DNY59

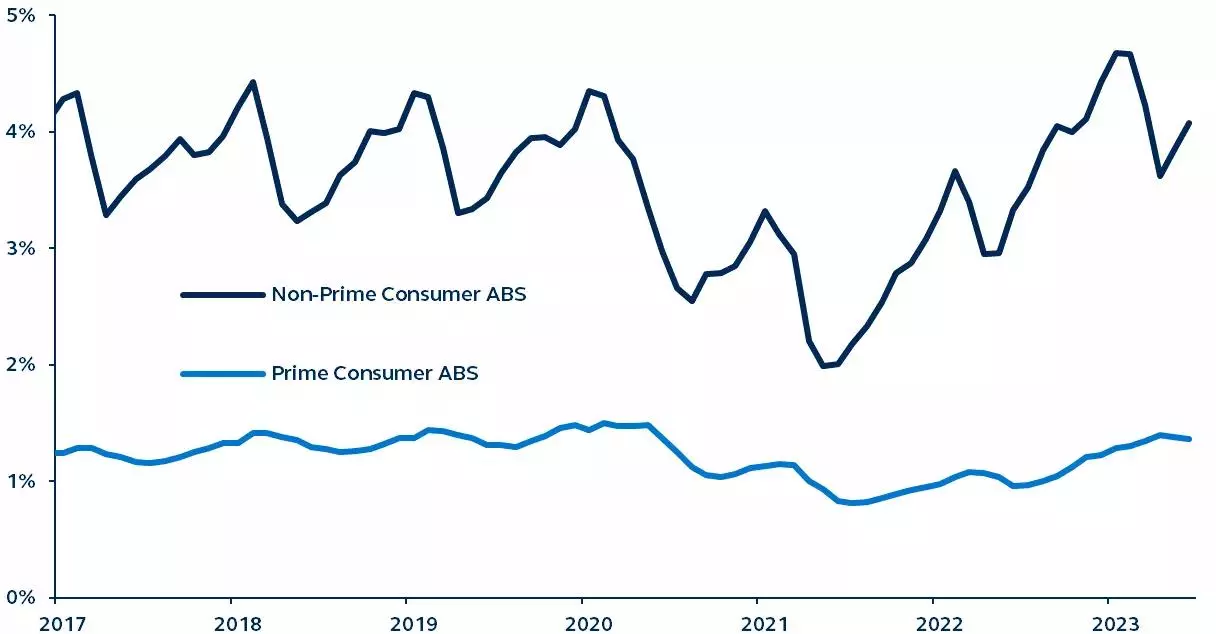

As a likely economic slowdown approaches, the investment outlook for short, high-quality consumer asset-backed securities looks attractive. Although further prime credit normalization is expected given consumer headwinds, delinquencies and defaults remain below pre-pandemic levels.

The combination of attractive pricing and solid starting fundamentals could result in enticing risk-adjusted yields even as economic conditions deteriorate in the second half of the year.

ABS delinquencies

January 2017–June 2023

Source: Intex, Principal Asset Management. Data as of June 30, 2023.

The landscape for fixed income investors is shifting as we enter the third quarter of 2023. Notably, several historically reliable economic indicators are signaling that a recession is on the horizon – setting the stage for segments of fixed income to perform well as the economy slows.

In this environment, short, high-quality consumer ABS looks particularly attractive. The inverted yield curve and market technical factors have led to high benchmark yields and wide spreads, while prime consumer credit remains solid despite recent normalization.

This combination of attractive pricing and solid starting fundamentals could result in enticing risk-adjusted yields even if economic conditions deteriorate in the second half of 2023.

Although further prime credit normalization is expected given consumer headwinds, delinquencies and defaults remain below pre-pandemic levels, and tight post-Global Financial Crisis credit underwriting should keep performance in check.

Conversely, subprime credit has weakened more noticeably. Inflation has weighed on lower income households, and delinquencies and defaults among riskier borrowers are now above pre-pandemic levels.

As the U.S. economy faces headwinds, the investment outlook for short, high-quality consumer ABS looks favorable – particularly, prime credit with well-structured deals and strong sponsors.

Wider spreads have the potential to enhance returns and the resilient structure of the asset class, with a historical track record of performing well through economic cycles, offers a level of downside risk mitigation amidst heightened market volatility.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link