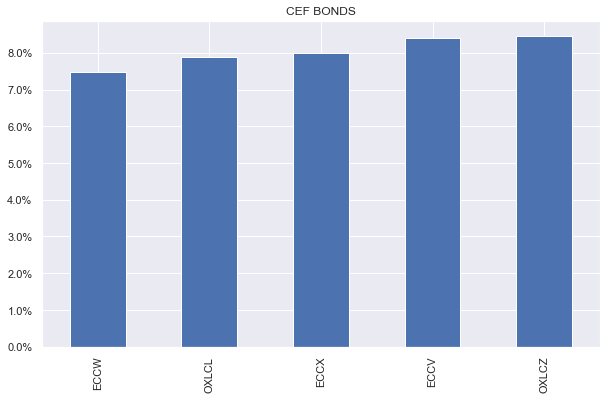

We also topped up our allocation of CLO Equity CEF bonds which tend to trade at yields of around 8%. We view these securities as relatively resilient high-yielders – an attractive combination in an expensive income market. Although the market treats OXLC and ECC bonds as pretty much the same, OXLC bonds have much higher asset coverage so those are the ones we hold.

Systematic Income

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Credit: Source link