PM Images

For the month of November, the market was in rally mode as the rates on risk-free Treasuries retreated meaningfully after surging the prior two months. The driving factor there seemed to be that the market is now anticipating that rate cuts are going to be coming sooner rather than later.

The market is pricing in a cut as soon as March 2024 of 25 basis points, with the largest probability. However, even the probability for a January rate cut is in the cards, with around an 18.6% probability of cutting by 25 basis points versus a ~81% probability that they maintain the current 525-550 bp range. With the Fed’s latest FOMC meeting, this all was pulled forward after the Fed indicated that three rate cuts could be on the table next year with the latest projections.

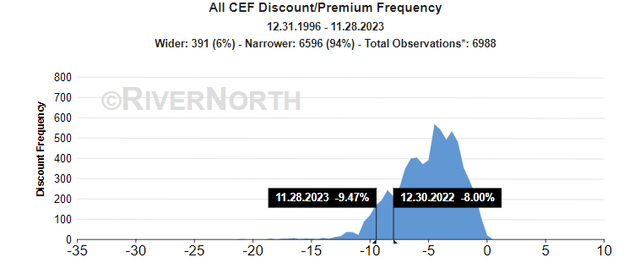

Overall, there are still many good deals in the closed-end fund (“CEF”) space, with discounts being historically wide.

CEF Historical Discount/Premium (RiverNorth)

Over time, I look at my closed-end fund portfolio to grow my monthly cash flow. This works through putting new capital to work and reinvesting the steady cash that comes in monthly as well. This has a compounding snowball effect over time. The more capital that is put to work, the larger the ball of monthly cash becomes.

With all that being said, here are the 4 closed-end funds that I added to during the month – as well as a preferred position that I scooped up.

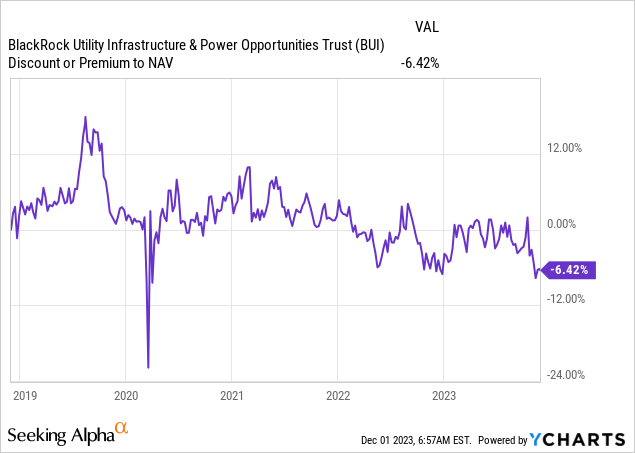

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

One of the main sectors to get hit during the rapid rise in rates over the prior couple of months was the utility sector. That provided a lot of opportunity for investors to add to this beaten-down space, and BUI was one such opportunity, as the fund also started to flirt with a discount. That has been somewhat rare with this fund over the last several years.

YCharts

Today, it still trades at a relatively attractive discount and could be worth considering. The fund’s NAV has been rebounding from those lows as pressure came off the utility space through the month of November. At the same time, the price has lagged, and that’s what has resulted in the fund’s discount widening – which is often exactly what we want to see when we are buying funds. That’s opposed to the NAV falling, but the price simply falls faster.

The fund has delivered an incredibly steady distribution since its launch. While the fund switched from quarterly to monthly, it maintained the same distribution. Though worth noting is that this fund launched post-GFC, but there were other utility funds that survived unscathed during that period, too, and I don’t believe that BUI would have really been too different. The fund’s NAV rate is currently at 6.71%; I don’t view that as being at risk at all currently and would anticipate the same monthly distribution to be maintained for the foreseeable future.

Voya Global Advantage and Premium Opportunity Fund (IGA)

I’ve held IGA for a while now, and I decided to add to my position while it remains deeply discounted. This fund is interesting because it provides global exposure but isn’t so reliant on growth investments. However, the growth space has performed incredibly well over the last decade+, particularly the mega-cap growth names and the Mag 7. However, with its value-oriented approach and deep discount, I feel that it provides a compelling buy to provide further diversification to one’s portfolio.

With that being said, while that’s the main long-term rationale for holding the fund or its sister fund, Voya Global Equity Dividend and Premium Opportunity Fund (IGD), I’m not the only one who has taken notice of the fund’s attractive discount.

This is yet another fund that Saba Capital has been building a position in – while they have many pans in the fire right now – this one is especially interesting because they had targeted it previously. That produced a tender offer in 2021. Additionally, they full on took over control of one of Voya’s previous funds, which is why the Saba Capital Income & Opportunities Fund (BRW) exists today after they had taken over what was previously Voya Prime Rate Trust.

So, there is definitely some history there that’s worth noting, as Saba takes over around 6.3% of the outstanding shares of IGA. A full-on liquidation, conversion, or takeover could be in the cards, but that is merely my speculation. As far as a tender offer, at this point, IGA is down to around $150 million. I believe that makes a meaningful tender offer almost unappealing, as what would be left of the fund. Alternatively, IGD is a significantly larger fund with $453.5 million in assets – a merger, then a significant tender offer in that case could be more plausible.

With all that being said, to reiterate, this is just pure speculation on my end; nothing might happen at all, and Saba simply sees the fund as attractively valued. Either way, given the sizeable stake from the activist group and the fact that I find it attractive overall, I believe it was worthwhile to add to this position.

Western Asset Inv Grade Income Fund Inc (PAI)

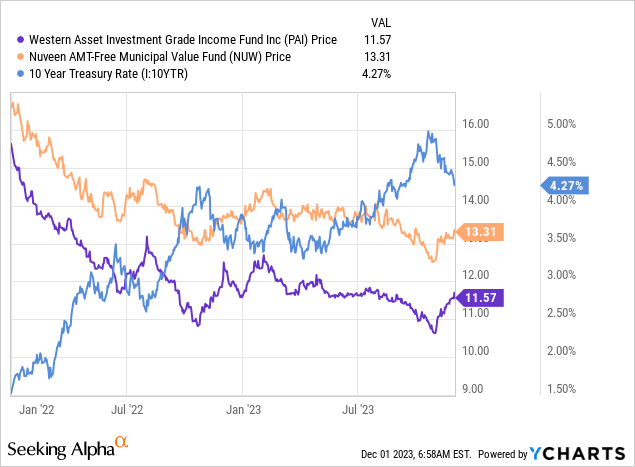

This month, it was PAI’s turn to get a batch of capital thrown at it. For those following my monthly updates, starting in May this year, I started utilizing PAI and Nuveen AMT-Free Municipal Value Fund (NUW) as my rate pivot plays. The idea is that these are higher up on the credit quality spectrum with longer maturities and, thus, higher effective durations. Higher duration means higher sensitivity to interest rate changes, so when rates decline, they have a higher chance to rebound harder, just as they had been hit harder by increasing interest rates.

In addition, these are both non-leveraged or incredibly low leveraged (NUW is at around 1% leveraged with the ability to go up to 10% leverage. Therefore, I feel that the risks of being wrong on these names over the next coming years would lead to fairly minimal damage. That had the added impact of still being invested but reducing my portfolio’s overall leverage levels and de-risking. In addition to these names, I had been allowing some cash to build up through the year as well. With (SPAXX) paying around 5%, that certainly isn’t anything to complain about.

By May 2023, both of these funds had been beaten down quite extensively through the Fed’s aggressive rate hiking cycle. Here’s a chart going back to the start of 2022 to today based on the NAV with the 10-Year Treasury Rate (US10Y) included. Clearly, we can see the negative correlation.

YCharts

PIMCO Dynamic Income Strategy Fund (PDX)

The main theme of this year for me was looking for low-leverage or no-leveraged funds and de-risking for the higher rate environment while positioning to take advantage of rates coming down; there was an exception made this month. This was a tactical play, as I added PDX to my portfolio’s arsenal.

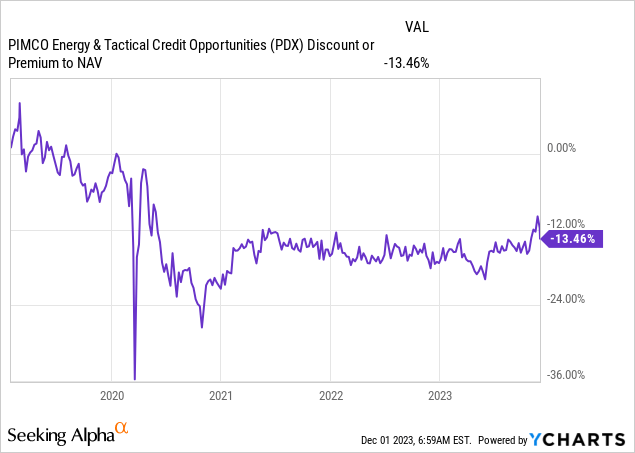

This was a unique situation where this was formerly NRGX, a mainly energy-focused fund. Though a unique energy-focused fund, to be sure, it was completely different from the rest of the PIMCO lineup of CEFs. With a pivot to the strategy to become more like its sister funds, there was an incredible opportunity in this fund. The fund will still place more of an emphasis on energy, with the fund “normally investing at least 25% of its total assets in the energy industry.”

Upon announcing this move, the fund did see its discount narrow meaningfully, and the fund performed well during the last few months anyway. Admittedly, I had meant to pick up a position sooner, but it had slipped my mind. Stanford Chemist’s “trade alert” for our IG members was my reminder and spurred me to action. However, at a discount of nearly 12%, the discount is still significantly wider than most of the PIMCO funds that often trade at premium levels.

YCharts

I suspect that what might get the ball rolling is when they announce a new distribution policy. Right now, the fund pays quarterly at a distribution rate of 4.36%. I wouldn’t be surprised to see a move to pay monthly at a rate of 10% on the NAV. That would translate to $2.288 annually or a monthly payout of $0.1906.

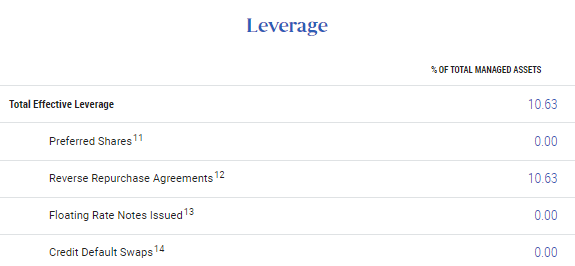

In addition to this transition, I suspect the fund will also ramp up its leverage significantly from current levels. For now, the fund has run with a fairly modest amount of leverage relative to its multi-sector bond fund sisters.

PDX Leverage Stats as of 12/01/2023 (PIMCO)

Of course, that means greater risks but also greater potential yield that they can offer investors.

XAI Octagon Floating Rate & Alternative Income Term Trust 6.5% Series Term Preferred (XFLT.PR.A)

Finally, earlier this month, I highlighted the baby bonds and preferred offerings from the collateralized loan obligation (“CLO”) funds. I followed that up by taking a position in XFLT.PR.A, with further additions to these fixed-income instruments also still under consideration. In fact, I’d consider adding further to this one because, with limited volume in these names, it can be incredibly difficult to build a sizeable position. XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT)’s preferred is set to mature on March 31, 2026, and provides a current yield of about 6.7% with a yield to maturity of 7.8%.

Credit: Source link