your_photo

Introduction

Cogent Communications (NASDAQ:CCOI) is a Washington-based entity that serves as a low-cost high-speed internet service provider across 51 countries around the world. Besides the core offering of internet access, CCOI also offers data center colocation space.

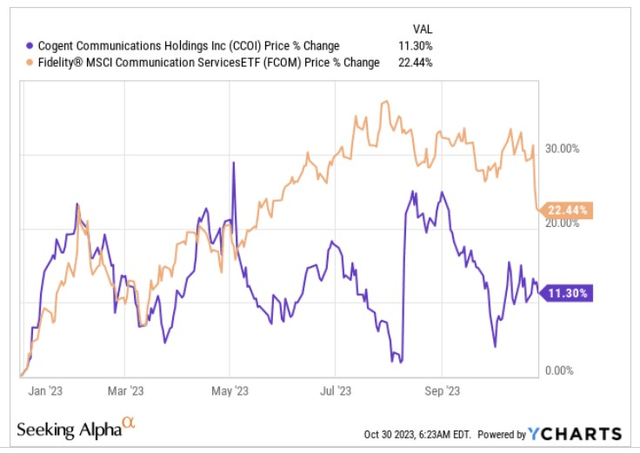

This year the stock of CCOI has had quite a choppy year but has still ended up delivering double-digit returns on a YTD basis. That may be a decent outcome for a fair few, but it certainly falls well short of what its peers from the communication services universe have delivered (the popular communication services ETF- FCOM has outperformed CCOI by 2x).

YCharts

Despite the underperformance, we think if CCOI can successfully integrate the T-Mobile Wireline Business (the deal closed in early May this year), we could be looking at a real powerhouse. The dividend theme, the risk-reward on the charts, and the forward valuations provide further support for those considering a punt on CCOI at this stage. However, execution risks should not be entirely dismissed as CCOI hasn’t dabbled with an acquisition for a good 17 years now!

Nonetheless, here are three key reasons why CCOI may be considered:

Forward Valuations Don’t Reflect The Scope Of Potential EBITDA Improvements on The Anvil

CCOI management has long-term ambitions of reducing the costs of transmitting bits and being one of the lowest-cost operators in this space. It is already executing rather well on this front with the legacy Cogent business, which recently saw EBITDA cross the $60m mark for the first time, and in the process also deliver 160bps of margin improvement.

Now initially, the acquired Wireline business could be inimical to overall group margins as CCOI works through integration issues, but once they tweak things and establish an optimum cost base (greater office consolidation and the exit of 100-150 employees are on the cards), CCOI management will be well placed to execute and bring through strong EBITDA margin improvement on a much bigger revenue base. Note that immediately, the revenue base has already shifted from $600m annually to $1bn annually, and CCOI which was predominantly an SME focussed business will now also target larger accounts with big enterprises.

Longer-term, the goal is to drive through roughly 100bps worth of margin improvement every year, eventually taking EBITDA margins to the 45% level.

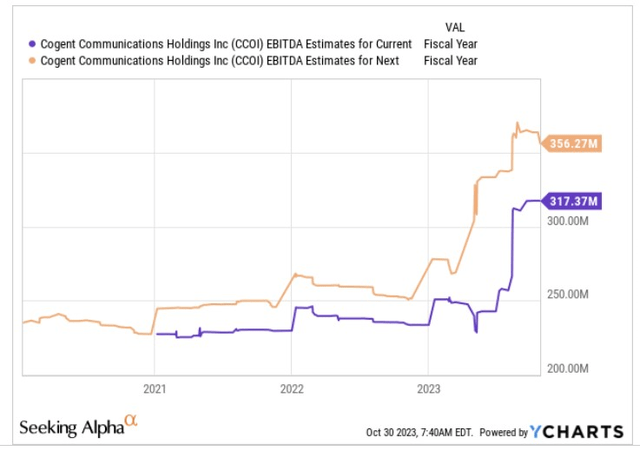

Even through FY24, if one considers the degree of EBITDA growth one is getting, it’s hard not to be swayed. Taking the FY22 EBITDA of $231m as the base, consensus suggests that you could be looking at an impressive EBITDA CAGR of 24% through FY24!

YCharts

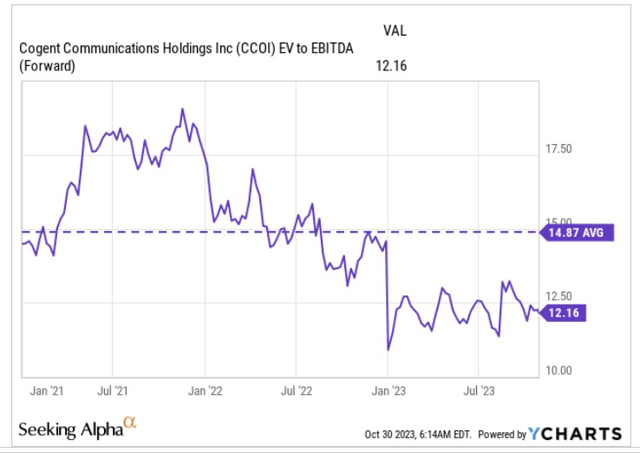

Given such pronounced EBITDA growth, a forward EV/EBITDA of a little over 12.1x feels rather cheap, particularly when this also translates to an 18% discount over the stock’s 5-year valuation average.

YCharts

Distribution Theme Will Flourish Even More As Leverage Comes Down Rapidly

Besides the core internet story, CCOI also receives plenty of interest from dividend-based investors and is in fact part of the NASDAQ US Dividend Achievers 50 Index. On the dividend front there are already a lot of things to admire, but this will take on an even better hue going forward.

The communication services sector is inherently characterized by reinvesting cash flows back into the business to support the growth narrative (this is supported by the fact that the median 10-year growth of dividends for this sector is only around 1%) but CCOI is rather different in that over the last 10 years, its dividends have grown at 22% CAGR.

Interestingly enough, if you get in now, you could be locking in a rather handsome yield of almost 6%, around 120bps better than the long-term average.

CCOI’s normal dividend theme will carry on, even with the net debt leverage ratio at 4.56x, but expect this figure to come down rapidly to 2.5x-3.5x. We use the word “rapidly”, because firstly as part of the deal with T-Mobile, CCOI will receive $350m in cash commitments in the first year to offset the operating losses of the acquired business. Then over the next couple of years or so, there will be another $350m of cash payments.

On the EBITDA front as well, there should be some useful upticks, particularly as CCOI gets involved in more high-margin businesses such as optical wavelength services. This is believed to be a $2bn market, growing at healthy rates of 7% p.a and CCOI intends to offer wavelength services in 800 carrier-neutral locations across America over the next two years, also targeting a 25% market-share over time.

Now with the numerator coming down at a rapid pace, coupled with reverse dynamics on the denominator, CCOI’s net leverage should quickly come down to its target range of less than 3.5x, leaving the company with ample cash. Management has reiterated that they are not keen on maintaining a cash-heavy balance sheet, and would rather choose to distribute the largesse to shareholders by way of dividends or possibly a recommencement of buybacks.

Closing Thoughts- Appealing Risk-Reward On the Charts

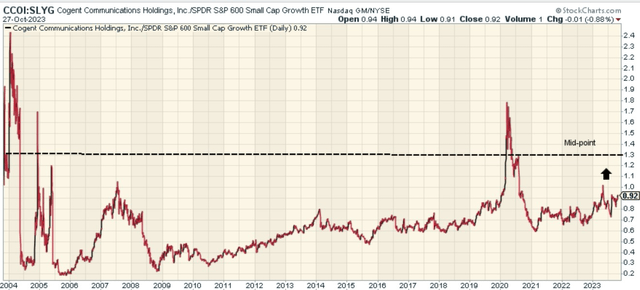

CCOI’s stock is one of many growth stocks that comprise the S&P 600 Small-cap Index, and the image below helps explore if the stock could benefit from some rotational interest from those fishing for beaten-down opportunities within this universe.

Stockcharts

Well, CCOI may not come across as beaten-down, but it certainly doesn’t look overbought either, with the CCOI:SLYG ratio currently trading around 30% off the mid-point of its two-decade long range.

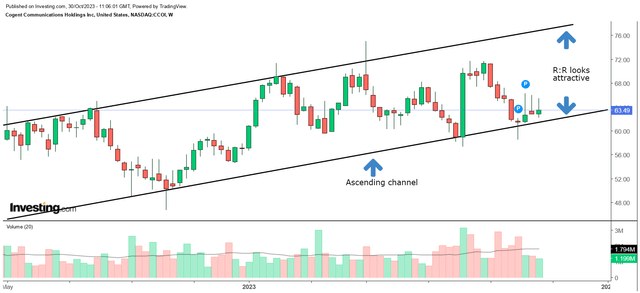

If we shift our focus to CCOI’s own standalone weekly imprints, it’s fair to say that the risk-reward here looks even more attractive. Even if CCOI has come across as a volatile bet over the last 17-18 months, what’s evident is that these price imprints have taken place within a certain ascending channel, with the stock respecting both the upper and lower boundaries.

In that regard, a long position at this juncture looks like a good bet, as we’ve recently seen the relative flattening of the price action near the lower boundary of the channel, whilst it is a good 17-18% away from the upper boundary of the channel.

Investing

As an aside, also consider that discretionary insider selling which was pretty rampant all through August and September, appears to have disappeared in October.

Credit: Source link