Sezeryadigar

Co-authored by Treading Softly.

When you think of an albatross, do you think of something that brings bad luck – maybe a curse or psychological burden to bear, or do you think of something that brings good luck and fortune?

For decades, the albatross was viewed by mariners as a sign of good luck and fortune on their voyage. If you saw an albatross while you were at sea, this meant that there were good things to come for you. Yet, many of the perspectives on the albatrosses shifted heavily after a famous poem was written called The Rime of the Ancient Mariner. In this story, a mariner saw, shot, and killed an albatross and was forced by the rest of the crew to wear it around his neck as a sign of his poor decision-making. As the story goes on, the entire crew ship dies, except for him, who lives on to tell the tale.

When it comes to the fixed-income sector, many will view changes in interest rates as an albatross. It can be a good omen for those who believe it to be an omen of that type, and it can be a bad omen as well. The result is, regardless of what is going on in the fixed-income sector; interest rates can play a heavy role in the intermediate trading value of an investment. This interlocutory period can cause a lot of consternation and stress for fixed-income investors. Yet, if they continue to hold for the long run, they can see great benefits. The issue that many run into with the fixed-income sector, like almost every other investment, is impatience.

There can also be added confusion when someone uses a CEF (Closed-End Fund) to invest in the fixed-income sector because the CEF, while owning fixed-income investments, does not operate like one on its own. A CEF will pay out 90% of its taxable income at the bare minimum to maintain its regulatory requirements. This means that the CEF’s total return governs its distribution coverage, not the investments it holds. This can cause some funds to raise or lower their distributions based on the impact interest rates have on their holdings, as well as on the leverage at the fund level.

Today, I want to take a look at an outstanding fund that can provide you with a strong income. It exhibits signs of having benefitted from high interest rates and is well-positioned to experience tailwinds from upcoming rate cuts.

Let’s dive in!

Yield 10.9% and a Big Hike

Nuveen Preferred & Income Opportunities Fund (NYSE:JPC) is a CEF focusing on preferred equity.

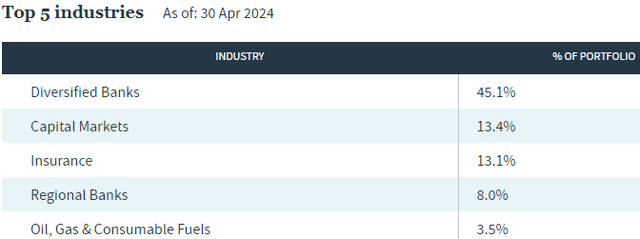

JPC‘s portfolio is primarily in financial preferred, with diversified banks making up the lion’s share of its investments. Source.

JPC Website

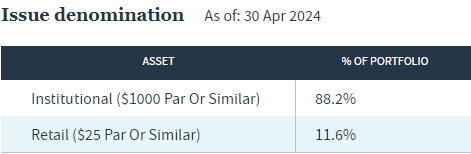

JPC also focuses primarily on institutional preferred. These are preferred with a par value of $1,000.

JPC Website

JPC works well alongside other large fixed-income focused investments like Virtus Infracap U.S. Preferred Stock ETF (PFFA), as there is minimal overlap and room for both to benefit strongly.

Interest rates are at their highest since before the GFC, which has been a headwind to the prices for all fixed-income. JPC felt the negative impact along with it.

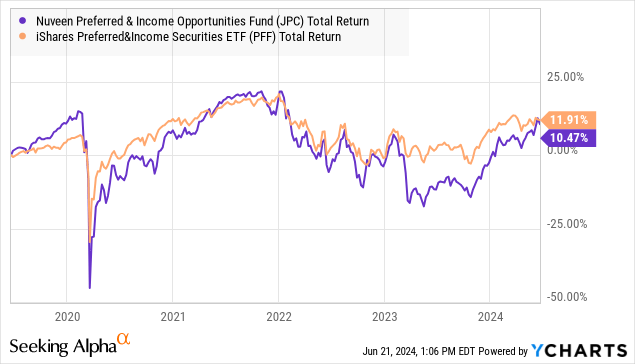

JPC’s focus on larger preferred is very similar to the types of holdings you would find in the iShares Preferred & Income Securities ETF (PFF). As a result, looking at the past five years, we can see that JPC has higher highs and lower lows than PFF.

This extra volatility can be attributed to the leverage that JPC uses, which is usually in the 30-40% range. As of this writing, it sits at 38%, which is the high end of JPC’s range. This makes sense with the outlook for preferred being so bullish. Ideally, you want to be less leveraged on downswings and more leveraged during upswings.

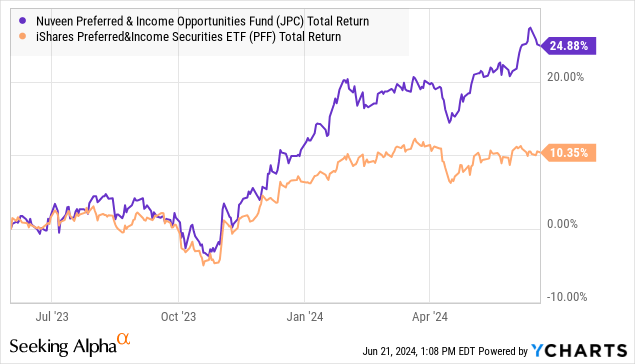

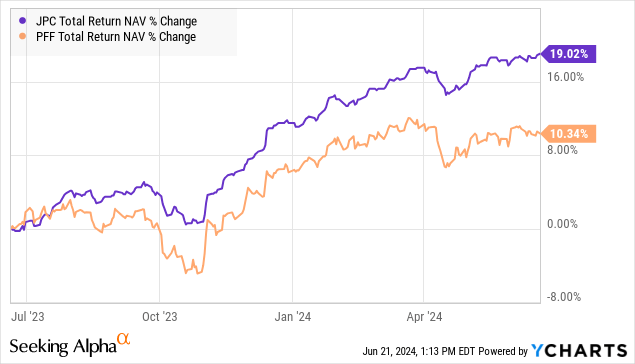

Over the past five years, JPC has seen a similar total return as PFF. However, since the Fed made its last rate hike in July 2023, JPC has been off to the races.

We can look at the chart and see where the Fed made its pivot, and the market became reassured that at least more rate hikes are unlikely. The leverage that caused underperformance relative to PFF is now a major advantage, with JPC soaring 25% over the past year.

As a result of the strong tailwinds, JPC decided to increase its distribution 40% to $0.0665/month. This is the highest that JPC’s distribution has been since 2016. Is it sustainable?

In the near term, yes. Remember, CEFs are required to pay out most of their taxable income and capital gains. As a result, a CEF’s return can be understood as having two parts — the distribution you receive + the change in NAV.

We can look at “total return on NAV,” which includes gains in NAV and the distributions paid, to show the fund’s economic return. Over the past year, JPC achieved a total return on NAV of 19%

JPC’s new distribution is approximately 10% of NAV. That’s much less than 19%, suggesting that with the current trend, we can expect NAV to continue to climb even with the higher distribution.

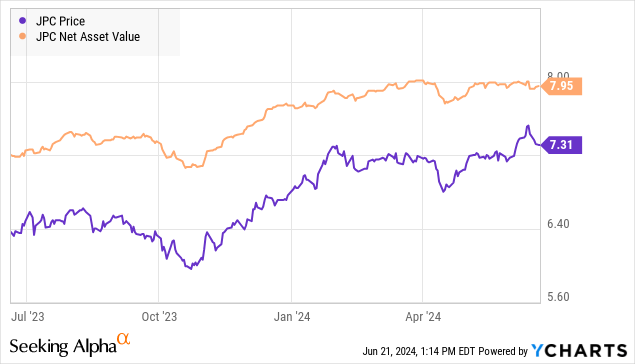

The other factor influencing JPC’s decision is that its share price is trading well below NAV.

Management believes increasing the distribution will attract more investors and close this gap. For those of us who already hold JPC, this is a big win. While some will make the absurd statement that “dividends don’t matter,” well, as a matter of math, they can matter quite a bit. Suppose that over the next year, JPC’s portfolio goes up exactly $1.00 (12.5%), a very plausible number. JPC could:

- Distribute $0.57 and increase NAV by $0.43.

- Distribute $0.798 and increase NAV $0.202.

It is a defined pie; every penny that pays the distribution comes out of NAV. As the investor, am I better off under option 1 or 2?

The answer is—”it depends on how the market values NAV.” In option 1, I have $0.57 in my pocket and $8.38 in NAV, which equals $8.95 in value. In option 2, I have $0.798 in my pocket and $8.152 in NAV, for $8.95 in value. Except for one caveat: I currently have $7.95 in NAV, but I can’t sell it for $7.95. I can only sell it for $7.31!

Fast-forward a year; can I expect that to change? If not, then under option 1, I have $0.57 in my pocket and $8.38 in NAV that I could sell for approximately $7.7. For all practical purposes, I have $8.27 in accessible value.

Under option 2, I have $0.798 in my pocket and $8.152 in NAV, valued at approximately $7.5. I have $8.298 in accessible value.

The “value” is the same, but by receiving more in distributions, I am less exposed to the risk that the market values $1 at $0.92. Something it does with relatively high frequency.

If JPC management is right, and the higher distribution does attract more buyers, then the discount might disappear, and shareholders can eat their dividend cake and have their NAV too. If not, we get our returns as dividends, where $1.00 is valued at $1.00, instead of as NAV, where $1.00 in gains is valued at something less than $1.00.

We were happy with JPC when it had a lower distribution, and are even happier buying it now that it has a higher distribution.

Conclusion

Building an interest rate-agnostic portfolio can provide you with the ability to ignore interest rates as a means to an end. This end would be that you’re going to receive great income regardless of what the Fed is doing and knowing that you can’t necessarily predict the future on whether rates are going up, down, or sideways.

At the end of the day, I want a portfolio that generates the income that I need, regardless of what the Federal Reserve decides to do as it tries to battle inflation. Interest rates don’t have to be an albatross that governs the outcome of my portfolio. You don’t have to believe in any sort of magic or omens to be able to decide that your portfolio is going to do what it is designed to do. However, you can also govern the investments that are in your portfolio. So, when you’re buying today, buy the best opportunities that exist in the market to provide you with great income. Looking forward — JPC provides us with that type of income and outlook.

When it comes to retirement, the more income you can get from the market, the better. Expenses are going to continue to rise year after year. Life is expensive and only gets more expensive as the dollar loses value. Inflation is the great rot that sets in on anyone’s retirement lifestyle and savings. It erodes the value of your savings against the cost of living. Having a portfolio that generates a livable yield and real income for you today can help you fight against that constant rot and allow you to enjoy a reduced-stress lifestyle. You can take the albatross off your neck anytime by building such a portfolio. This way, you can enjoy the financial freedom and security that so many investors dream of.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Credit: Source link