Ksenia Raykova/iStock via Getty Images

Foreword

This article is based on the April 4, 2024, “Fortune*100 Best Companies To Work For” article by Chloe Berger and Irina Ivanova:

‘Gen Z doesn’t live to work. They work to live’: The paradox that defines the best companies to work for (BCTWF) in 2024.

Finding the best company to work for seems an elusive task for disillusioned young and older employees alike. Any employer worth its salt has recognized and responded to the shifting demands of the workforce in order to hold on to top talent. Like any youthful type, Gen Z is reckoning with working for “the man,” but our 27th edition of the Best Companies to Work For list, published with our partners at Great Place to Work, shows an emerging corporate equivalent of “the man in therapy.” Helping employees find meaning in their jobs, many of these best companies offer wellness benefits and a commitment to their workforce looking as diverse as the nation’s population. In practice, creating a more empathetic workplace looks like staying loyal to workers, emphasizing the needs of individuals with diversity and inclusion initiatives, and, naturally, paying employees well.

The best companies create great work experiences not just for management, but also for their part-time employees on the front lines, for those who’ve just joined and those who’ve spent their whole career there, for every race and ethnicity, gender, neurotype, or other demographic in the organization—we look at it all. Companies with the broadest set of employees who report positive workplace experience receive the highest rankings on lists.

Great Place To Work surveyed companies employing more than 8.2 million people in the U.S. and received more than 1.3 million survey responses. Of those, nearly 630,000 responses were received from employees at companies who were eligible for the 2024 100 Best, and this list is based on their feedback.”

It turns out that 44% of these eligible companies are private entities. Since the dividend dogcatcher (author) only reports about viable publicly owned companies, the real candidates for ownership in 2024 were 56, of which 44 pay dividends.

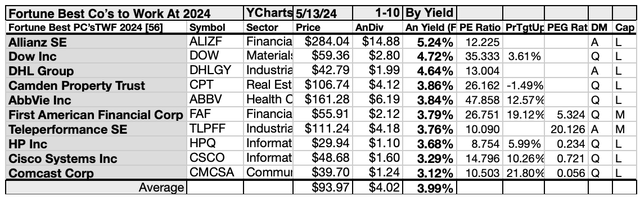

Any collection of stocks is more clearly understood when subjected to yield-based (dog catcher) analysis, this collection of F100-BCTWF for 2024 is perfect for the dogcatcher process. Below is the November 1 data for the 44 dividend stocks populating those F100BCTWF as parsed by YCharts.

The prices of 2 of those 44 BCTWF dividend selections made the possibility of owning productive dividend shares from this collection a reality for first-time investors.

The 2 Dogcatcher ideal best to buy F100BCTWF May Dividend stocks were: DHL Group (OTCPK:DHLGY); HP Inc (HPQ).

Those two both show annual dividends from a $1K investment, exceeding their single share prices. Many investors see this condition as a “look closer to maybe buy” opportunity.

Which, if any, of the 2 are “safer” dividend dogs? To find the answer, seek-out my “Safer” May Dividend Dogcatcher follow-up detailing the “safest” of these stocks for 2024 in the Seeking Alpha Investment Groups Marketplace appearing on or about 5/20. To get there, simply click on the link in the last Summary bullet point above.

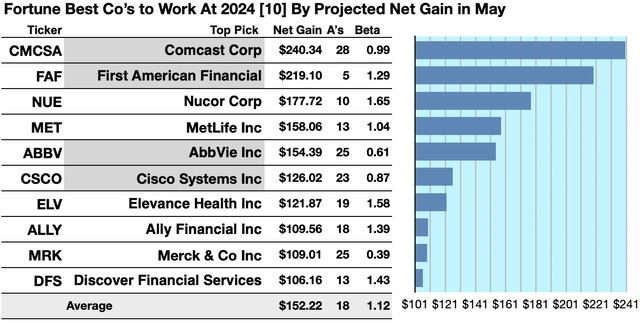

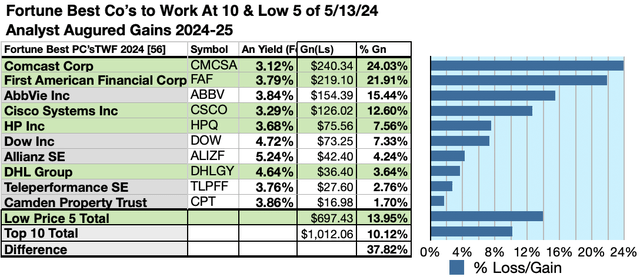

Actionable Conclusions (1-10): Analysts Estimated 10.62% To 24.03% Net Gains From Ten F100-BCTWF Dividend Stocks To May 2025

Four of ten top F100-BCTWF dividend stocks by yield were also among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, the yield-based forecast for these May besties was graded by Wall St. Wizards as 40% accurate.

Source: YCharts.com

Estimated dividends from $1000 invested in each of the highest yielding F100-BCTWF (besties) stocks, added to the median of aggregate one-year target prices from analysts (as reported by YCharts), generated the following list. (Note that one-year target-prices by lone-analysts were not included.) Thus, ten probable profit-generating trades projected to May 2025 were:

Comcast Corp (CMCSA) was projected to net $240.34 based on the median of target price estimates from 28 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 1% less than the market as a whole.

First American Financial (FAF) was projected to net $219.10, based on dividends, plus the median of target price estimates from 5 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 29% over the market as a whole.

Nucor Corp (NUE) was projected to net $177.72 based on dividends, plus the median of target estimates from 10 brokers, less transaction fees. The Beta number showed this estimate subject to risk/volatility 65% greater than the market as a whole.

MetLife Inc (MET) was projected to net $158.06, based on dividends, plus the median of target price estimates from 13 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 4% greater than the market as a whole.

AbbVie Inc (ABBV) was projected to net $154.39, based on the median of estimates from 25 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 39% less than the market as a whole.

Cisco Systems Inc (CSCO) was projected to net $126.02 based on the median of target estimates from 23 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 13% less than the market as a whole.

Elevance Health Inc (ELV) was projected to net $121.87, based on dividends, plus the median of target price estimates from 19 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 58% greater than the market as a whole.

Ally Financial Inc (ALLY) was projected to net $109.56 based on the median of target price estimates from 18 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 39% more than the market as a whole.

Merck & Co Inc (MRK) was projected to net $109.01, based on dividends, plus the median of target price estimates from 25 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 61% under the market as a whole.

Discover Financial Services (DFS) was projected to net $106.16, based on dividends, plus median target price estimates from 13 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 43% greater than the market as a whole.

The average net gain in dividend and price was estimated at 15.22% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 12% over the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

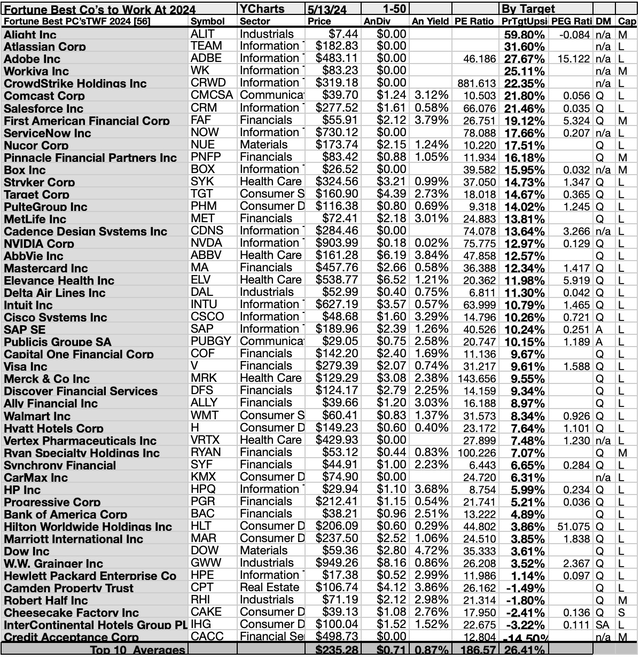

50 F100-BCTWF In May 2024 Per Analyst Target Data

Source: YCharts.com

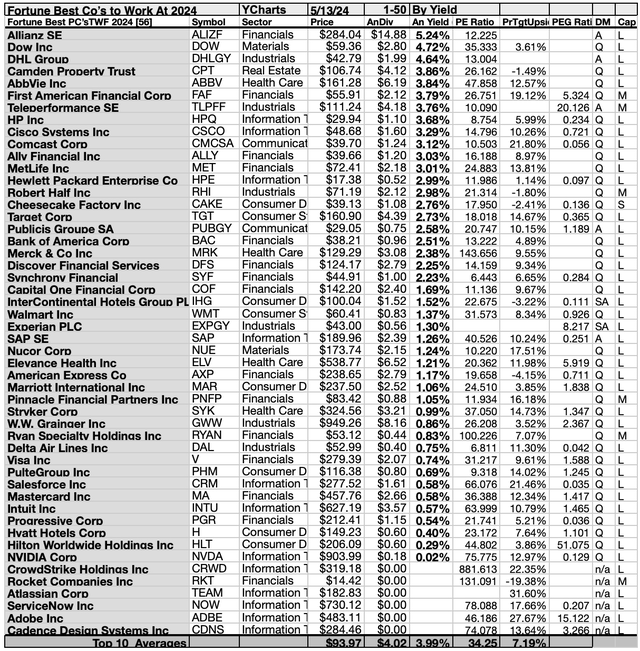

50 F100-BCTWF Per May Yields

Source: YCharts.com

Actionable Conclusions (11-20): Ten Top F100-BCTWF By Yield For May

Top ten F100-BCTWF by yield for May represented seven of eleven Morningstar sectors. First place was held by the first of two financials members, Allainz SE (OTCPK:ALIZF) [1]. The other financials company placed sixth, First American Financial Corp [6]. Then, one materials member placed second, Dow Inc (DOW) [2].

Third place was claimed by the first of two industrials representatives, DHL Group [3]. The other placed seventh, Teleperfomance SE (OTCPK:TLPFF) [7].

Fourth place went to the lone real state representative, Camden Property Trust (CPT) [4]. Down the line, fifth place was secured by the healthcare representative, AbbVie Inc [5]. Finally, in eighth and ninth places were two technology sector members, HP Inc [8], and Cisco Systems Inc [9] which were followed by the lone communication services member, Comcast Corp to complete the top ten F100-Besties of 2024 dividend pack for May.

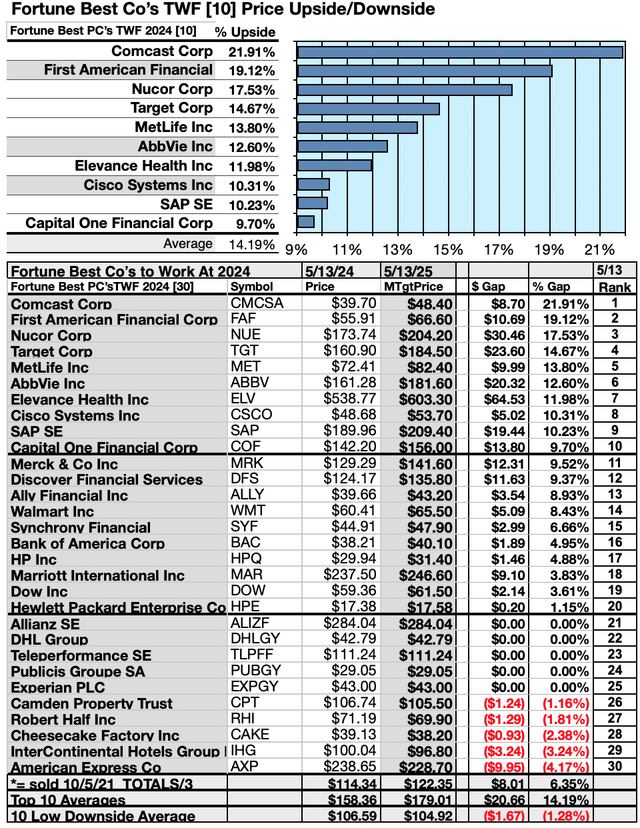

Actionable Conclusions: (21-30) Ten Top F100-BCTWF For May Showed 9.7% to 21.91% Upsides, while (31) Five Down-siders Sagged -1.16% & -4.17%

Source: YCharts.com

To quantify top dog rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, median analyst target price estimates became another tool to dig out bargains.

Analysts Forecast A 37.82% Advantage For 5 Highest Yield, Lowest Priced, of 10 F100-BCTWF Dividend Stocks In May

Ten top F100-BCTWF yield (dividend / price) results provided by YCharts produced the following ranking.

Source: YCharts.com

As noted above, the top ten Kiplinger F100-BCTWF stocks for 2024 screened 5/13/24, showing the highest dividend yields, represented seven of eleven in the Morningstar sector scheme.

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield F100-BCTWF for 2024 (32) Delivering 13.95% Vs. (33) 10.12% Net Gains by All Ten Come May 2025

Source: YCharts.com

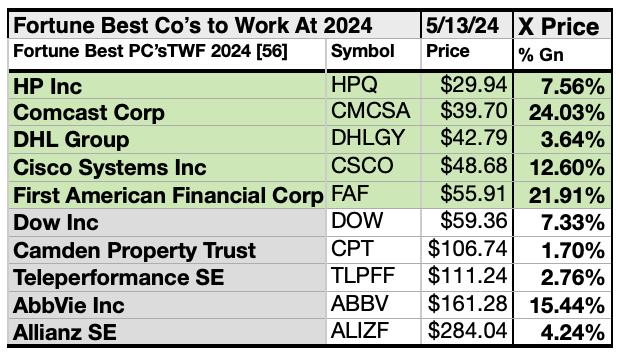

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten F100-Besties for 2024 by yield were predicted by analyst 1-year targets to deliver 37.82% more gain than $5,000 invested as $.5k in all ten. The second lowest-priced selection, Comcast Corp, was projected to deliver the best net gain of 24.03%.

Source: YCharts.com

The five lowest-priced top-yield F100-BCTWF for 2024 Dividend Dogs as of May 13 were: HP Inc; Comcast Corp; DHL Group; Cisco Systems Inc; First American Financial Corp, with prices ranging from $29.94 to $55.91.

Five higher-priced F100-Besties for 2024 Dividend Dogs as of May 13 were: Dow Inc; Camden Property Trust; Teleperformance SE; AbbVie Inc; Allianz SE, whose prices ranged from $59.36 to $284.04.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

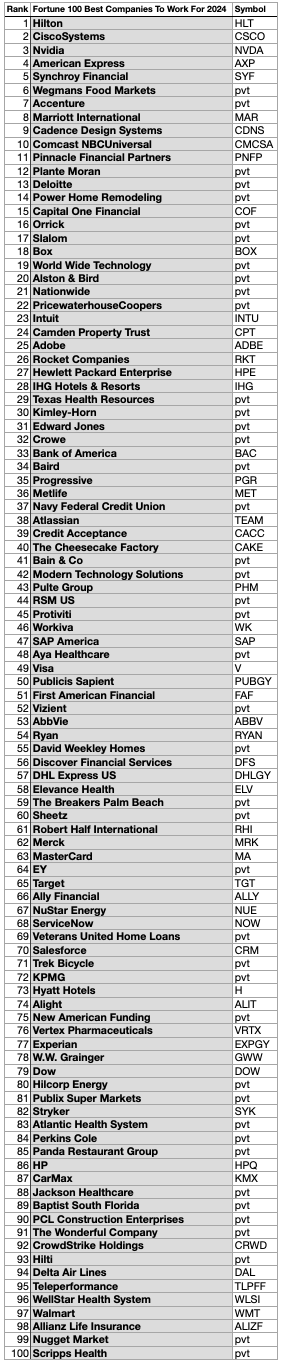

This article features Fortune100-Best Companies To Work For and May. Therefore, most of the original list of 100 dividend paying companies is neglected. To remedy this condition, the following is provided

A Complete List of The Fortune 100 Best Companies To Work For in 2024

(Stocks Listed as ranked by Great Place To Work research-driven criteria, in ascending order.)

Sources: Fortune.com, YCharts.com

If somehow you missed the suggestion of which stocks are ripe for picking at the start of this article, here is a reprise of the list at the end:

The prices of 2 of these 100 F100-BCTWF for 2024 made the possibility of owning productive dividend shares from this collection more viable for first-time investors: The 2 Dogcatcher ideal best to buy May F100BCTWF Dividend stocks were: DHL Group, & HP Inc.

Those two both show annual dividends from a $1K investment, exceeding their single share prices. Many investors see this condition as “look closer to maybe buy” opportunity.

Which, if any, of the 2 are “safer” dividend dogs? To find the answer, seek-out my “Safer” May Dividend Dogcatcher follow-up detailing the “safest” of these stocks for 2024 in the Seeking Alpha Investment Groups Marketplace appearing on or about 5/20. To get there, simply click on the link in the last Summary bullet point above.

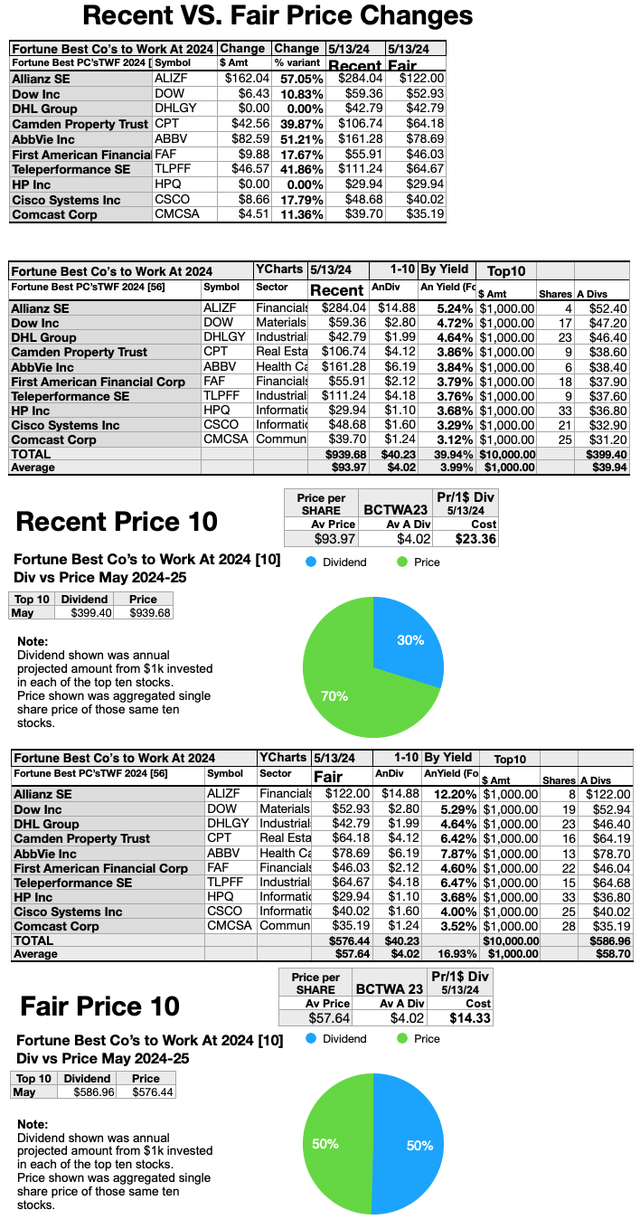

How All Ten Top F100-BCTWF For 2024 Stocks Could Become Ideal Fair Priced Dogs

Source: YCharts.com

Two of the top ten F100-BCTWF stocks for 2023 are recently priced less than the annual dividends paid out from a $1K investment. The dollar and percentage differences between recent and fair prices are detailed in the top chart. Two ideal fair-priced stocks plus the eight at current prices are shown in the middle chart. Finally, the fair pricing of all ten top dogs conforming to that dogcatcher ideal is the subject of the bottom chart.

With renewed downside market pressure to 57.05%, it is possible for all ten highest-yield F100-BCTWF for 2024 stocks to become fair-priced with their annual yield (from $1K invested) meeting or exceeding their single share prices. This pack got a nice head-start with two of ten already fair priced.

Stocks listed above were suggested only as possible reference points for your purchase or sale research process. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link